Introduction

After an impressive rally since the August stock market bottom, volatility is back, led by the decline in Nvidia’s (NVDA) market cap. On Tuesday, September 3, the tech giant lost close to $280 billion in market cap.

Although a 10% decline (which is how much $280 billion was) is not much in light of its year-to-date performance of more than 140%, it made for some great financial headlines, as we can see below.

Google News

Personally, I believe there are several reasons for the stock market weakness.

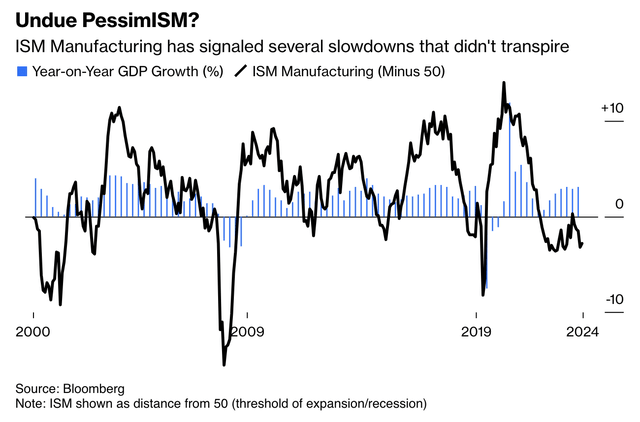

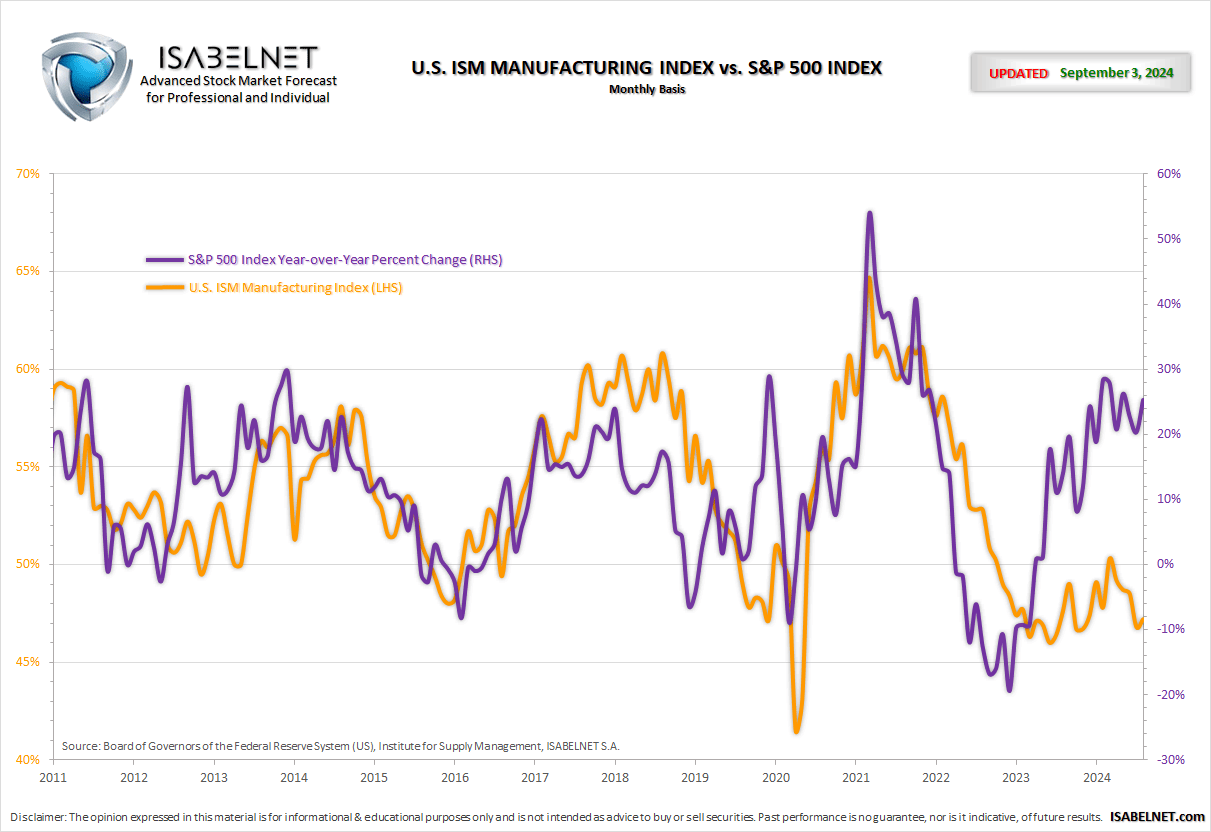

One of them is the weakness in the ISM Manufacturing Index. Although the index rebounded a bit, it remained in contraction territory and was only higher due to factors like pricing and inventories – not because of orders, which saw an acceleration in the rate of contraction.

Although the manufacturing sector in the United States pales in comparison to the size of the consumer/services sector, it is a good indicator of economic cycles.

Bloomberg

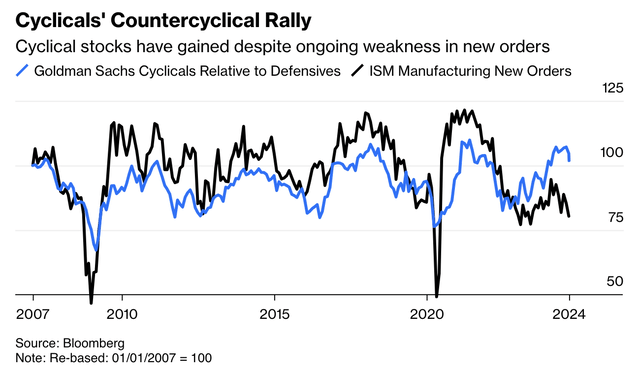

Hence, the market is taking this seriously, as the new orders component of the ISM Index has caused cyclical stocks to underperform relative to defensive stocks. Right now, it looks like this could continue for a while.

Bloomberg

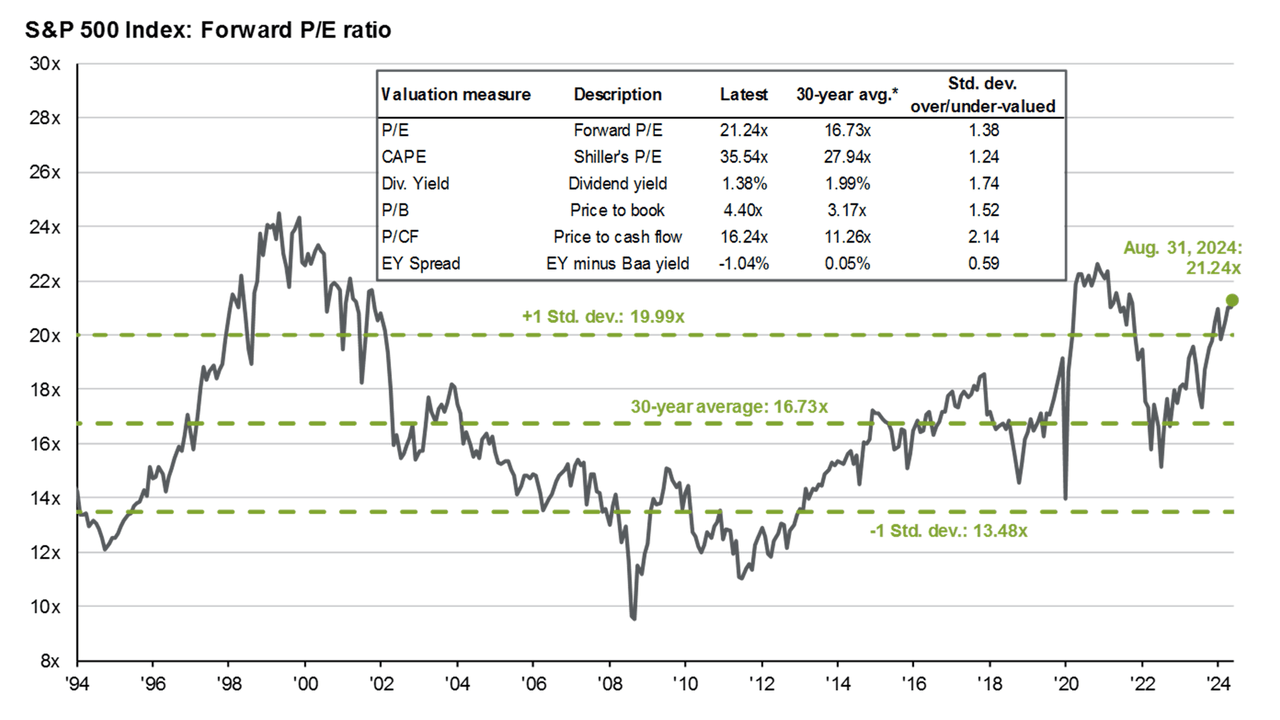

On top of that, the stock market valuation remains lofty.

The updated chart from JPMorgan shows that the S&P 500 trades at a forward P/E ratio of 21.2x. This is the highest number since the Dot-com bubble, ignoring the pandemic.

JPMorgan

Although this does not suggest a pending stock market implosion, these numbers imply the margin for error is slim. If earnings growth expectations come down, the market may be in for a correction.

After all, this is what the comparison between the year-over-year performance of the S&P 500 and the aforementioned ISM Index looks like:

ISABELNET

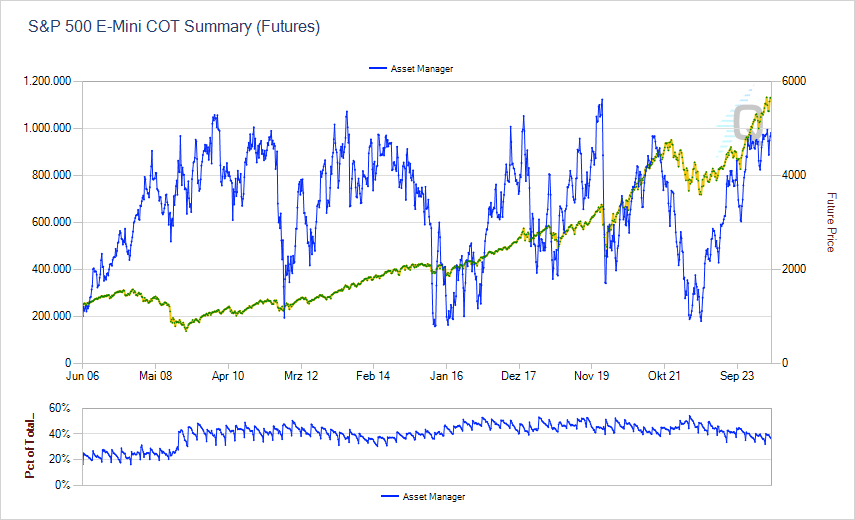

It also does not bode well for the risk/reward that asset managers are very bullish on the S&P 500. The chart below shows asset manager positioning in the S&P 500 E-mini future, the most important stock market future, and the most liquid future in the world(!).

Right now, bullish positioning is close to levels that indicated pullbacks in the past.

CME Group

Hence, I think Bloomberg’s John Authers hit the nail on the head when he wrote the following with regard to the market’s risk/reward (emphasis added):

US stocks are very, very rich, anything connected to AI has done remarkably well, and anyone holding such stocks is sitting on big profits. If this ISM number, like the last one, is followed by disappointing data about US jobs on Friday, then we might well get a rerun of August’s selloff. That wouldn’t be a risk unless stocks were already overpriced, whatever the date on the calendar. – Bloomberg

While I’m not predicting a sell-off, I’m making the case that the risk/reward of the market remains poor.

This is why I just transferred another substantial (relatively speaking) amount to my brokerage account, as I want to be prepared in case we get a correction.

Hence, in this article, I’ll give you three fantastic dividend stocks I’m looking to buy on weakness.

They all have fantastic business models, healthy balance sheets, an attractive dividend (growth) profile, and the ability to outperform the market on a long-term basis.

So, let’s start with pick number one, a “picks and shovels” play on the modern economy I would LOVE to own.

Amphenol (APH) – A Dividend Compounding Gem

Amphenol is a company I’ve had on my watch list for a while. My most recent article on the company was written on July 30, when I went with a Hold rating due to its lofty valuation.

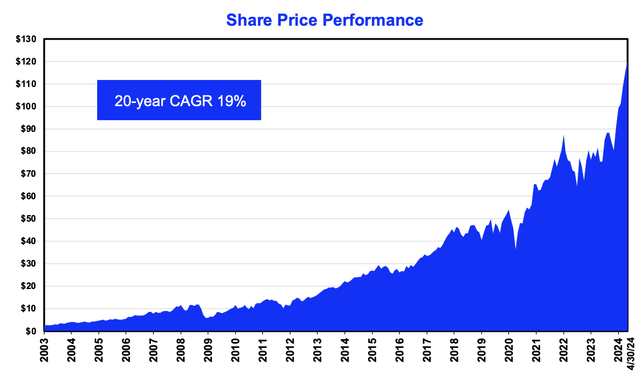

This company is one of the best wealth compounders in the industrial segment, having returned 19% per year between April 30, 2004 and April 30, 2024.

Amphenol Corporation

What makes this company special is its M&A-driven expansion.

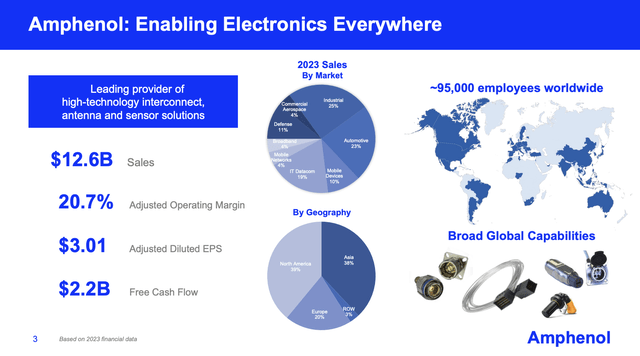

Currently, it employs roughly 95 thousand people across all economic hotspots of the world. Especially North America and Asia are key, as these markets account for roughly 2/3rd of its total sales.

Amphenol Corporation

As I already briefly mentioned, this footprint is the result of aggressive acquisitions. Over the past ten years alone, the company has acquired more than 50 companies.

Amphenol Corporation

This has resulted in a diversified product portfolio, including exposure in automotive markets, mobile devices, defense, commercial aerospace, and IT Datacom, which makes the company a major winner of a wide range of secular tailwinds, including:

- The boom in data center growth.

- The post-pandemic commercial aviation rebound and long-term passenger growth.

- Accelerating (global) defense spending.

These tailwinds have helped to bring the 10-year (ending 4Q23) revenue CAGR to 11%. Higher margins have resulted in a 10-year EPS CAGR of 12%.

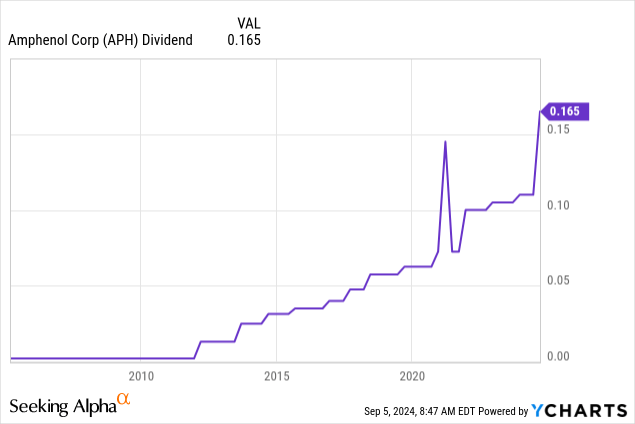

In 2Q24, the company reported 11% organic revenue growth and increased its quarterly dividend by 50% to $0.165 per share. This translates to a 1.1% yield.

Although a 1.1% yield is not exciting, the five-year dividend CAGR is 13.6%, excluding the recent 50% hike. It also has a 40% payout ratio and an investment-grade credit rating of BBB+, one step below the A range.

On top of that, the company has a book-to-bill ratio of 1.12x, meaning for every dollar of finished work, it gets $1.12 in new orders. This is supportive of future growth.

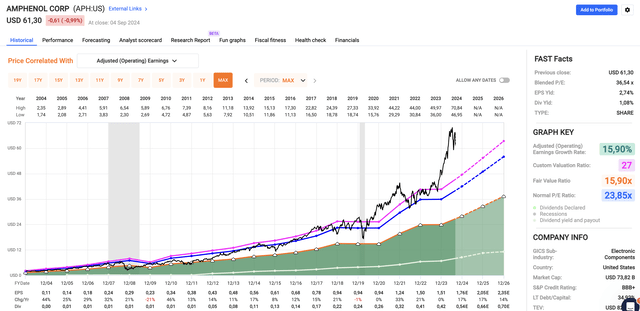

Using the FactSet data in the chart below, the company is expected to maintain elevated growth, with 17% EPS growth in 2024 and 2025, potentially followed by 14% growth in 2026.

The bad news is that APH trades at a blended P/E ratio of 34.5x, almost eight points above its ten-year average P/E ratio of 27.0x.

FAST Graphs

Using a 27x multiple, the company has a fair stock price of $65, a few dollars above its current price.

Hence, in order for me to make it a full position, I want it to come down a bit more. This could happen if the “AI trade” loses momentum, as this would hurt “picks and shovels” stocks like APH as well.

Depending on my cash position, I see myself buying APH this year, which is why it deserves a spot in this article.

Waste Management (WM) – One Of The Best Defensive Stocks

When it comes to watching stocks I want to buy during corrections, I have to include Waste Management, a company I have often called the perfect potential addition to my dividend growth portfolio.

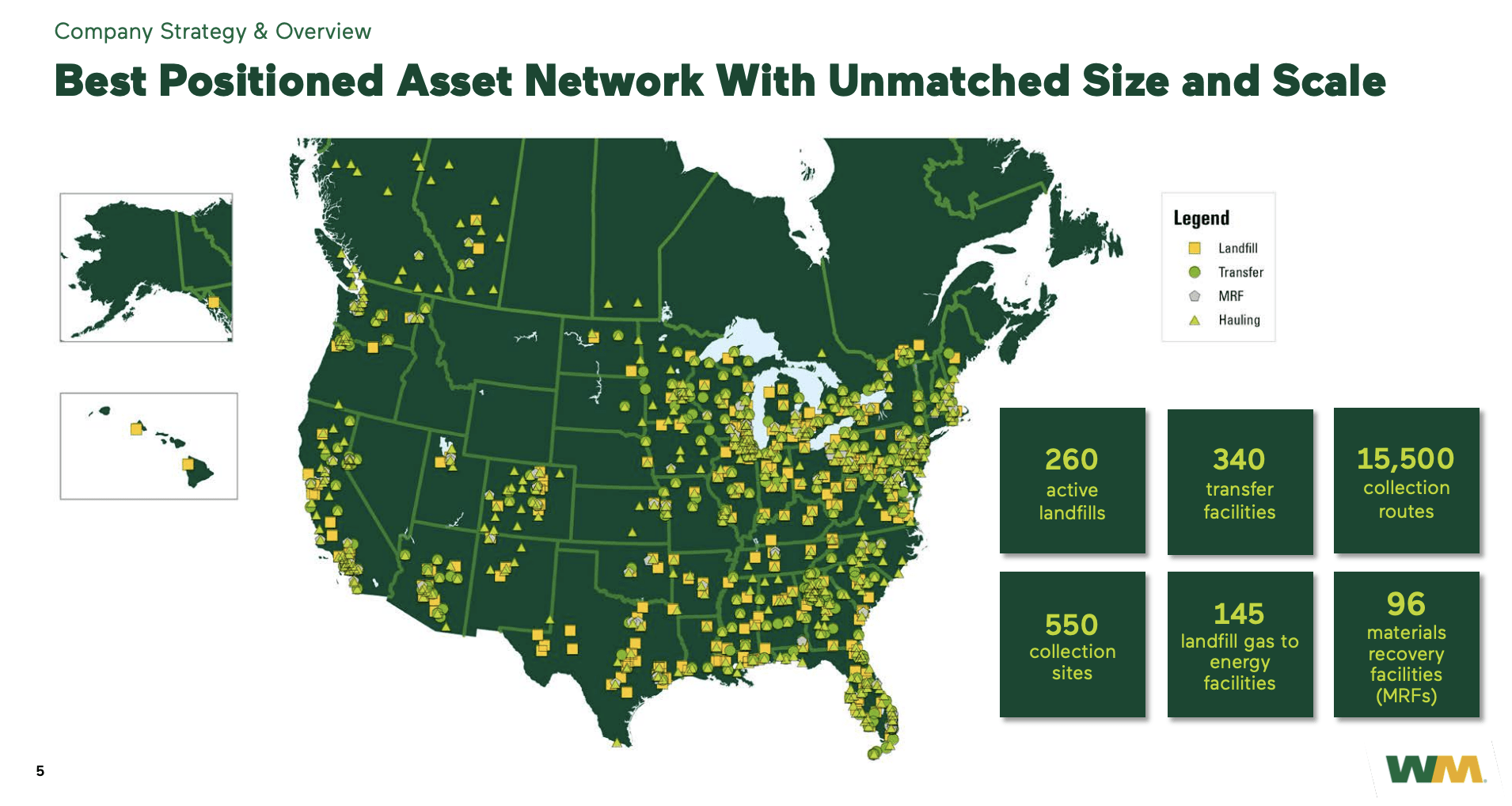

The company owns hundreds of landfills, transfer facilities, collection sites, and thousands of collection routes that make it a key player in the North American waste management industry.

Waste Management

Although this industry has a cyclical aspect (more consumption means more waste), it is a rather anti-cyclical industry with secular growth from a number of tailwinds:

- Population growth.

- Increasingly complex waste (i.e., medical waste).

- Automation can tremendously reduce long-term costs.

- New technologies that allow companies to turn waste into green energy (i.e., methane).

It also benefits from a wide-moat business model.

We assign WM a wide economic moat because we have very high confidence in the firm’s ability to generate excess returns over the next 10 years, and we think it’s more likely than not that excess returns will persist over the next 20 years.

We believe that intangible assets stemming from its irreplaceable landfill footprint is WM’s primary and most durable moat source. Federal and state regulations and not-in-my-backyard activism have made it very costly to operate and close landfills and extremely difficult to receive approval for new landfills. – Morningstar (emphasis added)

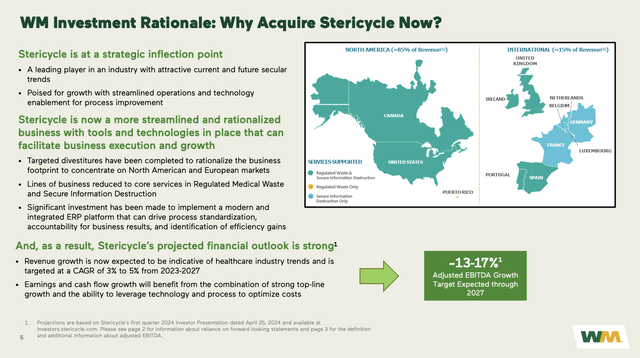

On top of that, the company is a major M&A firm, as it has bought an average of one company per year over the past three years. Its most recent deal is the takeover of Stericycle, a medical waste company with a major footprint in high-growth markets in Europe. This was a $7.2 billion deal with a 13x EBITDA multiple.

I believe this is a great deal, as this business is expected to see 13-17% annual EBITDA growth through at least 2027. In light of an aging population and healthcare growth, this is a great place to be.

Waste Management

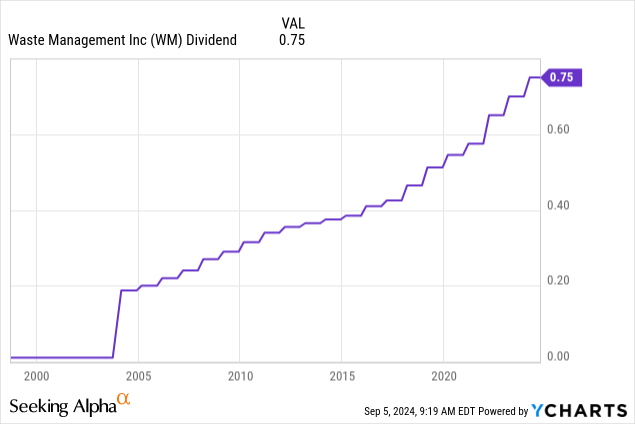

With regard to its dividend, WM currently yields 1.4%. This dividend comes with a 42% payout ratio and a five-year CAGR of 8.2%.

The company’s dividend has an uninterrupted growth streak of 20 years.

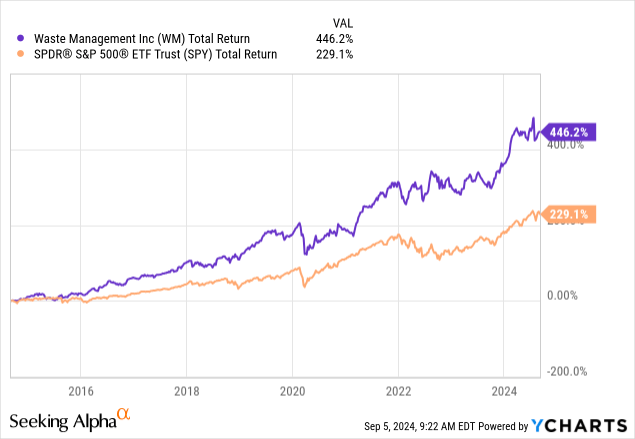

Although the dividend yield is somewhat low, investors have been in a great spot. Since September 2014, WM shares have returned 446%, almost twice the return of the S&P 500!

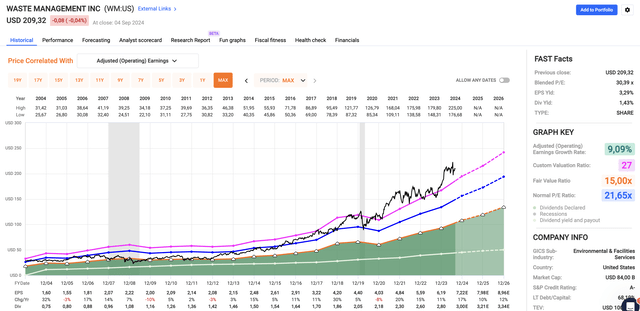

Valuation-wise, WM has a blended P/E ratio of 30.4x. That’s almost ten points above its long-term average and roughly three points above its ten-year average.

FAST Graphs

The good news is that WM is expected to maintain 10-17% annual EPS growth through at least 2026, which gives it a fair stock price of $241, 15% above the current price.

Hence, I believe WM is another gem that makes a great investment during a potential market correction, as I have little doubt it will be capable of delivering elevated future returns with a great risk profile.

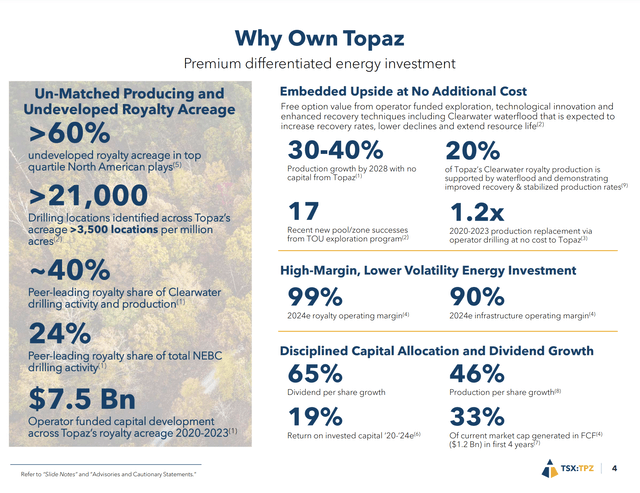

Topaz Energy (TPZ:CA) – A Canadian High-Yield Play

In recent weeks, we have discussed many natural gas opportunities.

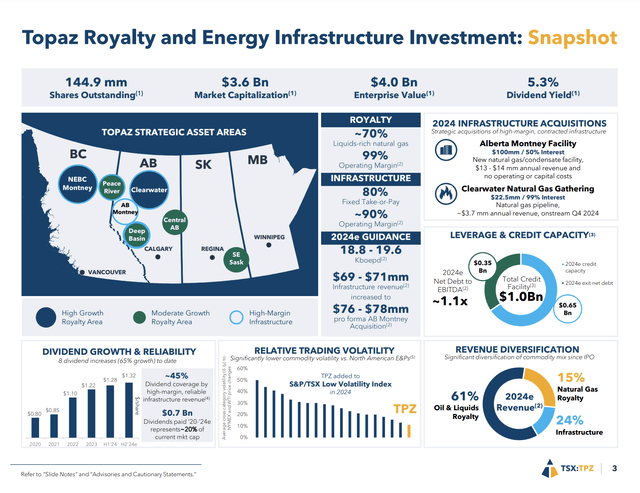

Topaz Energy is a giant in that space. However, one thing sets it apart: it does not produce natural gas.

This company owns mineral rights, which is one of my favorite places to put money, as I have significant exposure to Texas Pacific Land (TPL) and LandBridge (LB), two of its peers that also enjoy surface rights.

Topaz Energy generates 76% of its revenue from oil and gas royalties – most of it coming from the Western Canadian Sedimentary Basin, one of the biggest formations for oil and gas production in the world.

These operations have a 99% operating margin.

On top of that, it has infrastructure operations, with have 80% take-or-pay income and an operating margin of 90%.

Topaz Energy

These margins are provided by the fact that oil and gas producers have to deal with all operating costs, allowing Topaz to sit back and collect royalties. Even better is that this provides the company with up to 40% expected production growth by 2028 without any additional cost.

On top of that, its producers replaced 120% of production in 2020-2023.

Topaz Energy

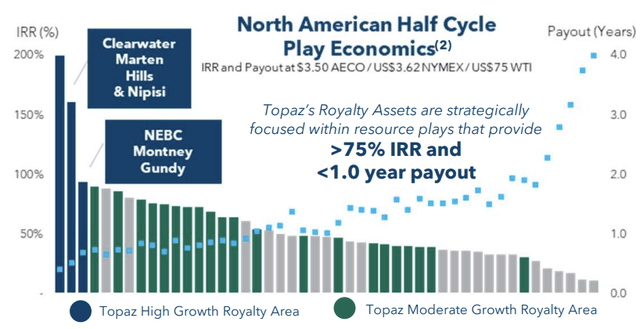

In general, the company benefits from some of the best production spots in North America, including fast-growing areas in the NEBC Montney, where producers achieve an internal rate of return close to 100% in an environment of C$3.50 AECO/$3.62 NYMEX.

Topaz Energy

This bodes well for its dividend.

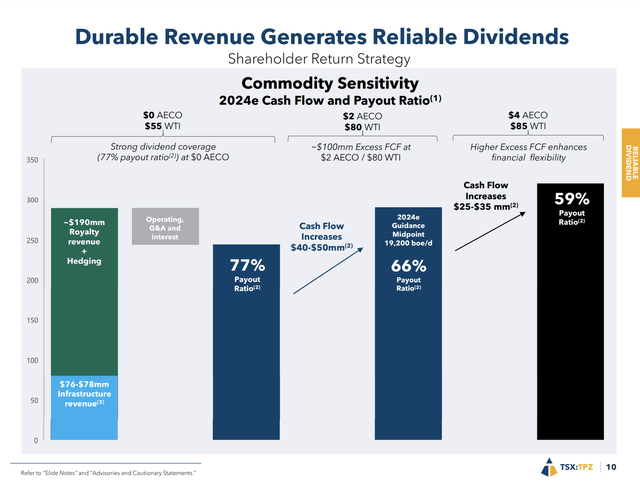

Currently yielding 5.2%, the company aims to return up to 90% of its capital to shareholders. This year, the dividend is breakeven at C$0.00 AECO and $55 WTI. This is not a typo. Even if natural gas prices in Canada were to drop to zero, the dividend would be safe as long as WTI trades above $55.

In an environment of C$4.00 AECO and $85 WTI, the payout ratio drops to 59%. In that environment, it could pay close to 7% in dividends.

Topaz Energy

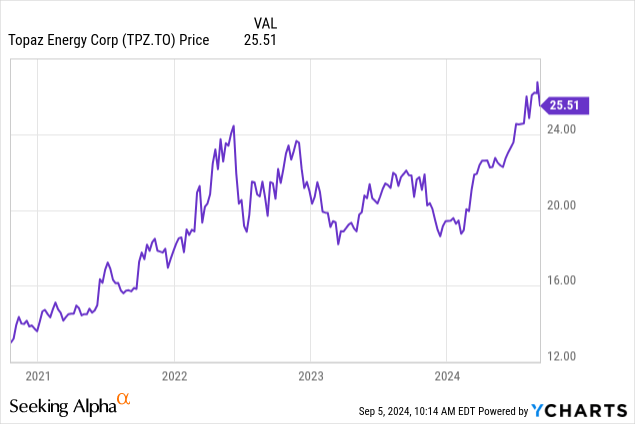

This also explains why its stock price has been doing so well despite the pressure on natural gas and oil prices.

In light of strong long-term natural gas demand, rapid LNG export growth, the fact that more than 90% of Canadian Montney reserves are undeveloped, elevated production growth, and elevated margins, I believe Topaz is the place to be for investors seeking attractive income in the energy space.

Especially if the market corrects, I am hoping it causes Topaz to sell off, as it would make the risk/reward even better.

All things considered, I am closely watching all three investments mentioned in this article, and will likely own at least one of them before the end of the year.

Takeaway

The recent market volatility serves as a reminder of potential challenges ahead.

Economic indicators like the ISM Manufacturing Index suggest persistent weaknesses, and elevated stock market valuations leave little room for error.

While I’m not forecasting a sell-off, the current risk/reward setup remains unattractive.

Hence, I’ve increased the cash position on my brokerage account to be ready for potential buying opportunities in a downturn. I’m eyeing three dividend stocks: Amphenol, Waste Management, and Topaz Energy.

These stocks are in a great spot to thrive long-term, and I’m prepared to add at least one of them to my portfolio.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here