Jacobs Solutions (NYSE:J) released its Q3 result on August 6th showing an improvement in backlogs. In my initiation report published in April 2024, I highlighted my ‘Strong Buy’ rating based on the thesis of growth from critical infrastructure and sustainability. Jacobs is nearing the completion of the spin-off of their Critical Mission Solutions and Cyber & Intelligence Businesses and merger with Amentum. I reiterate a ‘Strong Buy’ with a one-year price target of $170 per share.

Spin-off of Critical Mission Solutions and Cyber & Intelligence Businesses

On July 16th, Jacobs filed a Form 10 registration statement for the planned spin-off of their Critical Mission Solutions and Cyber & Intelligence Businesses and merge with Amentum, with an expectation of completing in the second half of FY24. I think the spin-off and merge will create value for Jacobs’s shareholders for the following reasons:

- After the merge, the new Amentum will generate around $13 billion in total revenue, with more than 80% coming from government technology markets. Jacobs’s shareholders will have 60% equity ownership in the new Amentum. The separation will potentially unlock Amentum’s valuation, particularly for their stable revenue stream with a diversified portfolio mix.

- After the spin-off, I think Jacobs could better focus on critical infrastructure and sustainability, growing their businesses to satisfy the needs of sustainability and ESG initiatives. It is evident that critical Mission Solutions and Cyber & Intelligence Businesses are quite different from Jacobs’s core construction and consulting businesses.

- As indicated over the call, the management might use the proceeds to repay some of their debts. As the end of Q3, Jacobs had 37% of total debts tied to floating rates with a weighted average interest rate of 5%. The potential repay of debts will strengthen Jacobs’s balance sheet.

Strong Growth in Backlog

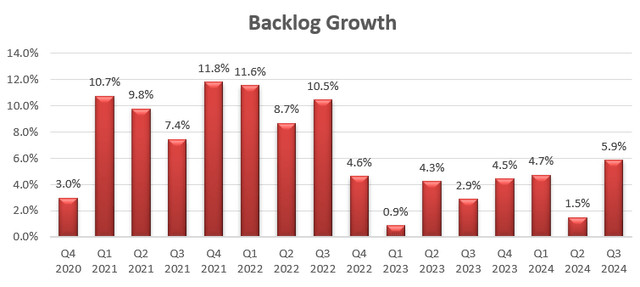

My biggest takeaway from the quarter is the strong growth in total backlog, as presented in the chart below.

Jacobs Solutions Quarterly Earnings

The strong backlog growth is driven by several factors:

- As indicated in my initiation report, Jacobs has been focusing on high-margin critical infrastructure projects over the past few years. For instance, the water, environmental and advanced facilities end markets have witnessed strong demands for infrastructure construction and consulting, as the management indicated over the earnings call. These critical infrastructure projects tend to carry higher margin and larger sizes for Jacobs.

- The demands for high-end science-based consulting and advisory services remained strong during the quarter. On July 24th, Jacobs was awarded the competitive FBI technology supplies and supports agreement, with an $8 billion total ceiling contract value over the next eight years. This is a perfect example of Jacobs leveraging their crucial IT solutions, including infrastructure services and software/emerging technologies.

Outlook and DCF Valuation

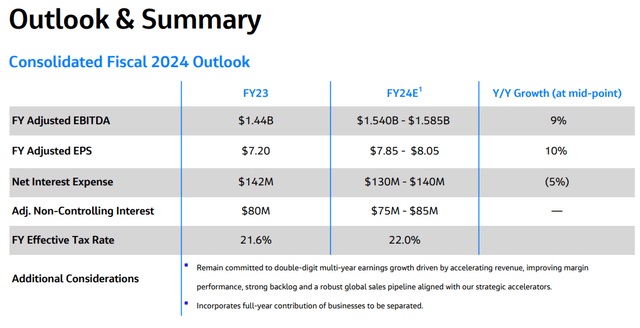

In Q3, Jacobs delivered 1% revenue growth and 5.9% backlog growth, and provided guidance for their FY24 as follows:

Jacobs Solutions Investor Presentation

As Critical Mission Solutions is going to be separated, I only calculate the growth for the remaining segments. I calculate Jacobs will deliver 5% revenue growth in FY24 and 9% from FY25 onwards, based on the following arguments/assumptions:

- People and places solutions: The business segment has become an important growth driver for the company, growing by 8% CAGR over the past three years. Importantly, Jacobs has a robust project pipeline within the business segment, including water, environmental and advanced facilities. The strong backlog enables the company to sustain its growth momentum; therefore, I estimate the People and places solutions segment will grow by 4% in FY24 and 9% from FY25 onwards, primarily driven by the global push towards ESG and sustainability.

- Divergent Solutions: Over the earnings call, the management indicated some government project delays such as space-based ISR program. These project delays have caused a sluggish revenue growth year-to-date. I don’t anticipate there will be substantial improvements before the U.S. election. As such, I anticipate the revenue will decline by 11% in FY24, then recover to 5% from FY25 onwards.

- PA consulting: I assume the segment will continue to grow by 5%, aligned with their historical average.

I model 10bps annual margin improvement for Jacobs, driven by: 5bps from gross profits due to higher margin projects, and 5bps operating leverage from SG&A. It’s worth noting that Jacobs is a labor-intensive business, and investors should not expect a huge margin improvement in the future, in my opinion.

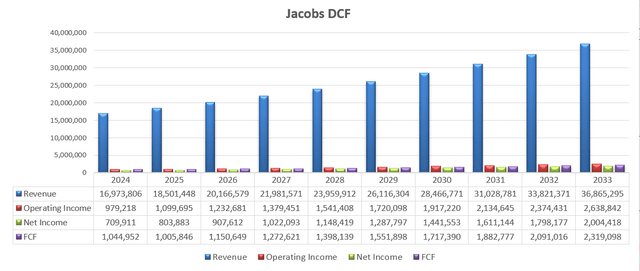

Lastly, I assume Jacobs will invest 2% of total revenues in acquisitions, contributing 100bps to the overall topline growth. The DCF summary can be found below:

Jacobs Solutions DCF

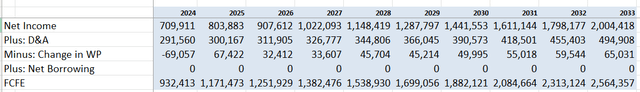

I calculate the free cash flow from equities as follows:

Jacobs Solutions DCF

The cost of equity is calculated to be 9.8% assuming: risk-free rate 3.8%: beta 0.86; equity risk premium 7%. Discounting all the free cash flow from equities at a discount rate of 9.8%, I calculate the one-year target price to be $170 per share.

Key Risks

In Q2, Intel (INTC) announced their financial earnings and indicated the company plans to reduce their capital expenditure spending over the next few years, as part of their restructuring initiatives. Specifically, Intel’s CAPEX will be reduced by 20% in FY24. Jacobs has been working on several projects for Intel to help build up the manufacturing facilities. The reduction in Intel’s CAPEX could potentially impact Jacobs’s growth in the near future.

End Notes

I think the separation of Critical Mission Solutions and Cyber & Intelligence Businesses makes strategic sense to Jacobs’s existing shareholders, and the strong backlog growth will support Jacobs’s business growth in FY25. I reiterate a ‘Strong Buy’ with a one-year price target of $170 per share.

Read the full article here