I published my initial investment thesis on Gaotu Techedu (NYSE:GOTU) in September 2023. Due to extreme good luck, the stock quickly doubled in less than 6 months after my “strong buy” rating. In Feb of 2024, I wrote another article downgrading GOTU to hold as the stock rose too far. Since then, GOTU has dropped almost 50%. I believe the recent development in China’s after-school tutoring market, especially the change in government attitude, is very positive for GOTU. However, the stock price has not fully priced in such positive development. Therefore, I am upgrading GOTU to a “buy” rating.

The Chinese government has loosened regulations for after-school tutoring

One thing to understand about the Chinese government is that it’s very capricious. Because there isn’t a mechanism for checks-and-balances, the government can make regulatory changes at will. As a result, China is notorious for its inconsistent policymaking. Such is the case for the after-school tutoring industry. The Chinese government cracked down on the after-school tutoring in 2021 as the government deemed the industry’s boom as a “disorderly development.” The clampdown lasted for almost two years and decimated the industry.

However, when the Chinese government announced the ban on after-school tutoring, it probably didn’t expect China’s economy to enter one of the worst recession is China’s modern history after the burst of China’s massive real estate bubble. As the economic slump went on, China’s unemployment rate, especially the youth unemployment, skyrocketed. According to data from Statista , youth unemployment hit as high as 21.3% in June of 2023.The youth unemployment rate was so embarrassing that the National Bureau of Statistics of China paused releasing the data for 6 months.

The Chinese government is very concerned about the high youth unemployment rate as it may cause social unrest. However, there are very few options to boost the employment market for the youth. Among the limited options, the after-school tutoring market is a very rational one. According to this report, at its peak, China’s after-school tutoring industry employed 10 million people. It’s also one of the largest recruiters for the Chinese college graduates and graduate students, along with the real estate industry and the internet industry. As well all know, most of China’s non-SOE real estate developers such as Evergrande and Sunac have gone bankrupt. China’s internet giants such as Alibaba (BABA) and Tencent (OTCPK:TCEHY) are laying off employees to improve operating efficiency. Therefore, the after-school tutoring industry is the only industry that can add incremental employment at a large scale.

I believe the Chinese government changed their attitude towards the after-tutoring sector based on the above rationale. It is clear that the Chinese government has realized that they went too far with the regulation and now it’s time to reverse the course.

Usually, the way the Chinese government corrects its policy errors is to take small and gradual steps. With the after-tutoring sector, the first step was the draft regulation released by the Ministry of Education on February 2, 2024, which explicitly clears the hurdle for previously-ambiguous rule regarding after-school tutoring for high school students.

But more importantly, on August 3rd, China’s State Council unveiled a guideline on “boosting high-quality development of service consumption to release consumption potential”. Although the guideline didn’t specifically name the after-school tutoring industry, it did say “consumption related to sports, education and training, and residential services will also be spurred”. I believe this is a clear prelude for further relaxation for after-school tutoring as part of the education and training services. As most of the small after-school tutoring institutions have gone out of business, existing large players such as EDU, TAL and GOTU will clearly benefit from the policy turnaround.

GOTU’s growing non-academic tutoring business

Even if there is no further deregulation of the academic tutoring business, GOTU’s non-academic tutoring services and other traditional learning services have become the major source of GOTU’s revenue. GOTU’s management disclosed in Q1 2024’s earnings call that “more than 75% of total revenues came from non-academic tutoring services and other traditional learning services, which represents a 35% increase year-over-year”. Obviously, the growth momentum of GOTU’s non-academic tutoring services is very strong. This is in-line with EDU and TAL. I think the growth rate of the non-academic business itself is worth noticing for GOTU.

Financial projections and valuation

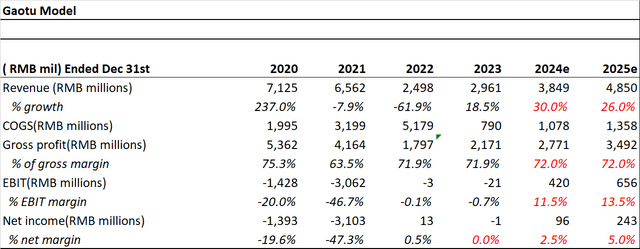

In terms of financial projections, I’m assuming a 30% growth rate for GOTU for 2024, which is in-line with GOTU’s recent quarterly growth rate, but way below SeekingAlpha’s analysts’ estimates. However, to be conservative, I didn’t include the impact of potential policy relaxation in my model. Therefore, any policy tailwind will be pure upside.

author’s estimate

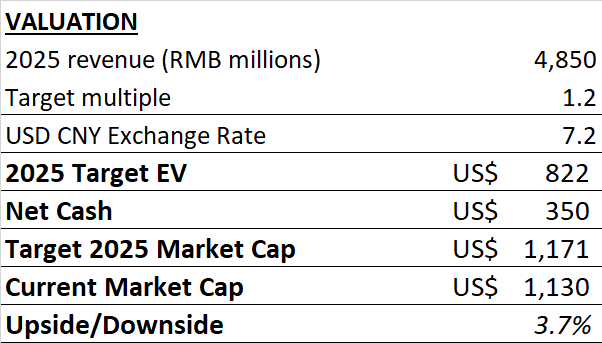

In terms of valuation, I’ve applied a 1.2 times EV/Sales multiple, which is the sector median, to GOTU’s 2025 estimated sales.

author’s estimate

At today’s valuation, GOTU looks a bit undervalued, even without considering the very likely positive regulation change.

Risks

The biggest risk for GOTU in the long term is the declining newborn population in China. According to Statista, in 2023, only 9 million babies were born in China. This is an almost a 50% decrease from 17.9 million in 2016. Fewer babies mean less demand for tutoring services in the future.

The second major risk GOTU faces is regulatory risk. As I’ve mentioned earlier, the Chinese government is very capricious in their policymaking. They may encourage the development of the after-school tutoring service during economic recession to boost youth employment. However, during boom times, they may tighten the grip again.

Lastly, as with all other Chinese ADRs, GOTU’s stock is very volatile as it is sensitive to both geopolitical and policy tensions.

Conclusion

I believe the Chinese government has changed its attitude towards the after-school tutoring industry, as evidenced by two Central Government level draft-regulation and guidelines in less than six months. GOTU’s valuation is already cheap with the non-academic tutoring business. The potential change in regulation provides further upside to GOTU’s share price. Therefore, I’m upgrading GOTU to a “buy” rating.

Read the full article here