Summary And Key Takeaways

Estée Lauder (NYSE:EL) was once a hyped darling of the masses, with its stock trading at lofty valuations. The rise was only short-lived, though, and the fall well deserved, as the business has been suffering for several years now. Despite being down by ~75% from the high, I don’t see any reason to rush in. To the contrary, even the dividend is in jeopardy.

Why This Beauty Isn’t Pretty Anymore – Better Prepare For A Dividend Cut

Estée Lauder was founded in 1946 by Estée and Joseph Lauder. Today, it is one of the world’s leading beauty companies, offering skin care, makeup, fragrance and hair care products over different price ranges.

The snapshot below is from the last annual report, showing how their individual brands are positioned between price points and progressiveness:

Estée Lauder, annual report FY 2023

Me not being an expert in this field of cosmetics, was a bit surprised, though, that their brand Estée Lauder seems to be only somewhere in the middle of the price range, as I at least have seen it in one or the other stores presented prominently alongside others like Lancôme, while I’ve never heard of others, seemingly more expensive ones in this line-up…

But that’s just as a side note.

It’s positioning and perception, though, is more towards the prestigious luxury market, so it is effectively competing against pure-play names like L’Oréal (OTCPK:LRLCF), but also partly against LVMH (OTCPK:LVMHF) (with brands like Dior).

The founding family still controls the company via a dual-class share structure, comprising an 84% voting majority, while only having a 35% economic interest. Class A has only one vote per stock, while class B has ten.

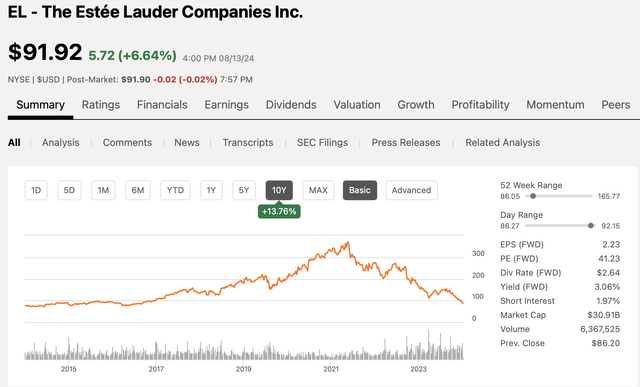

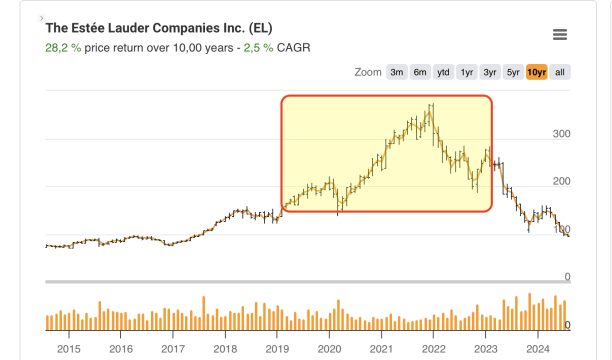

Before we dive into the numbers, here’s a price chart of Estée Lauder’s stock over the last ten years for a big picture overview:

source: Seeking Alpha

We can see immediately that there must be a clear issue with the stock, if not the entire company. Stocks don’t hover around decade-lows without a reason.

While the strong appreciation after the lockdowns was more in sympathy with the stock market rallies of 2020 and especially 2021, but also of course growing results (I don’t want to deny that), the rapid fall from grace happened due to challenges on an individual, i.e. business level.

On the next chart, you can see the development of some business fundamentals which peaked around the high – or the other way around, the stock has peaked around peak business fundamentals (blue = sales, black = operating income, green = free cash flow).

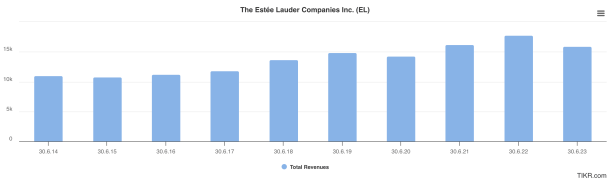

source: TIKR source: TIKR

Since fiscal year 2022, the business is trending sharply lower.

Not just a bit, but operating earnings and free cash flow are showing the weakest results over the last ten years!

There were mainly two reasons while Estée Lauder has fallen out of favor:

- one, there were still lockdowns in China during 2022, respectively Asia travel in general was weak

- EL is positioned in a sandwich between the big players L’Oréal and LVMH and others on one side, but also above fast-growing cheaper competitors on the other

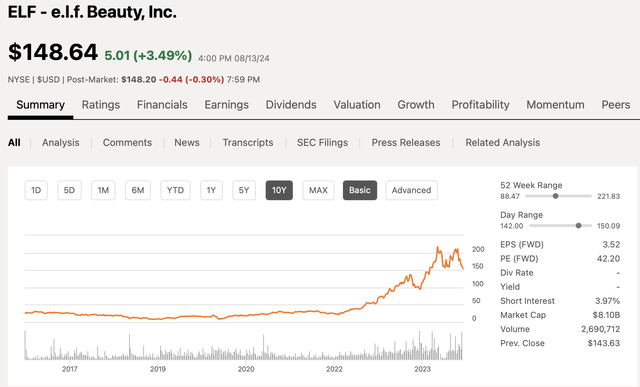

One such phenomenally fast rising star is e.l.f. beauty (ELF) – its stock tripled in just the last 1.5 years and even 9x-ed over the last five years.

In the long-run, this looks certainly like a more healthy development (neglecting the valuation multiple).

source: Seeking Alpha

As sales went up by 15x (X, not percent!) over the last five years, it is out of question that this company has grabbed tremendous market share, likely not from L’Oréal, but from such candidates like EL.

EL started restructuring programs, including job cuts and other cost savings initiatives.

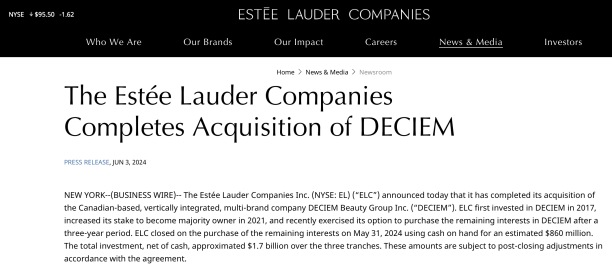

It also a few months ago acquired the company DECIEM – a Canadian company with the “The Ordinary” brand. It was from what I could find (never heard of it before) a social media success story, banking on high transparency regarding ingredients.

EL was already the majority owner at the time of the last annual report; hence the brand was already displayed in the brands chart above. However, you’ll have noticed that this brand is positioned on the lower end of the price spectrum – thus likely not generating huge margins and contradictory to wanting to be a premium company.

Now, they bought them out completely for in total 1.7 bn. USD, of which 860 mn. USD were due now in a final tranche for the remaining equity not under control.

source: Estée Lauder website

DECIEM was a privately held company and said to have achieved sales of 460 mn. USD in 2021.

source: CBC Canada

This number has likely increased somewhat as EL said that the purchase fits into its set of brands generating all sales between 0.5 bn. USD and a full bn. USD. As EL is generating ~15 bn. USD in sales, this is also just a small tuck-on acquisition and certainly not a transformative move, at least for the time being.

I haven’t found anything regarding profitability, though. But as said, as a lowly priced brand, it likely won’t contribute too much to the bottom line. All in all, the paid price looks a bit high.

Until the last set of results (the next ones are due next Monday, 19 August 2024), EL was constantly disappointing and lowering their outlook. In May, reporting about their fiscal Q3, they showed some first signs of relief with organic (+6%) and even total sales growth (+5%).

What reads like a first sign of a potentially successful turnaround, should be taken with a grain of salt, though.

First, they still are expecting (this was in May!) a challenging market environment, leading to results for 2024 being lower than 2023. Concretely, despite an assumed acceleration of organic sales growth, reported net sales are expected to be down still by -2% to -3%.

Earnings were expected to be affected negatively due to restructuring charges and higher interest rates on their debt to reach only 1.96-2.09 USD per share. In comparison, last FY saw 2.80 USD and the two years before 6.60 USD and 7.80 USD!

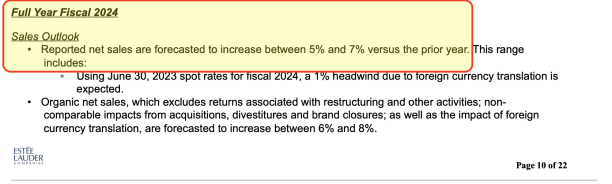

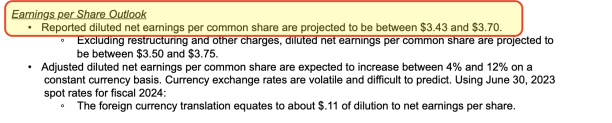

Not only that, the guidance at the beginning of the current fiscal year saw sales to be higher by between 5% and 7% and EPS to arrive in a range between 3.43 USD and 3.70 USD.

That’s a gigantic miss!

source: Estee Lauder earnings announcement FY 23 source: Estée Lauder earnings announcement FY 23

And I must admit that I don’t believe they will hit the last, massively lowered guidance either, as the economic development has worsened since their last earnings announcement.

Even if they hit it miraculously, the outlook is more likely to be weaker than stronger.

Balance Sheet And Capital Allocation

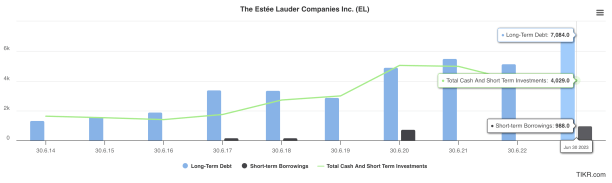

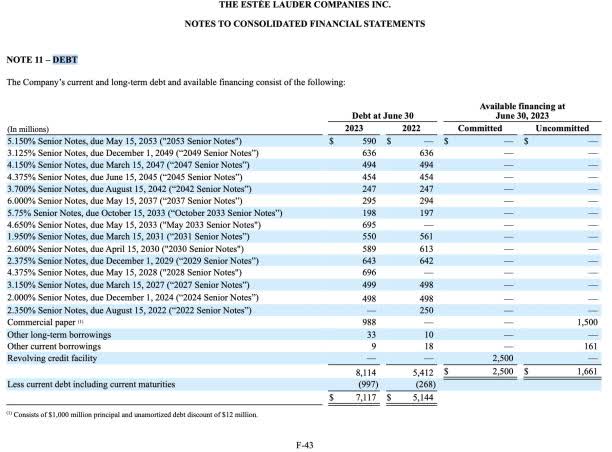

Net debt stands at around 5 bn. USD. The chart below shows the numbers until the end of June 2023 (fiscal year 2023), but since then, the numbers worsened a bit. In February 2024, they issued a 650 mn. USD bond with a 5% coupon (above their average cost of debt) and also paid 860 mn. USD for the DECIEM acquisition, while paying out a dividend with a yearly run rate of almost a billion USD.

source: TIKR

The only good thing here is that they have structured their debt ladder very favorably. No big near- or even midterm maturities, only small increments every other year.

source: Estée Lauder, annual report FY 2023, p. F-43

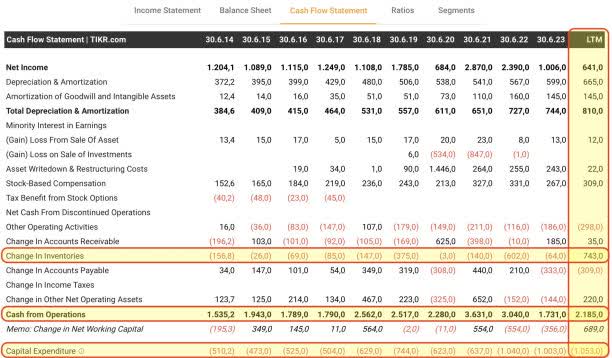

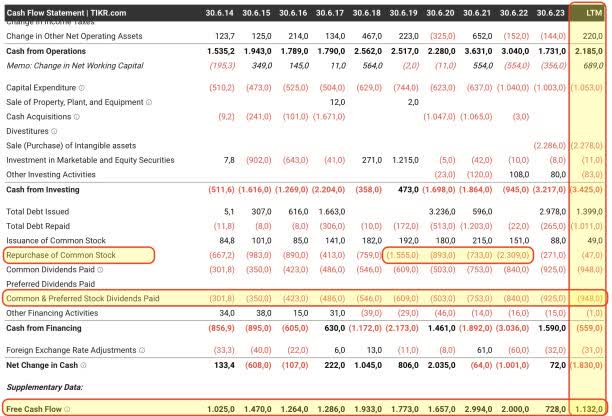

Free cash flow was expected to come in around a billion USD for this year. This number is realistic, however, not due to operational excellence, but rather due to lower inventories – this is a one-time effect.

source: TIKR

You can see below, FCF should be around a billion USD, however, only this year. The next will likely see a way lower number with weaker consumer sentiment and with support from the inventory side unlikely to repeat.

And herein lies the danger for the dividend, as the next chart clearly shows.

source: TIKR

Above, we can see that the dividend costs them currently ~950 mn. USD p.a.

So, even with the generously positive one-time working capital effect of lower inventories, FCF covers this number only with a small margin. Also keep in mind that cost of debt will be higher now, i.e. pressuring earnings and cash flows a bit.

This is a clear sign for me that the dividend is in danger. The buffer is just too small, and there’s a decent chance that the new fiscal year 2025 won’t be strong – to the contrary!

The last chart above also shows when share buybacks have been done aggressively – you likely already guessed it, when the stock was way higher than it is now for in total ~5.5 bn. USD. As a reminder, today their net debt number is higher and at 5x FCF. The end result was a not even 5% lower share count…

source: TIKR

Valuation

With this, let’s have a look at the valuation and let’s be even generous with the assumptions. Think of kind of a base and a bull case scenario.

The base case would be current sales of 15 bn. USD and a FCF of a bn. USD. The market cap is 34 bn. USD, for an enterprise value of 39 bn. USD – still a rich multiple of 39x.

Being a bit more optimistic and assuming that growth reemerges and margins rise again to achieve a FCF of 2 bn. USD. In FY 2021, they had 2.9 bn. USD and in FY 2022 2.0 bn. USD – or at the peak. This translates into an EV / FCF multiple of still ~20x.

In other words, a hefty recovery is still priced in.

That said, the upside for me is basically non-existent.

On top, you also have a realistic risk for a dividend cut, if not entire suspension, depending on how the guidance for the new fiscal year comes in. Should we indeed go into a harsher recession, it’s almost a given that they will completely eliminate the payout, family descendants or not.

EL is about to report FY 24 earnings next Monday, 19 August 2024. I am especially concerned about the guidance.

Risks To My Thesis

Estée Lauder could guide above my expectations and surprise to the upside, sending the stock up. Likewise, I could be too pessimistic about consumer spending.

Conclusion

Risks first is my strategy. As almost the entire FCF is spent on the dividend while business momentum is weak (and the stock on top still pretty expensive), I do not see a favorable risk and reward situation. Avoid.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here