Investment Thesis

EMX Royalty (NYSE:EMX) reported a good second quarter, citing an “$8.76M and $7.84M in adjusted revenue and other income and adjusted royalty revenue, respectively, which represented a 32% and 49% increase, respectively, compared to Q2 2023”. I think the company has a variety of undervalued assets in their royalty portfolio, strong cash flow, and a cheap valuation. Thus, investors who are interested in the junior gold royalty stocks should take a look at buying EMX Royalty at near historical lows.

Company Overview

EMX Royalty is a Canadian-based gold mining royalty company that “has a long-standing track record of success in exploration discovery, royalty generation, royalty acquisition, and strategic investments” according to its website. They make money by investing in potential mineral exploration and development, partnering with gold miners, and then collecting royalty payments for the minerals extracted and then sold.

The company’s “royalty and property portfolio spans five continents, and consists of a balanced mix of precious metal, base metal, and other assets”. Among these metals are gold, copper, nickel, zinc, and lead. EMX Royalty is focused on building cash flow through strategic investments and careful management of their royalties. Their three-pronged business model stems from royalty generation, royalty acquisition, and strategic investments, according to their annual report.

While gold approaches new highs, I was surprised to see that the junior gold mining space is somewhat neglected. Stocks like EMX Royalty stood out as being underperformers relative to the market, despite strong operating results and a diverse asset portfolio. I also like that management, directors, and employees own 12.6% of shares outstanding according to their investor presentation, aligning management’s interest with shareholders.

Overall, with gold prices even higher, it’s rather confusing to see the market not valuing EMX Royalty’s assets properly, in my view. Given the rise in adjusted royalty revenue, I believe the market is undervaluing the fundamental track record, which gives investors a nice buying opportunity. The rise in inflation and potential recessionary talk arguably makes the precious metal space more attractive, creating nice tailwinds for stocks like EMX Royalty.

Strong Uptrend In Royalties Should Continue

In the recent quarter, the press release says,

Adjusted revenue and other income increased by 32% compared to Q2 2023.

Timok generated royalty revenue of $1,586,000 in Q2 2024 for a second consecutive quarter of record production from the upper zone.

The Company is currently on pace to achieve the upper end of its annual guidance for GEOs sold and adjusted royalty revenue, while aiming for the lower end of our option and other property income guidance.

I’m surprised that the market is not more excited on this news. Since the press release, the stock still muddles around the low $1.60s, barely budging. To me, the neglection is unwarranted, and I see improvements in adjusted EBITDA, GEOs sold, and adjusted revenue to be good news. Management also explains plans for future growth,

The Company is excited about the prospect for continued growth in the portfolio for 2024 and the coming years. The driver for near and long term growth in cash flow will come from the large deposits of Caserones in Chile and Timok in Serbia.

These projects should improve the cash flow capabilities for shareholders and make the fundamentals more visible for the market to see. Eventually, it may be obvious to the market that fundamental improvements are underway and the stock re-rates higher. Investors can see that higher GEOs sold unsurprisingly corresponds with higher revenues, and I think this uptrend will continue as management continues to invest and generate more royalties. Therefore, investors should view the recent quarterly results as evidence that the bull thesis still has legs.

Metal Prices Should Remain High

I think that metal prices from gold to copper will remain attractive, helping EMX Royalty generate more royalty revenue. Put simply, miners have more incentive to extract minerals from the ground when metal prices are high, which increases royalty revenues and asset portfolio value for EMX Royalty. As of this writing, gold is already trading at around $2500/oz, and copper at $4/lb.

With regard to gold, news that central banks are hoarding gold is part of the reason why demand continues to push the price higher. According to the World Gold Council,

According to the 2024 Central Bank Gold Reserves (CBGR) survey, which was conducted between 19 February and 30 April 2024 with a total of 70 responses, 29% of central banks respondents intend to increase their gold reserves in the next twelve months, the highest level we have observed since we began this survey in 2018.

Inflation, global recession fears, and overall macro uncertainty have increased the buying appetite of central banks to balance their reserves. I think gold still has room to move up, and the cheapest beneficiaries are the junior space, which trades very cheaply and is for the most part ignored. I think central banks will still be the primary reason why gold prices continue to remain high, which keeps the uptrend in royalty revenues going for EMX.

Furthermore, copper is seeing more demand due to the clean energy transition. The IEA indicates that copper will see more use in renewable energy, electric vehicles, and a potential rebound in China manufacturing. Copper may also potentially be in short-supply in the future, as “it is estimated that mines will only meet 80% of copper needs by 2030”. I think market forces will keep copper at attractive prices so that EMX’s copper royalties and investments perform well.

With cash flows improving and a strategic refinancing pushing the maturity of their debts to 2029, there’s a lot to like for investors. Yet, the stock continues to trade sideways and neglects to price in these positive developments. Higher metal prices should allow the cash to flow in, strengthen the balance sheet, and sustain good business performance.

Money Pours Into EMX’s Flagship Royalties

The two copper flagship royalties EMX has are Caserones and Timok, both of which are firing on all cylinders at the moment. According to the presentation, management claims that near-term catalysts are “significant untapped exploration potential” for Caserones and an extended project life for Timok. I think these catalysts are valid, and increase the value of these royalties for shareholders.

I expect both the Timok and Caserones royalties to pay a lot more in the future, which will likely drive both royalty revenues and the share price higher from today. Management talks about “significant investment by Zijin Mining Group at Timok through continued development of upper and lower zones” in their press release. In particular, the lower zones have both good discovery and production potential, based off of Zijin Mining’s website.

With gold and copper at reasonably high prices, I think that the current valuation of EMX Royalty is very cheap. Significant investment and development into Caserones and Timok show that major mining companies are eager to get to work, generating more royalty revenues for EMX. In my view, Caserones and Timok are the two major crown jewels that may drive most of the value for shareholders, as they have attractive optionality value due to their strong exploration and untapped discovery potential.

Valuation – $3+ Fair Value

Valuing junior royalty/streaming companies can be very tricky, so I will try to do a peer comparison analysis. I’ll be using Franco-Nevada (FNV), Osisko Gold Royalties (OR), and Wheaton Precious Metals (WPM). Franco-Nevada has a P/S ratio of 20x, Osisko Gold Royalties at 16.5x, and Wheaton Precious Metals at 24x. EMX Royalty does indeed trade at a massive discount to revenues compared to its larger peers, trading at 6x FWD sales according to Seeking Alpha.

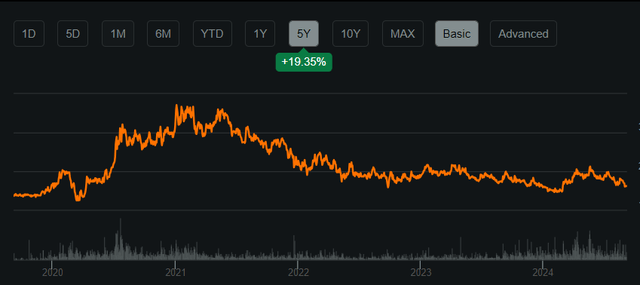

If we assume that revenues increase to $40 million annually as the uptrend in royalty revenues continue, and apply a below-peer multiple of 10x sales, we get a fair value of $400 million in market cap. Divide by shares outstanding of 112 million gets me $3, rounded down. I think that investors can see the undervaluation if they look at the historical stock chart over the past 5 years.

Seeking Alpha

Despite improvements in cash flow, royalty revenues, and investments in new projects, the stock has traded roughly flat over the past five years. I think that the stock sells too low from a historical chart perspective, giving me more evidence that this name is undervalued. The business has gotten a lot better and likely deserves a higher valuation given its strong past track record.

Risks

A lack of catalysts and overall neglect can leave the share price hanging around historical lows. The company has cited going concern risks in the past,

As at December 31, 2023, the Company had a working capital deficit of $2,270,000 (December 31, 2022 – working capital of $31,562,000). As such, the consolidated financial statements of the Company contain a note that indicates the existence of a material uncertainty that raises substantial doubts about the Company’s ability to continue as a going concern.

To combat this, investors may expect future dilution or more debt on the balance sheet to mitigate the working capital deficits that the company may have in the future. Right now, they have significant cash of $21.4 million, but this money may run out and cause another working capital deficit. Investors should watch the cash position in order to assess the risk of potential future dilution.

Metal prices could fluctuate down, putting pressure on junior royalty companies like EMX. Exploration efforts are not guaranteed of success, and royalty revenues may not grow as I expect it to if production stalls from the miners. As a junior royalty company, EMX does not have any control over the mining operations themselves, so accidents could stall and delay production and negatively affect royalty revenues.

Buy EMX Royalty

I got interested in the junior royalty/streaming companies after witnessing inflation, central banks buying gold, and talks of recessions in the U.S. pushing the price of gold higher. I think EMX Royalty happens to be one of the cheapest junior royalty stocks in the sector. All in all, as someone who doesn’t like chasing gold or gold stocks at YTD highs, I like EMX Royalty’s asset portfolio and recent royalty revenue performance enough to give this name a buy rating.

Read the full article here