Editor’s note: Seeking Alpha is proud to welcome Naysay Analysis as a new contributing analyst. You can become one too! Share your best investment idea by submitting your article for review to our editors. Get published, earn money, and unlock exclusive SA Premium access. Click here to find out more »

Losses As Far as the Eye Can See

Eye care drug company Harrow (NASDAQ:HROW) looks destined to lose money indefinitely, in my opinion. It reported a loss of $20 million for the first half of 2024, a doubling of the $10 million loss in the same period last year, and worse than the $14 million loss in the previous six months. Adjusted EBITDA is declining, operating cash flow is negative and declining, yet leverage is increasing.

Harrow’s effort to reinvent itself as a drug marketing company is expensive. Selling, general, and administrative expenses in 2024 have almost doubled over 2023. Interest payments exceed $21 million annually, compared to $7 million in 2022.

Harrow is guiding for — shall we say “eyeballing” — revenue of over $180 million in 2024. However, it may have to make a $35 million milestone payment by the end of the year and owe royalty payments of 10-14% of sales. Quantifying Harrow’s recent pivot to pharmaceutical marketing shows increases in debt, dilution, and loss, as well as revenue.

| In Millions | 2023 | 2022 | 2021 | 2020 |

| Shares outstanding | 35 | 30 | 27 | 26 |

| Liabilities | 242 | 130 | 87 | 32 |

| Earnings (loss) | (25) | (14) | (18) | (3.0) |

| Revenue | 130 | 89 | 72 | 49 |

The same trends exist on a quarterly basis….

| In Millions | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

| Liabilities | 248 | 235 | 242 | 211 |

| Earnings (loss) | (6.5) | (14) | (9.2) | (4.3) |

| Revenue | 49 | 35 | 36 | 34 |

Sources: SEC filings

Don’t Blink

I rate Harrow a strong sell and expect the stock to lose 90% in the next five years. It might be worth as much as $6 per share, but $4 looks more likely.

Valuation is a shot in the dark, because of frequent changes to the business model, or what the annual report dubs “our recent strategy shift.” Harrow is, in spirit, a startup generic drug company. Although its main products are branded, the active ingredients are generic and the competition includes many generics; generic drug companies typically trade around a price-to sales ratio of 1. Another comparable is Pacira BioSciences (PCRX), which trades at a similar ratio and recently cratered due to generic competition. Assuming a P/S ratio of 1 and $200 million in revenue gives Harrow a price target a bit under $6.

Harrow’s assets were purchased recently, so book value remains a decent indicator. It reported stockholder equity of $60 million on March 31. That makes the stock fairly priced at $1.70.

The value of its assets lies in recently purchased drug licenses (the legacy business of pharmacy compounding has proved unprofitable for years). Those licenses, mainly in a deal with Novartis (NVS), cost approximately $190 million. Adding current assets and subtracting total liabilities results in a value of $80 million, or $2.30 per share.

Call the balance-sheet valuation $2. Averaging with the revenue-based target of $6 gives a price target of $4.

Those valuations are probably too high. The sellers of Harrow’s licenses are established companies that developed the drugs; they hold the strong positions in bargaining. They know the value of their products, and at least two can sell directly in the U.S. market and don’t need Harrow. Harrow is the desperate buyer, needing to reinvent itself after years of financial and regulatory problems (see FDA warnings in March and June of last year, and multiple other FDA warnings dating to 2017 regarding Imprimis, for example)

I doubt the business model can work.

The Hope for Growth

Financials

The company’s latest strategy is to raise money through borrowing and share-issuance, in order to buy licenses to formulations developed by other companies. Often, it licenses drugs based on an ancient active ingredient right as generic competition is entering the market. It then markets its branded version in North America. It also maintains a troubled pharmacy compounding business (it does not manufacture active ingredients).

It is hard to see why the strategy would work. Harrow is licensing commercial rights from established companies (e.g., Novartis) that are fully able to commercialize their own products. It’s natural to suspect the companies are offloading drugs they consider weak prospects.

The three drugs Harrow describes as “key” to its strategic plan are Vevye, Iheezo, and Triesence. The March 2024 Letter to shareholders refers to them as building-blocks for “franchises”:

This year remains focused on three key operational initiatives: (1) building a formidable dry eye disease franchise, including successfully launching VEVYE®; (2) continuing to lay the foundation for Harrow’s retina franchise with IHEEZO® and TRIESENCE®; and (3) stabilizing ImprimisRx [compounding subsidiary]….

Harrow’s promise of franchises is based on drugs that are ancient. The active ingredients were approved as long ago as 1955.

Harrow’s drugs compete with other formulations of the same active ingredient, including generic formulations. It faces further competition from brands based on other active ingredients for the same indications, and with their generics. Competitors like Allergan are much better established, and don’t depend on secured loans at nearly 12% or dilution of common stockholders for funding.

Interest payments in 2024 will be around $22 million, over 10% of revenue. The licenses require Harrow to make royalty payments of up to 14% of sales over a certain amount, and additional milestone payments depending on sales.

In sum, earnings visibility begins with a set of low-margin products their creators didn’t want. It proceeds with a subtraction of about 25 percentage points for interest and royalty payments, followed by the subtraction for operating expenses, which have trended steadily higher in the last year.

Harrow has financed its reinvention by borrowing and diluting common stockholders to the tune of $285 million since 2021, according to the annual report. The majority of its debt is due in less than two years.

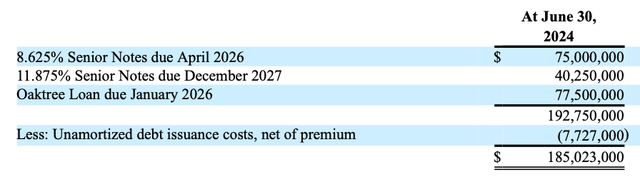

Summary of Harrow’s debt (10-Q)

The senior notes (HROWL and HROWM) are unsecured. In contrast….

The Oaktree Loan is secured by nearly all of the assets, including intellectual property, of the Company and its material subsidiaries. The Oaktree Loan has a maturity date of January 19, 2026 and carries an interest rate equal to the Secured Overnight Financing Rate plus 6.5% per annum (totaling 11.83% at December 31, 2023)…

A minimum debt payment of $160 million in 2026 raises questions about Harrow’s ongoing losses, in my opinion.

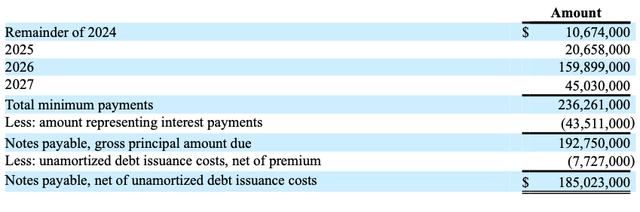

At June 30, 2024, future minimum payments under Harrow’s debt (10-Q)

Losses are steepening, but suppose they plateau close to their current level. In that scenario, Harrow will lose an additional $60 million by the end of 2025, or the vast majority of its cash on hand (cash burn has been erratic). Solvency looks okay for the next 12 months, but investing requires a theory of how Harrow will address the large debt payments due by April 2026.

All the usual “flow” metrics are heading the wrong way.

| In Millions | 2024 H1 | 2023 H1 |

| Operating cash flow | (7.4) | (3.7) |

| Net cash flow (distorted by financing & investing) | (3.1) | (74) |

| Adjusted EBITDA | 9.0 | 16 |

| Net loss | (20) | (11) |

Harrow has $70 million in cash, alleviating any immediate concerns, but a foggy cash runway requires discounting the stock.

Future Optics

Harrow launched Vevye in the U.S. around the end of the 2023, after buying the commercial rights from Novaliq for $8 million. It will have to pay 10-14% in royalties on net sales, along with potential commercial milestone payments.

Vevye is a treatment for dry eye. The active ingredient is cyclosporine, which has been approved for similar indications for about 20 years. It is found in branded competitors such as Restasis and generic versions, including two approved this year. Vevye is a different dosage of cyclosporine, and relies on a different delivery method. The competition includes drugs based on newer active ingredients, such as Xiidra and Miebo from Bausch + Lomb (BLCO). See “Why Is Dry Eye So Difficult to Treat?” for more about Vevye and its competition.

Betting on Vevye means betting against: a) the 20-year track-record of Restasis; b) generic cyclosporine; c) newer drugs, such as Miebo; d) industry heavyweights like Allergan.

Harrow bought the license and marketing rights to Sintetica’s patented drug, Iheezo in 2021. Sintetica is a Swiss company with a U.S. presence. It appears fully capable of marketing its own drugs, but saw more profit in licensing out the rights. The annual report says: “Pursuant to the Sintetica Agreement, the Company agreed to pay Sintetica a per unit transfer price to supply IHEEZO, along with a per unit royalty for units sold.” Iheezo has been fully launched for over a year, with no improvement in earnings.

Iheezo is a new formulation of an old anesthetic. The active ingredient (chloroprocaine hydrochloride) was approved in the 1950s. Competitors based on chloroprocaine include Nesacaine-MPF, which has been generic for decades. Nesacaine is injected, whereas Iheezo is topical.

Topical anesthetics used for similar indications include lidocaine, tetracaine, and proparacaine. All available in generic form, all old. For instance, tetracaine was approved for topical ophthalmic use in 1965. A bet on Iheezo is a bet against the multi-decade track record of established drugs, and the value of the 80% discount typically provided by generics.

In its largest deal, Harrow purchased the commercial rights to Triesence and some other drugs from Novartis for $130 million, plus a $35 million milestone payment if Harrow gets Triesence to market. The milestone payment is close to the combined value of Harrow’s other deals, making Triesence Harrow’s most expensive asset.

Like the others, the active ingredient is old and exists in other brands from established companies and in generics. Triamcinolone acetonide was approved in 1950s.

Competitors are legion, including some using the same active ingredient, such as Trivaris, Kenalog and generic forms of Kenalog. Trivaris was discontinued (not for safety or efficacy reasons) by Allergan. Triamcinolone acetonide is also used in Kenalog, which is not approved for ophthalmology but routinely used off-label and in generic form.

Triesence is a steroid, a dime-a-dozen class of drugs developed as early as the 1940s. The article “Steroid Wars” is a good introduction, as is the older “Topical Steroids 101” both from Review of Optometry:

…we have many topical steroids to pick from, so pick the right tool for the job. For surface inflammation (episcleritis, allergic conjunctivitis, etc.), pick the less-penetrating varieties (FML, Alrex). These steroids have ample anti-inflammatory action at the ocular surface with less propensity to increase IOP.

For moderate inflammation, Lotemax, Vexol and Flarex are good choices. They have good anti-inflammatory activity with less steroid-induced IOP response compared with other agents.

For severe or deeper inflammation, use your biggest gun: prednisolone acetate 1% (Pred Forte, Econopred Plus). If the patient has a history of steroid response, pre-existing glaucoma or other risk factors, consider Vexol or Lotemax.

Many of these are owned by Allergan, Bauch + Lomb, or Alcon, and several have gone generic. (Harrow bought the commercial rights to Flarex a year ago; a generic based on the active ingredient became available this year.)

Harrow plans to increase the cost of Triesence, but demand will be elastic, given robust competition including generics. Active ingredients approved when Chryslers were hip and Keith Richards was 11 do not have moats.

Both Allergan and Novartis are fully able to monetize the potential of their own drugs in North America. Instead, the former discontinued the product and the latter sold the commercial license to Harrow, suggesting limited potential for profit.

A bet on Triesence is a bet against established companies, brands, and generics.

The Smart Bet

These are risky bets, and Harrow has neither the track record nor financial strength to make the stockholders winners.

|

In Millions |

2023 |

2021 |

2019 |

2017 |

2015 |

2013 |

|

Shares outstanding |

35 |

27 |

26 |

21 |

9.8 |

9.0 |

|

Liabilities |

240 |

87 |

32 |

21 |

16 |

1.0 |

|

Retained earnings |

(134) |

(95) |

(74) |

(89) |

(58) |

(32) |

That’s a long history of very negative shareholder yield. The large debt due in early 2026, committing of all assets as collateral to Oaktree, and lack of earnings make further dilution predictable, in my opinion. I would bet that Harrow issues preferred stock in 2025. Another smart bet is that the common settles near $4 in the next five years.

Shorting and Other Risks

I do not recommend shorting the stock. Nobody should plan to hold a short position for five years, and there are no LEAPs (long-dated options) available. The cost to borrow is currently less than 1%. Put options with a strike of $36 expiring in September recently traded at $1.80.

I am short a small amount, but only partly because of my view of Harrow in particular. The position is part of hedging an overweight long position in healthcare, and hedging the US market which I view as overpriced; accordingly, I have several short (or long inverse ETF) positions.

Risks to my Strong Sell (Avoid) recommendation are that the stock could outperform, and that my fundamental analysis is wrong. As the economist John Maynard Keynes said, “markets can remain irrational longer than you can remain solvent.” I am not a pharmaceutical expert, but made claims about that industry. For example, I argued that Harrow’s drugs will have low margins because a) their developers didn’t want them, b) they face a generic market, and c) are based on generic active ingredients. That is a common-sense argument about a specialized topic, and such layperson arguments can easily miss details. I have analyzed Harrow’s financial statements, which are complicated due to recent financing and investing activities and its recent strategy shift, so I could be wrong in my assessment of Harrow’s financial strength and future prospects.

Read the full article here