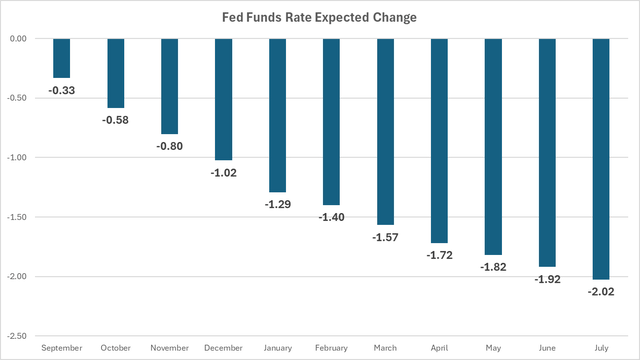

The Fed’s long-awaited rate-cutting cycle is nearly upon us. September 18 is the date to mark on your calendar – that’s when the first quarter-point ease is likely to come. There’s even about a 1-in-3 chance of a large half-percentage point cut – perhaps depending on how next Friday’s payrolls report verifies and what happens with August CPI to be published later in September.

Lower rates, all else equal, should bode well for Bitcoin, but there are other macro and seasonal headwinds. I have a hold rating on the ProShares Bitcoin Strategy ETF (NYSEARCA:BITO) looking out the next two months, but am bullish longer-term. This is technically a downgrade since I was bullish on the product in Q4 last year.

Price action was strong from October 2023 to this past March, leading up to and through the SEC’s approval of 11 spot Bitcoin ETFs back in January. BITO is down by about 20% since peaking back in March, though.

Rate Cuts Priced In By Month

CME FedWatch Tool, Author

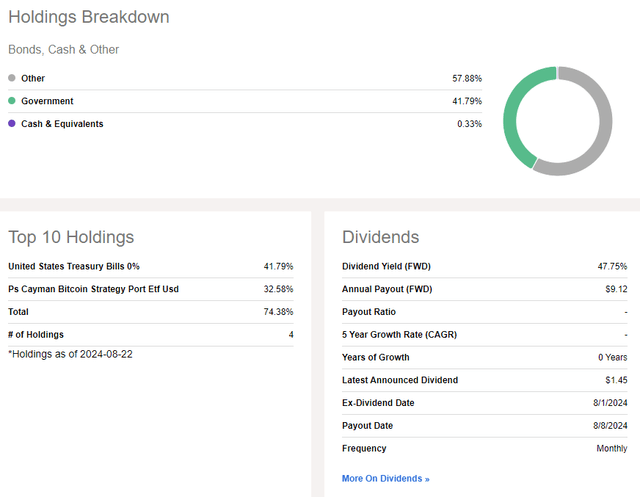

According to the issuer, BITO offers a way to gain exposure to Bitcoin-linked returns with the liquidity and transparency of an ETF. It aims to produce returns that correspond to Bitcoin. Importantly for prospective investors, BITO invests in Bitcoin futures and does not invest directly in Bitcoin. There is no guarantee that returns will correspond to Bitcoin. The ETF is the world’s largest and first US Bitcoin-linked ETF and has tracked the performance of spot Bitcoin since its inception.

Despite a plethora of spot Bitcoin ETFs now with more than seven months of trading history, BITO remains a moderate-sized fund with more than $1.8 billion in assets under management, up from $1.0 billion when I last reviewed the product. Its annual expense ratio is high at 0.95%, significantly above the level of the spot Bitcoin funds, while its stated yield is lofty at 47.8% as of August 28, 2024. The high payout rate is likely due to the ETF having held gains for many years, and there are requirements that distributions be made to shareholders.

Share-price momentum has been weak since the tail end of the first quarter, and I’ll detail price action in Bitcoin itself later in the article. Risk metrics are likewise weak given high annual volatility levels, but BITO remains a liquid ETP with more than eight million shares traded daily over the past 90 days on average and a median 30-day bid/ask spread of five basis points, per ProShares.

A macro factor that could weigh on Bitcoin over the coming months is a higher US dollar. The US Dollar Index (DXY) recently tested the 100 level, the lowest since July 2023. The greenback has historically risen from September through November, however, and if that transpires once more in 2024, then BITO would likely be at risk.

The Dollar’s Snapback Likely Bearish for BITO

TradingView

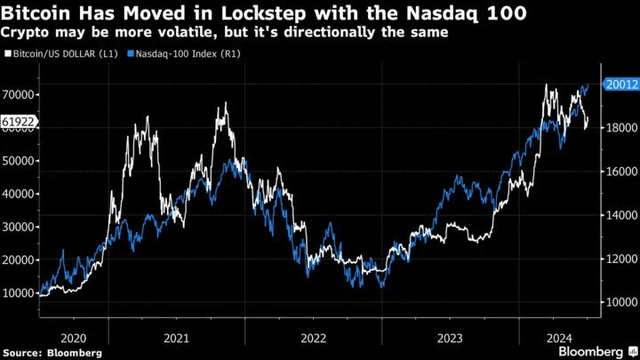

Bitcoin itself hasn’t offered much in the way of diversification. The world’s largest cryptocurrency has moved in lockstep with the Nasdaq 100 for much of the past four years, and there was extreme volatility earlier this month during the yen-carry-trade unwind.

Crypto investors, like me, would like to see Bitcoin buck the same trend as equities. Of course, with stocks near highs, one could make the case that so long as equities’ uptrend persists, then that should generally bode well for BITO.

Bitcoin Not Offering Much Diversification Benefit

Bloomberg

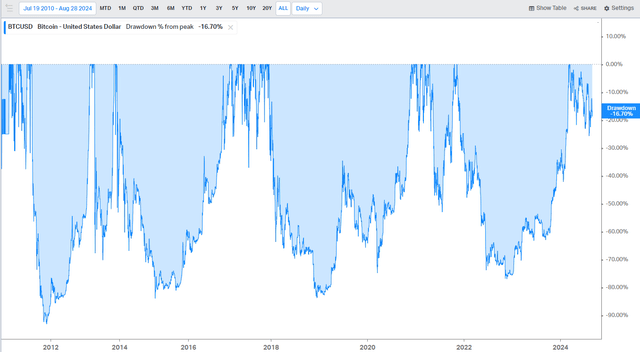

But Bitcoin is still in a material drawdown off its early 2024 peak near $73,000.

The current pullback is low by historical standards, though, and we shouldn’t discount the risk that Bitcoin is in the early inning of a multi-year bear market.

Bitcoin: Historical Drawdowns Often Exceed 70%

Koyfin Charts

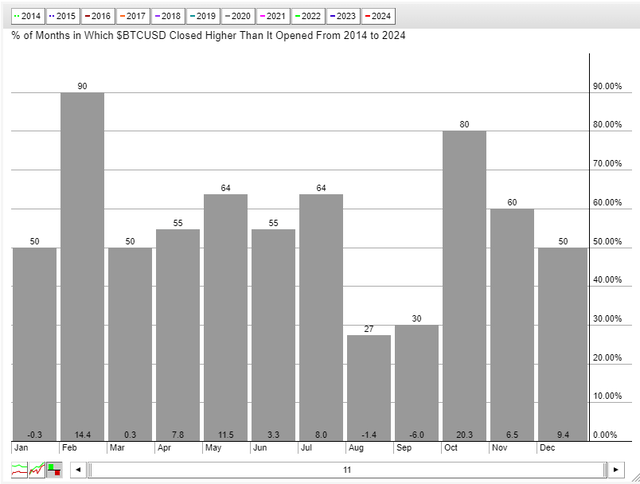

Focusing on the near term, August and September are historically poor months for Bitcoin. September has only been up in three of the past 10 years, with an average loss of 6%.

The good news is that the October through December period is the best of the year, with massive gains having taken place over the past decade.

Bitcoin: Bearish August-September Trends

StockCharts.com

It’s key that prospective investors recognize that BITO holds Bitcoin futures. So far this year, BITO has returned 35.3% compared with spot Bitcoin’s 43.3% gain.

BITO: Holdings & Dividend Information

Seeking Alpha

The Technical Take

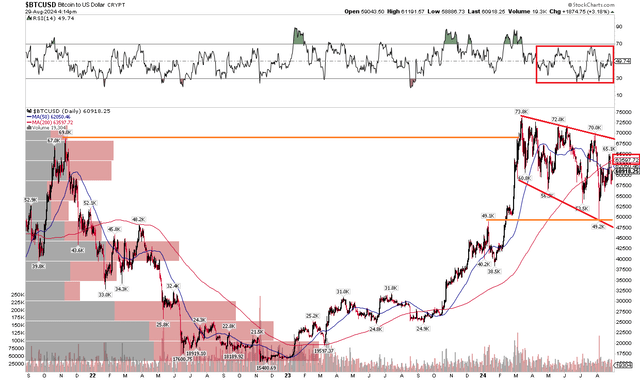

With mixed macro risks, Bitcoin itself remains in a consolidation phase in my view. I don’t see signs that a broad bear market is in the works. I make that assertion due to a series of lower highs and lower lows, suggesting that a broad bull flag pattern is in play. Notice in the chart below that support is apparent near the $50,000 level while the all-time high range of $69,000 to $73,800 is resistance. I don’t like that Bitcoin has traded below its flattening long-term 200-day moving average and that a bearish death cross pattern transpired a few weeks ago.

But take a look at the RSI momentum gauge at the top of the graph. It ranges in a neutral zone between 30 and 70, never spending much time in technical overbought or oversold conditions. I am concerned that the rally above the late-2021 previous all-time high could be a bearish false breakout, and I’d like to see Bitcoin rally to new highs, and perhaps that happens in the fourth quarter.

Overall, there are mixed indicators on the chart, further cementing a hold rating.

Bitcoin: Long-Term Bull Flag, Neutral Near-Term RSI

StockCharts.com

The Bottom Line

I have a hold rating on BITO. The Bitcoin futures ETF is in the throes of bearish seasonality with a handful of macro crosscurrents weighing while the long-term chart situation is constructive once we get through Q3.

Read the full article here