A woman fills a glass with tap water.

In dividend growth investing, it is often said that the safest dividend is the one just raised. I generally agree with this maxim.

This is most especially true when a payout hike is entirely supported by a company’s fundamentals. Put another way, dividend boosts are sustainable when the following conditions are met:

- The balance sheet is strong and stable.

- Earnings consistently move higher and the growth outlook remains promising.

- The dividend is comfortably backed up by earnings power.

Now, a company can shift its capital allocation strategy seemingly at a moment’s notice. This could put a dividend cut or suspension on the table. In my experience, that hasn’t happened too frequently, though.

One of the more recent dividend raises in my portfolio came from the water and gas utility, Essential Utilities (NYSE:WTRG). In July, the utility upped its quarterly dividend per share by 6% to $0.3255.

When I last covered Essential Utilities with a buy rating in May, I thought its planned capital spending would translate into solid long-term growth prospects. The company’s exceptional financial health was a plus as well. The discounted valuation is what sealed the deal for my buy rating.

I went on to up my position in Essential Utilities by 110% in July (for disclosure purposes, it’s still one of my smaller holdings at a 0.6% weight).

Today, I’ll be maintaining my buy rating. Essential Utilities’ second quarter results shared on Aug. 5th were decent for the circumstances. The company has major rate cases that should soon be playing out in its favor. Essential Utilities still possesses an A- credit rating from S&P. Finally, shares remain a great deal at the current valuation.

Positive Rate Case Outcomes On The Horizon

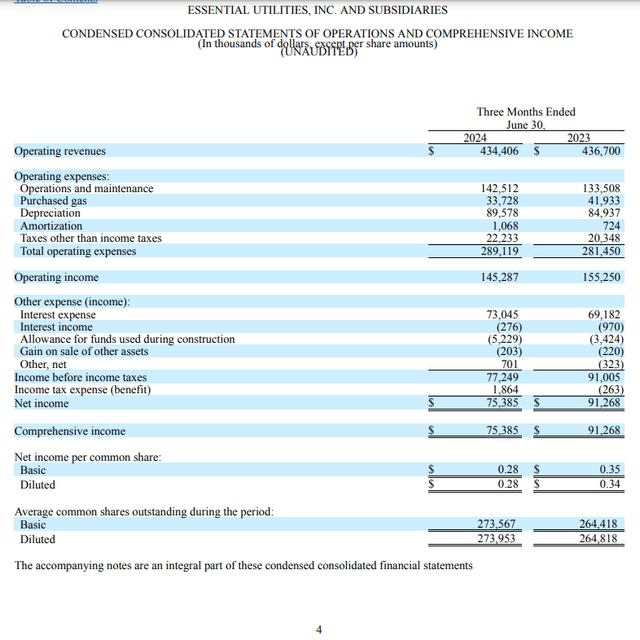

Essential Utilities’ Q2 2024 10-Q Filing

Last month, Essential Utilities shared what, I thought, were acceptable second-quarter results. The company’s operating revenue decreased by 0.5% over the year-ago period to $434.4 million during the quarter. This was $10.3 million less than the Seeking Alpha analyst consensus for the period.

Initially, this doesn’t seem like a positive. Considering the headwinds that Essential Utilities had to navigate, though, I was fairly pleased.

The utility’s Regulated Water segment operating revenue increased by 3% year-over-year to $302.5 million in the second quarter. Higher rates offset the decline in water usage during the quarter. This reduced water usage can be explained by higher than normal water volumes in the year-ago period.

Essential Utilities Regulated Natural Gas segment operating revenue declined by 7.8% year-over-year to $128.2 million for the second quarter. This was due to abnormally warm weather in Pittsburgh.

According to CFO Daniel Schuller’s opening remarks during the Q2 2024 Earnings Call, the city was 44% warmer than normal in the quarter. This resulted in less natural gas usage, which led to lower operating revenue for the segment.

Essential Utilities’ diluted EPS decreased by 17.6% over the year-ago period to $0.28 during the second quarter. That missed the Seeking Alpha analyst consensus by $0.07.

The reduced operating revenue base from weather headwinds accounted for $0.02 of the drop in diluted EPS. Higher operations and maintenance expenses also weighed on profitability. This is what pushed the company’s net profit margin 350 basis points lower to 17.4% for the second quarter. That’s why diluted EPS fell at a faster rate than operating revenue in the quarter.

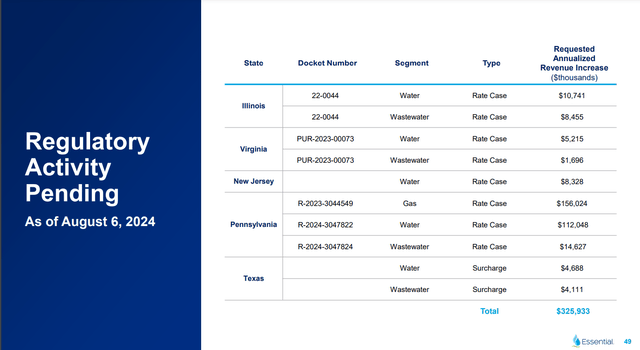

Essential Utilities’ August 2024 Investor Presentation

Company guidance for 2024 remains encouraging. Essential Utilities is guiding for $1.98 in midpoint adjusted diluted EPS ($1.96 to $2). From the 2023 base of $1.86, this is a 6.5% growth rate. The FAST Graphs analyst consensus is just below this guidance at $1.95 – – a 4.6% growth rate.

Looking beyond this year, Essential Utilities anticipates that adjusted diluted EPS can compound at between 5% and 7% annually. The company believes that its five-year capital spending plan can deliver 8% annual rate base growth for the regulated water segment and 10% annual rate base growth for the regulated natural gas segment. This provides a realistic path to such an adjusted diluted EPS growth target.

The FAST Graphs analyst consensus is that adjusted diluted EPS will surge 9.3% in 2025 to $2.13. Another 5.9% growth in adjusted diluted EPS to $2.25 is expected in 2026.

The uptick in growth beyond this year is based on the Peoples Gas rate case in Pennsylvania that’s requesting $156 million in additional annual operating revenue. The company reached a non-unanimous settlement for the case.

The Administrative Law Judge assigned to the case recommended a decision in line with the settlement, per CEO Christopher Franklin’s opening remarks during the Q2 2024 Earnings Call. That included a weather normalization provision, which could provide more stable performance for the business despite weather patterns. A decision for this case should be ahead in the coming weeks and be set for an effective date of Sept. 27.

Additionally, Essential Utilities’ Pennsylvania water rate case is moving along and is now in the discovery phase. This could be a $126.7 million boost to annual operating revenue, and a commission order is anticipated in February.

Essential Utilities is also a financially vigorous business. The company targets a debt-to-capital ratio of between 50% and 55%. This is better than the 60% ratio that rating agencies desire from the industry, per The Dividend Kings’ Zen Research Terminal.

Essential Utilities’ interest coverage ratio was also strong, clocking in at 3.3. This explains the A- credit rating from S&P on a stable outlook (unless otherwise sourced or hyperlinked, all details in this subhead were according to Essential Utilities’ Q2 2024 Earnings Press Release, Essential Utilities’ August 2024 Investor Presentation, and Essential Utilities’ Q2 2024 10-Q Filing).

40%+ Upside Through 2026

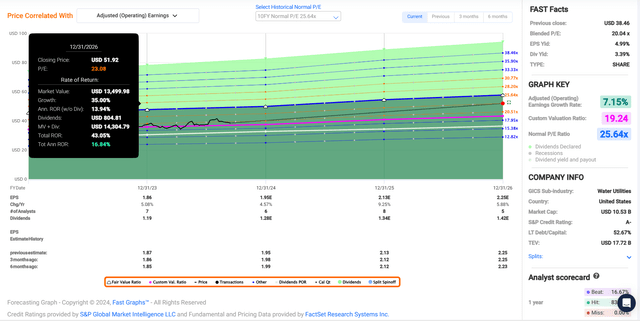

FAST Graphs, FactSet

Since my previous article, shares of Essential Utilities have generated 2% total returns, versus the S&P 500 index’s (SP500) 5% total returns. In my view, the utility is a marginally better value now than it was a few months ago.

Essential Utilities’ current-year P/E ratio of 20 is significantly less than the 10-year normal P/E ratio of 25.6 per FAST Graphs. I think the case could be made that the utility is worthy of returning to a valuation multiple in the mid-20 range.

Essential Utilities’ annual forward adjusted diluted EPS growth outlook of 7.2% is better than its 10-year average of 5.2%. This can support a higher valuation multiple than the present multiple.

As I have also discussed in recent articles, the interest rate environment by the end of 2026 could be similar to rates in the past decade. That could justify a meaningfully higher valuation multiple for Essential Utilities as investors pour more capital back into utilities.

Even so, I’ll err on the side of caution. My fair value multiple will be one standard deviation less than the 10-year average P/E ratio. That works out to a fair value P/E ratio of 23.1.

The current calendar year is approximately 71% complete. That leaves another 29% of 2024 and 71% of 2025 still to come in the next 12 months. This is how I’m weighing the FAST Graphs consensus estimates for 2024 and 2025 to get a forward 12-month adjusted diluted EPS input of $2.08.

Using my fair value multiple of 23.1, I come out to a fair value of $48 a share. Relative to the current $39 share price (as of September 13th, 2024), this is equivalent to a 19% discount to fair value. If Essential Utilities meets the growth consensus and returns to fair value, it could generate at least 43% cumulative total returns by the end of 2026.

A Safe And Reliably Growing Dividend

The Dividend Kings’ Zen Research Terminal

As is expected from a water utility, Essential Utilities’ 3.3% forward dividend yield registers below the utility sector median of 3.6%. This is because water utilities tend to be valued at higher multiples than their utility counterparts and have lower payout ratios. That explains the C grade for forward dividend yield and C- grade for overall dividend yield from Seeking Alpha’s Quant System.

Essential Utilities’ dividend is arguably quite safe, too. The utility’s EPS payout ratio is positioned to be in the low to mid-60% range in 2024. This is less than the 75% EPS payout ratio that rating agencies prefer from the industry, per The Dividend Kings’ Zen Research Terminal.

This is why the Quant System anticipates that Essential Utilities can deliver 6.6% annual forward dividend growth to shareholders. That’s moderately above the sector median of 5.2%. This accounts for the Quant System’s B- grade for overall dividend growth.

That means Essential Utilities could extend its 33-year dividend growth streak with robust dividend raises rather than token ones. For context, this streak is triple the sector median of 9.8 years. That is why the Quant System awards an A+ grade to Essential Utilities for overall dividend consistency.

Risks To Consider

Essential Utilities is a remarkable utility, but it still has risks that warrant a discussion. The company doesn’t note any new risks in its most recent 10-Q Filing, so I’ll be highlighting key risks from previous articles.

One risk to Essential Utilities is the significantly warmer weather as of late. This has some negative impact on water consumption, but it especially impacts the company’s natural gas operations.

Essential Utilities is asking for a weather normalization adjustment in its Peoples rate case in Pennsylvania. It seems likely that the company will be granted this adjustment. But if it isn’t, that would mean its natural gas results would still be quite vulnerable to unfavorable weather patterns.

One risk that I touched on in my previous article remains, which is Essential Utilities’ geographic concentration. A supermajority of operating revenue comes from Pennsylvania. Any natural disasters in this service area could result in damage to the company’s infrastructure. If this was beyond its commercially insured amounts, that could lead to an impaired earnings base.

The fallout from such an event could include a credit rating downgrade from the major rating agencies. This could inhibit Essential Utilities from fulfilling its capital spending plans, which could also be a hit to its growth potential.

Summary: A High-Quality Dividend Stock

The predictability of Essential Utilities’ business model has allowed it to reach Dividend Champion status. The company’s fundamentals appear to be intact, with respectable growth forecasts and a sound balance sheet. The payout ratio is also conservative, which, I believe, can enable further dividend growth. Shares are also attractively valued here.

So, Essential Utilities looks to be set up to generate 17% annual total returns by the end of 2026. That’s why I’m reiterating my buy rating.

Read the full article here