My Thesis Update

I wrote my 1st article about NIO Inc. (NYSE:NIO) stock in mid-January 2024 and then updated my bullish rating in mid-April and in mid-June. Unfortunately, the stock continued to fall despite a number of positive updates like improved margins and liquidity position.

Seeking Alpha, Oakoff’s NIO coverage

NIO is scheduled to report its quarterly results on September 5th, according to Seeking Alpha. I believe this event could potentially serve as a catalyst for the stock’s movement; however, I’m uncertain whether it will strengthen the current downtrend or reverse it.

My previous bullish thesis on NIO for the long run has become weaker, so I’ve decided to downgrade NIO to a ‘Hold’ rating before the earnings report based on the current market expectations.

My Reasoning

The last time NIO reported earnings (for Q1), it was before my last article came out, so today I’m going to mainly preview what’s coming next.

In August 2024 NIO delivered 20,176 vehicles, marking a 1.5% decrease from the previous month but a 4% increase YoY. This total comprised 11,923 premium smart electric SUVs and 8,253 premium smart electric sedans, bringing NIO’s cumulative deliveries to 577,694 vehicles. Unfortunately for NIO, it was the second month of deliveries decline. Here I should note that the whole Chinese auto market is getting more and more competitive with a bunch of new models entering the market. So because of that NIO is clearly struggling lately, apparently losing its share to other brands. In comparison to what we saw with NIO’s deliveries, Li Auto (LI) demonstrated way stronger performance in August, delivering 48,122 vehicles – a significant 37.8% YoY increase (although it was a slight decrease from July’s 51,000 deliveries).

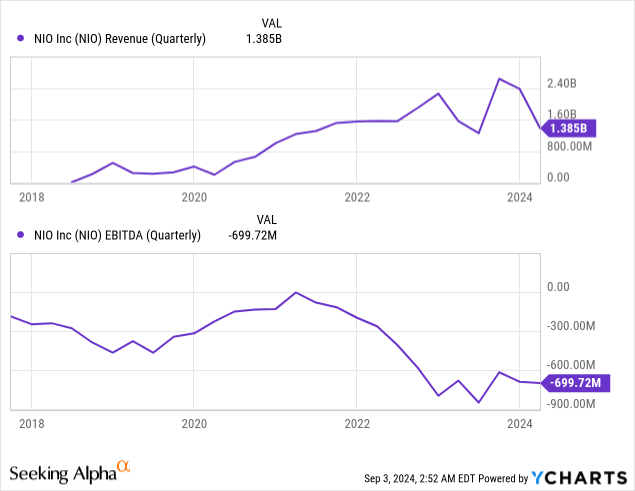

In case you don’t remember, NIO’s Q1 vehicle sales of $1,160.8 million was a 9.1% YoY decline (-45.7% QoQ dip), pressuring the bottom line even harder than in Q1 2023. Apart from the seasonally weaker sales, the management said the reason for that was “lower average selling prices, resulting from adjustments to user rights since June 2023, and a decrease in delivery volume.” Nevertheless, what we found was that NIO’s margins actually experienced a great increase: The vehicle margin stood at 9.2%, up from 5.1% in Q1 2023, although it decreased from 11.9% in Q4 2023. The negative EBITDA of almost -$700 million seemed “impressive” so to speak, but again, in relation to the lower revenue, the EBITDA margin looked better:

I sincerely hoped that NIO’s deliveries would recover and so its revenues would go up, but judging by the last two months of summer, this hope of mine began to fade.

Having received a strategic investment of ~RMB1.5 billion “to further develop its core technologies and expand its charging and swapping network”, as of March 2024 NIO had RMB45.3 billion (that’s ~$6.3 billion) in cash and cash equivalents, restricted cash, short-term investments, and long-term time deposits. However, if we assume that NIO’s EBITDA losses remain unchanged for the foreseeable future (i.e., at Q1 2024 levels), as the entire industry is currently struggling with competition and declining margins, then this liquidity cushion will last for about 2 years and 1 quarter. But it’s clear that NIO’s management will not wait until their coffers are empty, so I think we should expect a new round of investment as early as 2025. Whether this is another closed event or public share dilution, I don’t know, but the fact that NIO needs more time to develop and monetize its model range than I previously thought is becoming clearer to me.

I have become much more serious about the risk of NIO remaining just a niche player with no unique set of features. In recent months, I’ve personally tested several new models from Geely (OTCPK:GELYF), Avatr, ZEEKR (ZK), Changan, and some other Chinese automakers, and I can say that the mass segment of the Chinese auto industry is already comparable to German giants. At the same time, their selling prices are many times lower with similar features. How NIO can compete with its high price tag and increase deliveries against this background should be a big question for investors.

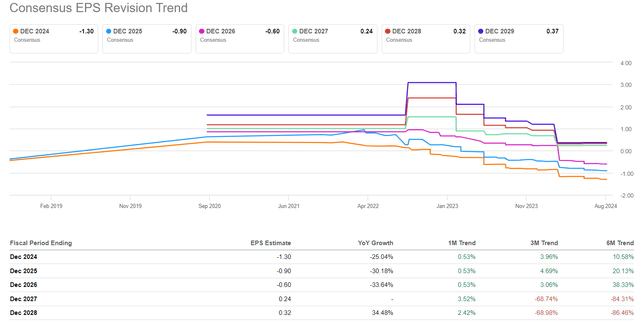

Despite these risks and falling deliveries numbers, Wall Street has become more positive on the prospective EPS figures over the past month. In addition, EPS expectations for the next 3 years have risen significantly over the last six months, although the consensus still expects heavy losses over the 2024-2026 period.

Seeking Alpha, NIO

Considering how the whole landscape in China has changed in the last 2 years, I think NIO may not turn a net profit even in 2027. If I’m right, the current consensus may prove to be too optimistic – a very good reason why NIO stock may remain in its current downtrend.

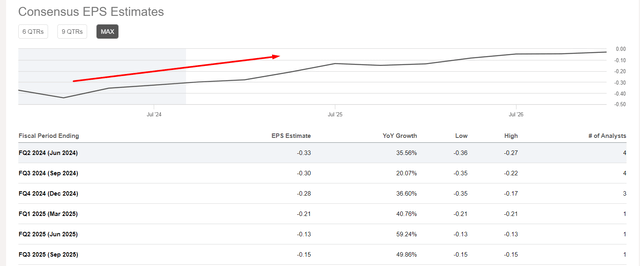

When it comes to what the market expects from NIO for Q2, we also see only positives and ignore the recent operational data and the risks I described above.

Seeking Alpha, NIO, Oakoff’s notes

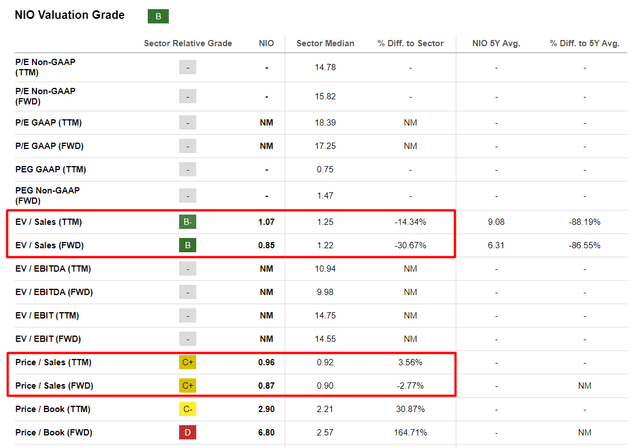

Regarding the valuation of the company, I have often read that NIO’s low P/S ratio of <1x is a reasonable reason to initiate a long position. But as I mentioned in the “Risks” section of my last article, it can be a big mistake to only look at sales-based multiples. We have already seen in the last reporting quarter how easily NIO’s sales can drop unexpectedly – if this trend continues for a few more quarters, the current multiple could rise very sharply. Also, since we are looking at sales-related multiples, it would be fair to take a look at EV/sales, which does not look too low actually:

Seeking Alpha, NIO, Oakoff’s notes

Concluding Thoughts

So, the market expects NIO to post an EPS of -$0.33 and sales of $2.44bn, which corresponds to year-on-year growth rates of +35.56% and +102.8%, respectively. These are very optimistic forecasts, which incidentally were increased last month despite the abundance of negative news like falling deliveries. In general, the situation in the EV market (and not only EVs) in China is evolving very rapidly: established tech brands such as Huawei or Xiaomi (OTCPK:XIACF) are entering the market with their cheap but very technological models, essentially forcing competitors to lower selling prices. Having huge profitable businesses (non-EV), they are likely to continue this tactic for many quarters to come. At the same time, the mass segment players are also trying to offer maximum value to consumers at an affordable price. All this can only have a negative impact on NIO with its luxury cars. Therefore, I think that in the medium term, it will be difficult for the company to justify the current consensus – there is a risk that profits will be missed and the downward trend in the stock price will continue. Therefore, I don’t think it makes sense to increase your long position (if you have one) before the report.

Good luck with your investments!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here