Earnings of Hanmi Financial Corporation (NASDAQ:HAFC) will likely dip this year before stabilizing next year. The anticipated margin compression will likely undermine the effect of loan growth. Overall, I’m expecting the company to report earnings of $2.00 per share for 2024, down 24% year-over-year, and $2.01 per share for 2025. Compared to my last report on the company, I’ve reduced my earnings estimate for 2024 mostly because actual earnings missed my estimates during the first half of the year. The December 2024 target price suggests a small upside from the current market price. Additionally, Hanmi is offering an attractive dividend yield. Based on the total expected return, I’m maintaining a Buy rating on Hanmi Financial Corporation.

Loan Growth to Improve After a Disappointing First Half of the Year

Loan growth missed my expectations in the second quarter of this year. The portfolio’s quarter-ending balance was barely changed from the balance at the end of March 2024. The management mentioned in the conference call that it is expecting low-to-mid-single-digit growth for this year, as quoted below.

So, just looking forward, I think that assuming that the payoffs are staying within the average of $80 million to $85 million with the pipeline that’s building up going into the third quarter, we think we can stay on course and expect the annual net increase of low to mid-single-digit growth.”

In my opinion, there’s a good chance that loan growth will improve in the second half of the year, leading to a low single-digit growth rate for the full year. My optimism is based on the economic environment, which currently isn’t bad compared to the past. Hanmi mostly caters to multi-ethnic communities in California, with US subsidiaries of Korean companies making up 14% of total loans. The company also has some presence in Texas, Illinois, Virginia, New Jersey, New York, Colorado, Washington, and Georgia. As the economies of these states are quite diverse, it makes sense to use the national average as a proxy for the different markets.

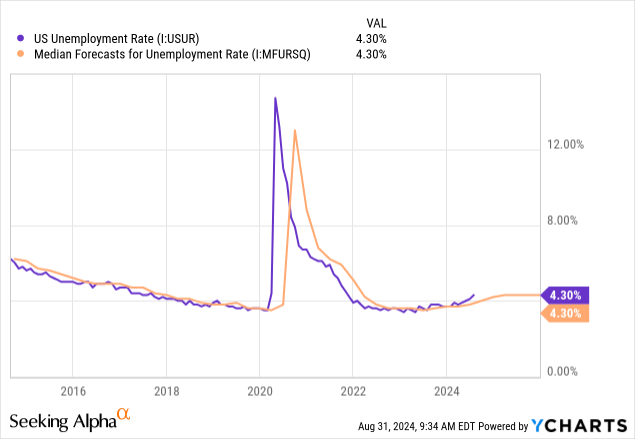

As shown below, the country’s unemployment rate continues to remain quite low compared to the past. Further, according to a survey of forecasters, the unemployment rate is expected to remain quite low compared to previous years.

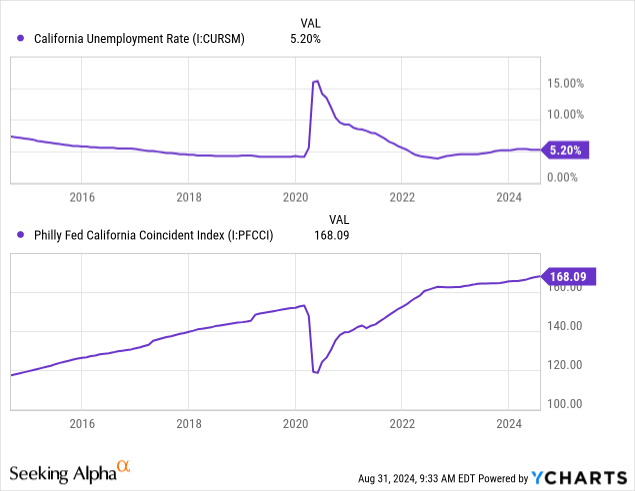

However, Hanmi’s main market of California isn’t currently doing that well. The economic activity seems to be faltering, as shown by the slope of the coincident index below.

Another important factor is that the upcoming interest rate cuts should boost the economy and drive the demand for credit products.

Considering these factors, I’m expecting the loan portfolio to grow by 1.0% every quarter through the end of 2025. Moreover, I’m expecting deposits to grow in line with loans. The following table shows my balance sheet estimates.

| Financial Position | FY19 | FY20 | FY21 | FY22 | FY23 | FY24E | FY25E |

| Net Loans | 4,549 | 4,790 | 5,079 | 5,896 | 6,113 | 6,231 | 6,484 |

| Growth of Net Loans | (0.4)% | 5.3% | 6.0% | 16.1% | 3.7% | 1.9% | 4.1% |

| Other Earning Assets | 657 | 762 | 924 | 862 | 878 | 901 | 929 |

| Deposits | 4,699 | 5,275 | 5,786 | 6,168 | 6,281 | 6,457 | 6,719 |

| Borrowings and Sub-Debt | 208 | 269 | 353 | 479 | 455 | 429 | 442 |

| Common Equity | 563 | 577 | 643 | 638 | 702 | 798 | 828 |

| Book Value Per Share ($) | 18.3 | 19.1 | 21.1 | 21.0 | 23.1 | 26.5 | 27.5 |

| Tangible BVPS ($) | 17.9 | 18.7 | 20.7 | 20.6 | 22.8 | 26.1 | 27.1 |

Source: SEC Filings, Author’s Estimates(In USD million unless otherwise specified)

Interest Rate Cuts to Slightly Pressurize the Margin

The net interest margin performed worse than my expectations during the second quarter of the year. The margin declined by nine basis points as asset yields remained somewhat stable while funding costs increased. However, surprisingly, the deposit mix improved by the end of the quarter. Non-interest-bearing deposits rose to 31.0% of total deposits by the end of June from 30.3% of total deposits at the end of March 2024. This should lead to a fall in funding costs, which should in turn lift the margin. I’m expecting the full-quarter benefit of this deposit migration to become visible in the third quarter of this year.

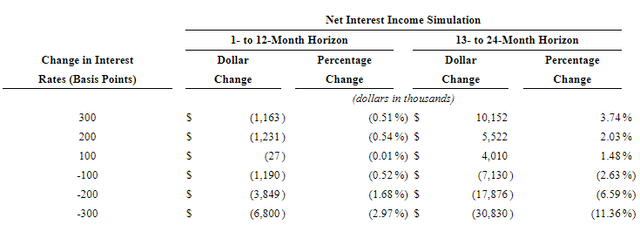

However, upcoming interest rate cuts can slightly squeeze the margin because of the characteristics of the deposits and loans. The results of the management’s rate-sensitivity analysis given in the 10Q filing show that a 100-basis points rate cut could reduce the net interest income by 0.52% in the first year and then by 2.63% in the second year of the rate cut.

2Q 2024 10Q Filing

I’m expecting a 25-basis points Fed funds rate cut in the second half of 2024 and a 100-basis points rate cut in 2025. As a result, I’m expecting the net interest margin to dip by two basis points in the last quarter of 2024 and eight basis points in 2025.

Expecting Earnings to Dip and Then Stabilize

The anticipated margin pressure will likely counter the effect of mid-single-digit loan growth. I’m also making the following assumptions to derive my earnings forecasts.

- I’m assuming provisioning will remain stable at the second quarter’s level.

- I’m expecting non-interest income to remain almost unchanged this year. For next year, I’m expecting gains on sales of mortgage loans to rise as rate cuts should boost mortgage activity, especially in the refinancing segment.

- The management has shown good expense discipline in the latest quarter. As mentioned in the conference call, the bank consolidated three branches during the second quarter to generate cost savings. This commitment to cost savings gives me hope that Hanmi will be successful in keeping non-interest expenses down in the short term. Therefore, I’m assuming the non-interest expense growth rate will remain below the historical average in the second half of 2024 and the full year 2025.

Considering these assumptions, I’m expecting the company to report earnings of $2.00 per share for 2024, down 24% year-over-year. Margin pressure and a decline in the loan portfolio size in the first half of the year are the major reasons for the expected earnings decline this year. For 2025, I’m expecting margin pressure to negate the effect of loan growth, leading to somewhat stable earnings. The following table shows my income statement estimates.

| Income Statement | FY19 | FY20 | FY21 | FY22 | FY23 | FY24E | FY25E |

| Net interest income | 176 | 181 | 195 | 238 | 221 | 197 | 196 |

| Provision for loan losses | 30 | 45 | (24) | 1 | 4 | 3 | 4 |

| Non-interest income | 28 | 43 | 40 | 34 | 34 | 35 | 39 |

| Non-interest expense | 126 | 119 | 124 | 130 | 137 | 143 | 148 |

| Net income – Common Sh. | 33 | 42 | 98 | 101 | 80 | 60 | 60 |

| EPS – Diluted ($) | 1.06 | 1.39 | 3.22 | 3.32 | 2.62 | 2.00 | 2.01 |

(In USD million unless otherwise specified)

Source: SEC Filings, Author’s Estimates

In my last report, I projected earnings of $2.18 per share for 2024. I’ve reduced my earnings estimate mostly because of the first half’s performance which missed my expectations.

Risks Stem From Office Property Exposure

A majority of Hanmi Financial’s riskiness stems from its exposure to office real estate. As mentioned in the earnings presentation, office loans totaled $572.6 million at the end of June, representing a sizable 9% of total loans. Apart from office loans, the company’s risk level is low, as discussed below.

- Apart from office loans, the loan portfolio’s credit quality is quite good, and it has improved significantly in recent quarters. Criticized loans were down to 1.15% of total loans by the end of June 2024 from 1.40% at the end of the same period last year.

- Unrealized losses on the Available-for-Sale securities portfolio are unremarkable. These unrealized losses totaled $108 million at the end of June 2024, as mentioned in the earnings presentation. To put this number in perspective, $108 million is 15% of the total equity book value. I’m expecting most of these losses to start reversing once the interest-rate downcycle starts.

- The deposit book’s riskiness is negligible. Uninsured deposits totaled $2.58 billion at the end of June 2024. As mentioned in the presentation, available liquidity totaled $2.49 billion at the end of June 2024; therefore, the uninsured deposits are mostly covered.

5.0% Dividend Yield

Hanmi Financial is offering an attractive dividend yield of 5.0% at the current quarterly dividend level of $0.25 per share and the August 30 closing price. The current dividend level and my earnings estimates imply a payout ratio of 50% for both 2024 and 2025. This payout ratio is above the 5-year average of 42%, but still easily affordable. Therefore, I don’t think there is any risk of a dividend cut.

Moreover, Hanmi Financial has excessive capital, so there is no need to curtail dividends to preserve capital. The company reported a total capital ratio of 15.24% at the end of June, as opposed to the minimum regulatory requirement of 10.50%.

Maintaining a Buy Rating

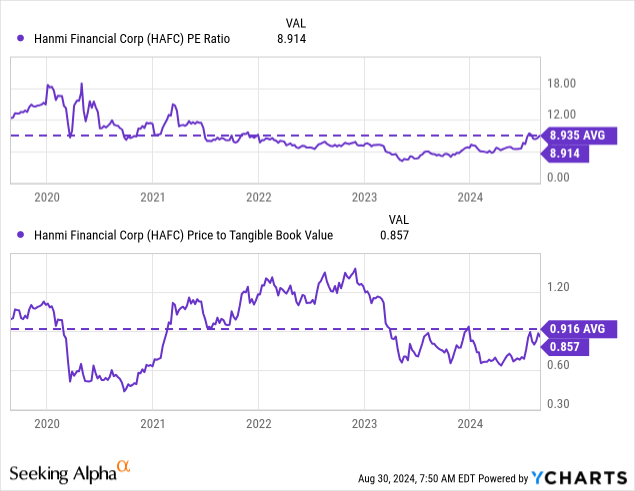

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Hanmi Financial. The stock has traded at an average P/TB ratio of 0.92x and an average P/E ratio of around 8.9x in the past, as shown below.

Multiplying the average P/TB multiple with the forecast tangible book value per share of $26.1 gives a target price of $23.9 for the end of 2024. This price target implies a 20.7% upside from the August 30 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 0.72x | 0.82x | 0.92x | 1.02x | 1.12x |

| TBVPS – Dec 2024 ($) | 26.1 | 26.1 | 26.1 | 26.1 | 26.1 |

| Target Price | 18.7 | 21.3 | 23.9 | 26.5 | 29.1 |

| Market Price | 19.8 | 19.8 | 19.8 | 19.8 | 19.8 |

| Upside/(Downside) | (5.6)% | 7.6% | 20.7% | 33.9% | 47.1% |

Source: Author’s Estimates

Multiplying the average P/E multiple with the forecast earnings per share of $2.00 gives a target price of $17.9 for the end of 2024. This price target implies a 9.7% downside from the August 30 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 6.9x | 7.9x | 8.9x | 9.9x | 10.9x |

| EPS 2024 ($) | 2.00 | 2.00 | 2.00 | 2.00 | 2.00 |

| Target Price ($) | 13.9 | 15.9 | 17.9 | 19.9 | 21.9 |

| Market Price ($) | 19.8 | 19.8 | 19.8 | 19.8 | 19.8 |

| Upside/(Downside) | (29.9)% | (19.8)% | (9.7)% | 0.4% | 10.5% |

Source: Author’s Estimates

Equally weighting the target prices from the two valuation methods gives a combined target price of $20.9, which implies a 5.5% upside from the current market price. Adding the forward dividend yield gives a total expected return of 10.6%.

In my last report, I adopted a buy rating with a December 2024 target price of $18.3. My updated target price is higher now because the moving-average historical multiples are higher. Based on the updated total expected return, I’m maintaining a buy rating on Hanmi Financial Corporation.

Read the full article here