I wrote an initial review of the FT Cboe Vest Gold Strategy Target Income ETF (BATS:IGLD) more than a year ago with a hold rating. At the time, I was not sold on the merits of IGLD’s strategy of writing short-term call options on the SPDR Gold Shares Trust (GLD) while owning a long-term synthetic long position in GLD. Effectively, investors in the IGLD ETF are holding a covered-call position in GLD.

So far, the IGLD ETF has delivered a solid performance, with 20% in total returns since my article (Figure 1). However, IGLD has underperformed GLD over the same time frame, as GLD has returned more than 30%.

Figure 1 – IGLD and GLD returns since June 23, 2023 (Seeking Alpha)

With more than a year gone by since my article, let us revisit the pros and cons of IGLD’s strategy and determine where IGLD should fit in investors’ portfolios.

By design, IGLD’s portfolio underperforms GLD during bull markets, as it has traded off upside returns for premium income. However, from a portfolio perspective, IGLD may allow investors to consolidate their cash and gold holdings into one security, freeing up capital to reinvest in higher return asset classes.

Overall, I believe IGLD could be an interesting way for yield-oriented investors to participate in the upcoming gold bull market. I am raising my rating on IGLD to a buy.

Brief Fund Overview

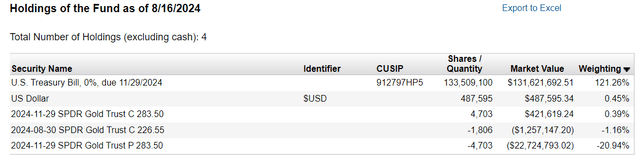

The FT Cboe Vest Gold Strategy Target Income ETF aims to provide exposure to the upside participation in the returns of holding the SPDR Gold Trust while providing a modest amount of current income. The IGLD ETF invests substantially all of its assets in U.S. treasuries and options on the GLD ETF (Figure 2).

Figure 2 – IGLD portfolio holdings (First Trust Portfolios)

Looking at IGLD’s portfolio, we can see that a synthetic long position in GLD is established by the November 29, 2024 expiry GLD calls and puts with a $283.50 strike price. Meanwhile, the IGLD ETF writes monthly calls to generate premium income. The IGLD also holds short-term treasury bills to generate additional income.

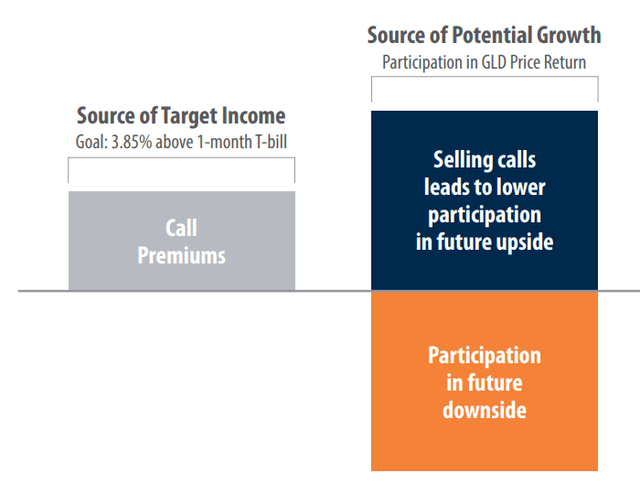

IGLD’s goal is to generate 3.85% in income above 1-month treasury bills while providing participation in GLD’s upside returns (Figure 3).

Figure 3 – IGLD strategy overview (IGLD product brief)

Covered-Call Underperforms In Bull Markets…

As mentioned in Figure 1 above, IGLD has underperformed GLD since June 2023. However, this does not necessarily mean IGLD is a bad product.

As shown in Figure 3 above, IGLD underperforms GLD by design, as it has written call options against its synthetic long position, leading to a reduction in upside participation. Since June 2023, IGLD has captured roughly 69% of the total return upside of GLD (20.7% / 30.2%).

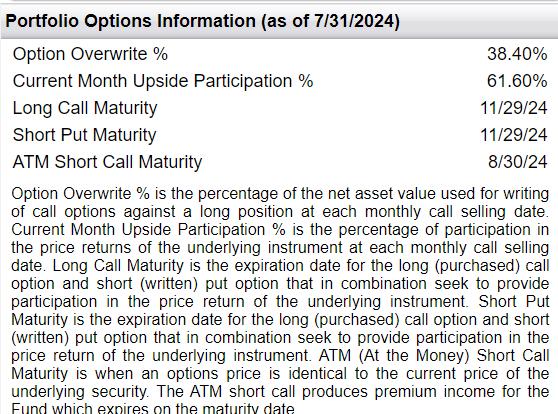

As of July 31st, 2024, the IGLD ETF overwrote 38% of its portfolio, leaving upside participation on 62% of the portfolio in the current month (Figure 4).

Figure 4 – IGLD option overwrite coverage (First Trust Portfolios)

…And Delivers Less Than Target Yield

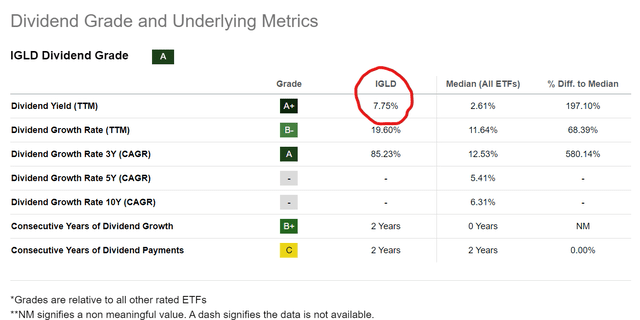

On the other hand, IGLD’s call-option writing and T-bill holdings have been able to fund an attractive trailing 7.8% distribution yield (Figure 5).

Figure 5 – IGLD pays a 7.8% trailing yield (Seeking Alpha)

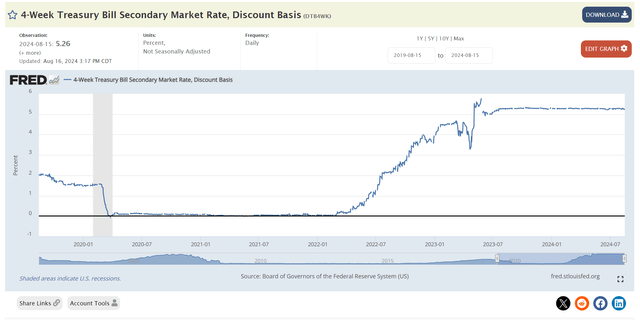

However, IGLD’s yield is substantially less than the target 3.85% above 1-month T-bill yield that was advertised, as 1-month T-bills have been yielding 5.25% for most of the past year (Figure 6).

Figure 6 – 1-Month T-bill yields have been 5.25% (St. Louis Fed)

I believe this is because gold, and the GLD ETF, have been in a strong uptrend. When the underlying assets experience strong rallies, covered-call funds like IGLD have to ‘buy back’ the sold options at expiry, lest their assets get ‘called away’. Hence, I believe a significant portion of IGLD’s option income has been used to buy back expiring options, reducing the total payout to investors.

May Be Useful From A Portfolio Perspective

Nonetheless, receiving a 7.8% distribution yield and 20% total returns since June 2023 is a problem many investors would love to have.

In fact, IGLD’s strategy may have transformed a formerly ‘unproductive’ asset, as determined by Warren Buffett in his 2011 letter to shareholders, into an asset paying a fairly attractive distribution yield while retaining much of gold’s theoretical upside potential.

In a broadly diversified portfolio, IGLD may be able to replace an investor’s allocation to cash (i.e., treasury bills) and gold (i.e., GLD), freeing up capital to invest in more productive assets like equities.

Don’t Forget The Potential Tax Benefits

Furthermore, for many investors, the IGLD may have a tax benefit compared to the GLD ETF. According to the IRS, precious metals, including GLD shares, are considered collectibles and are taxed at a 28% rate. This level of tax is considerably higher than capital gains tax, which ranges from 15-20% for most taxpayers.

In contrast, the IGLD ETF, since it invests in treasury bills and GLD options, may be taxed at income (for qualified income in distributions) and capital gains tax rates (when shares are sold), reducing investors’ overall tax liabilities (readers should consult a tax professional to verify whether their specific tax situation applies).

Gold Breakout To All-Time Highs

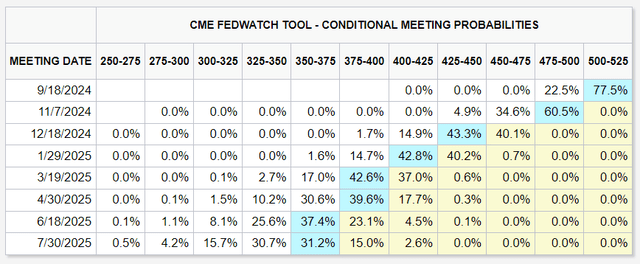

Recently, I wrote a bullish article on gold investments, including the Sprott Physical Gold Trust (PHYS). I believe gold is on the cusp of a major breakout, as the Federal Reserve is widely expected to begin a rate-cutting cycle at the upcoming September FOMC (Figure 7). Over the next 12 months, investors are pricing in 6 rate cuts by the Fed.

Figure 7 – 6 rate cuts expected over the next year (CME)

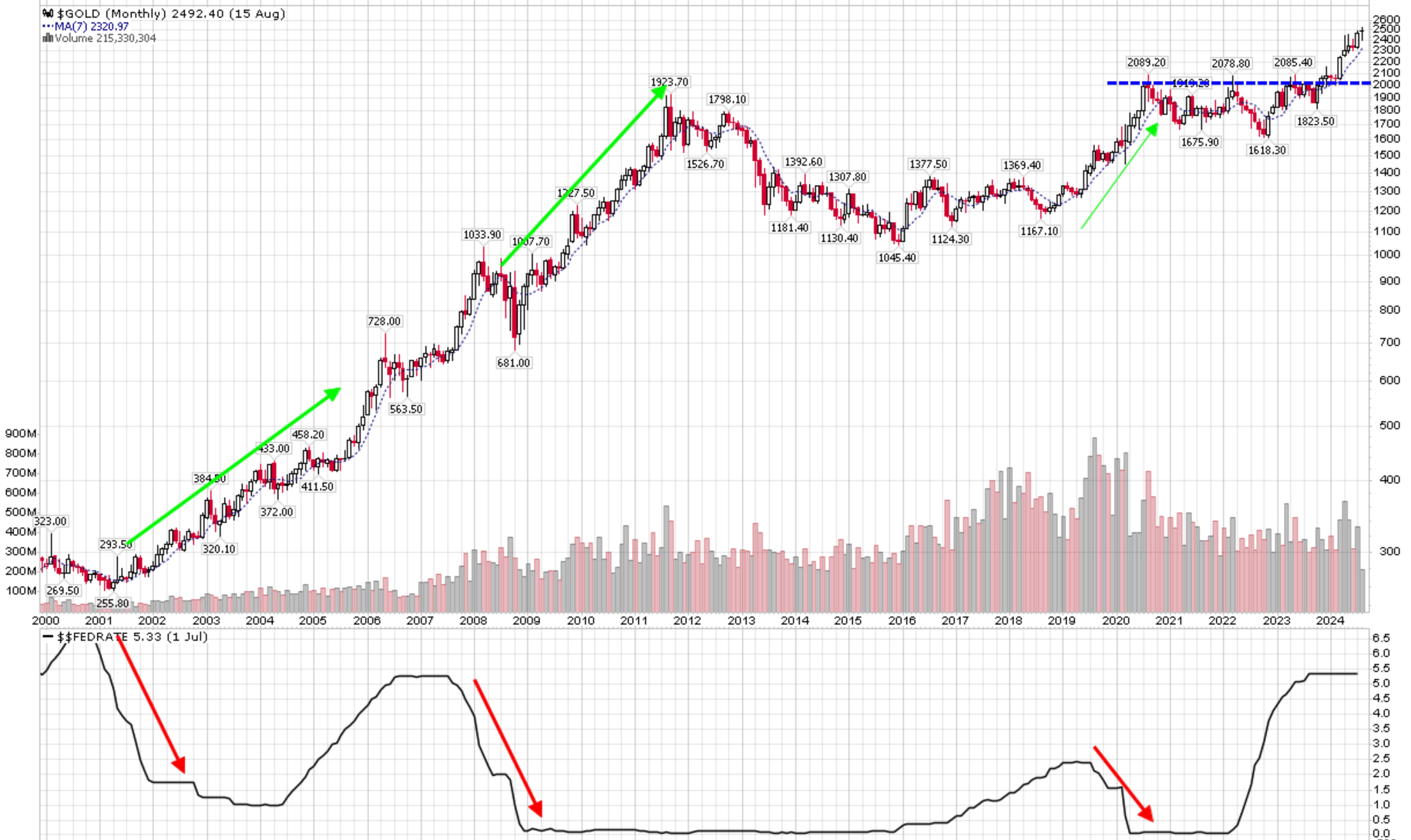

Historically, gold prices react very positively to Fed rate cuts, as lower nominal interest rates reduce real interest rates, which are a key driver of gold returns (Figure 8).

Figure 8 – Historically, gold reacts very positively to rate cut cycles (Author created with price chart from StockCharts.com)

I believe IGLD could be a good way for yield-oriented investors to participate in the upcoming gold bull market. IGLD should participate in 60-70% of the upside in GLD, while delivering a T-bill plus 2-3% yield.

Risks To IGLD

On the downside, although IGLD participates in 60-70% of the upside returns of the GLD ETF, its written call options do not shield the fund from GLD’s downside. If gold and GLD prices were to decline, the IGLD would suffer as well, with a small buffer from call option premiums received and returns from holding treasury bills.

Conclusion

Since my article in June, IGLD has performed well, delivering more than 20% in total returns and a 7.8% yield. With gold prices breaking out to new all-time highs above $2500 / oz, I believe the IGLD ETF could be an interesting way for yield-oriented investors to participate in the upcoming gold rally. I am raising my recommendation on IGLD to a buy.

Read the full article here