Performance Assessment

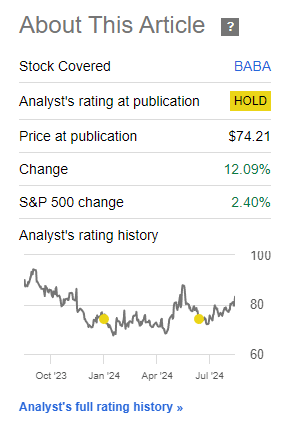

In my last coverage of Alibaba (NYSE:BABA), I had rated the stock a ‘Neutral/Hold’. Since then, the stock has outperformed the S&P 500 (SPY) (SPX).

Performance since Author’s Last Article on Alibaba (Seeking Alpha. Author’s Last Article on Alibaba)

However, I am not too fussed about missing this run up, as I believe it is still early days for a full-fledged turnaround. Hence, I anticipate further chances to accumulate the stock over time.

Thesis Update

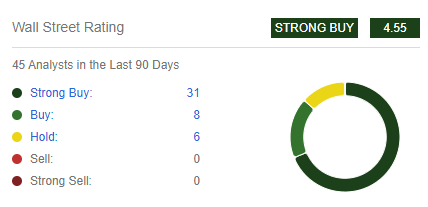

Upon release of Q1 FY25 earnings, BABA stock rose as sell-side analysts remained overwhelmingly positive on the stock:

BABA Rating by Wall St (Seeking Alpha)

Some renowned investors such as Michael Burry have also become more bullish, as recent 13-F filings show an increased portfolio weight in BABA from 8.74% to 21.26%.

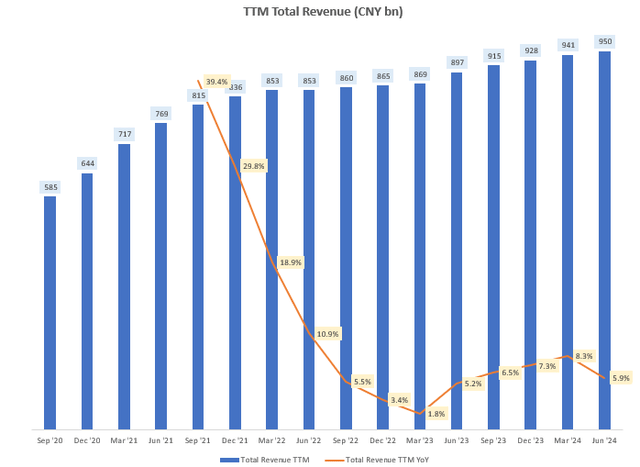

This is despite somewhat lackluster overall revenue growth:

TTM Total Revenue (CNY bn) (Company Filings, Author’s Analysis)

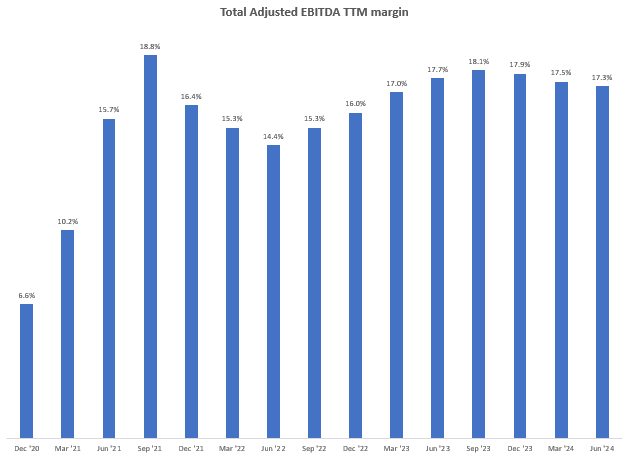

And a lack of improvement in operating margins (as discussed later in this article).

Now, I too am turning bullish on Alibaba stock as I note the following:

- There are some growth shoots in Cloud and AIDC

- Margin expansion is likely as management focuses on monetization

- Valuation is attractive, but this time with catalysts

- Technicals are turning bullish for an initial leg up

- China Retail Sales are a key monitorable

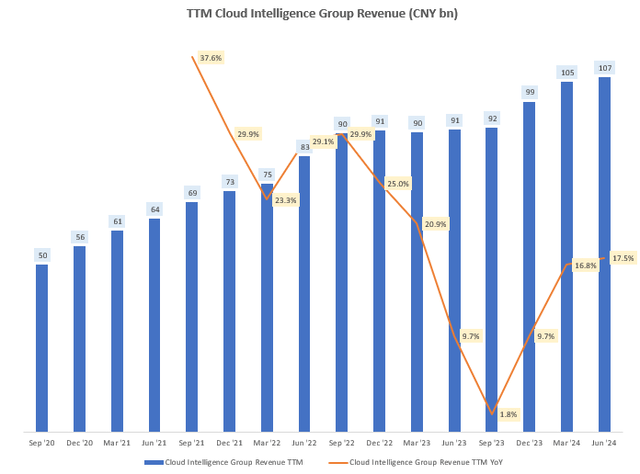

There are some growth shoots in Cloud and AIDC

There is a clear growth acceleration in Alibaba Cloud’s revenues as the TTM YoY growth rates have rebounded to the high-teens level:

TTM Cloud Intelligence Group Revenue (CNY bn) (Company Filings, Author’s Analysis)

This growth is driven mostly (more than half) by AI-related products and workloads:

…public cloud revenue [is] maintaining double-digit growth. AI-related product revenues sustained a triple-digit growth continuing to increase its share of public cloud revenue… more than half of that expected growth will be driven by AI products

– CEO, Head of Core E-Commerce Yongming Wu in the Q1 FY25 earnings call

Leading indicators of growth are also robust, since Alibaba Cloud’s customers are having significantly increased budgets for spending this year:

What we see certainly among our own cloud customers is that their AI budgets for this year are higher, significantly higher than what they were last year.

– CEO, Head of Core E-Commerce Yongming Wu in the Q1 FY25 earnings call

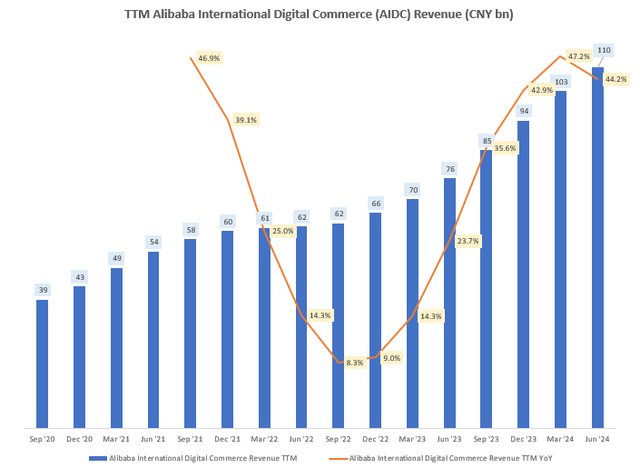

The company is also seeing impressive growth in its Alibaba International Digital Commerce (AIDC) business:

TTM Alibaba International Digital Commerce (AIDC) Revenue (CNY bn) (Company Filings, Author’s Analysis)

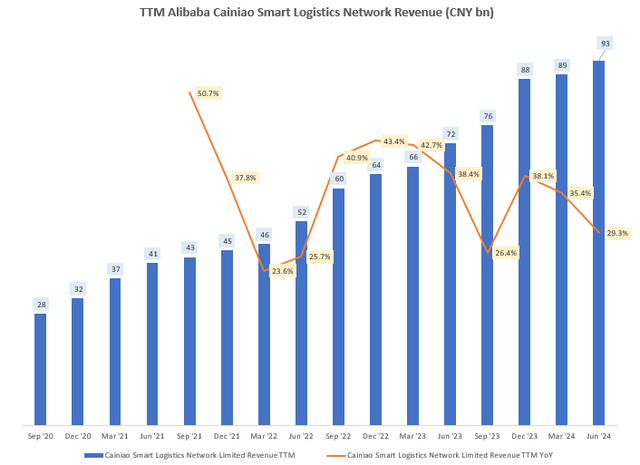

Here, the growth comps are extremely favorable; Q1 FY25’s 44.2% TTM YoY is on the back of an already robust 23.7% TTM YoY in Q1 FY24. A key driver of this growth is increased activity in AliExpress due to improvements in user experience, expanded assortment, product placement and presentation. This is bolstered by optimized logistics in Cainiao that has “significantly reduced average delivery time”, which has also been reflected in robust almost 30% TTM YoY growth in that segment:

TTM Alibaba Cainiao Smart Logistics Network Revenue (CNY bn) (Company Filings, Author’s Analysis)

Altogether, I believe the combined 32.5% revenue mix coming from these 3 growth segments – Cloud Intelligence, AIDC and Cainiao – are indicative of some meaningful growth shoots in Alibaba.

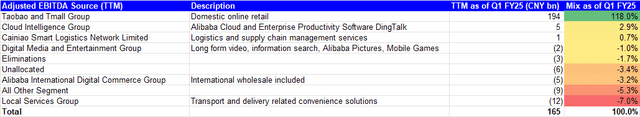

Margin expansion likely as management focuses on monetization

In my initiating coverage of Alibaba stock, I had identified margin expansion as a key upside risk as the company’s unprofitable segments transition toward profitability:

Adjusted EBITDA Mix for Q1 FY25 (Company Filings, Author’s Analysis)

But I was dismayed by a lack of progress on this front after Q4 FY24, which has continued this quarter as BABA’s adjusted TTM EBITDA margins have been mostly steady at around 17%:

Total Adjusted EBITDA TTM Margin (Company Filings, Author’s Analysis)

However, I am more optimistic about the margin expansion thesis playing out now because management seems to be focusing more explicitly on monetization of the loss-making businesses. Indeed, management has now disclosed a concrete 1-2 years timeline for reaching breakeven. This gives me some comfort and assurance on margin progression:

…we’ve implemented strategic realignments across our key Internet technology businesses through a thorough evaluation of their product capabilities and market competitiveness while maintaining product competitiveness, most of these businesses will now place a higher priority on monetization… We expect most of these businesses to breakeven within 1 to 2 years and gradually contribute to profitability at scale.

– CEO, Head of Core E-Commerce Yongming Wu in the Q1 FY25 earnings call

Valuation is attractive, but this time with catalysts

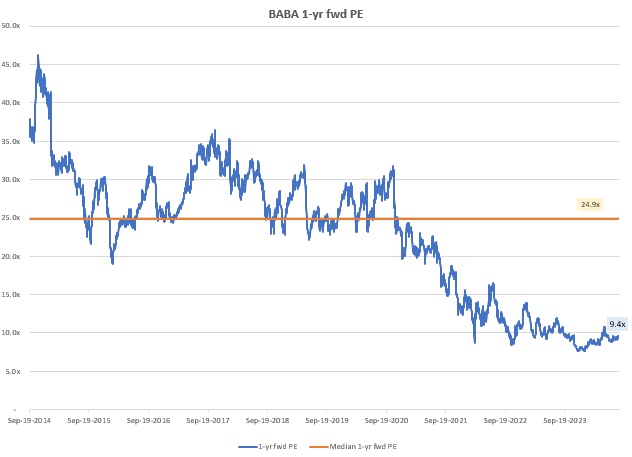

At a 9.4x 1-yr fwd PE, BABA trades at a hefty 62.3% discount to its longer term 1-yr fwd PE of 24.9x, which, I believe, is quite low even after assuming some de-rating effects due to the risks of investing in China. However, it has been at these discounted levels for a while and still, I had not been convinced of a buy.

So what is different this time?

I am more confident of the catalysts in the form of growth in the 3 businesses aforementioned and the margin expansion of unprofitable business segments. Importantly for incremental thesis validation checks, there is a clear 1-2 year timeline for these catalysts to steadily play out.

BABA 1-yr fwd PE (Capital IQ, Author’s Analysis)

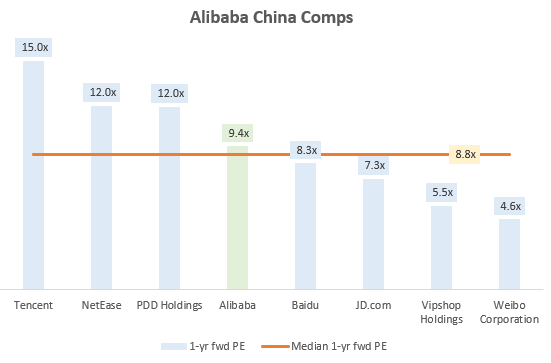

On a comparable valuation basis vs other Chinese internet peers, Alibaba trades at a small 6.4% premium to the 8.8x median 1-yr fwd PE of the compset:

Alibaba China Valuation Comps (Capital IQ, Author’s Analysis)

Besides BABA, the Chinese peerset includes Tencent (OTCPK:TCEHY), NetEase (NTES) (OTCPK:NETTF), PDD Holdings (PDD), Baidu (BIDU) (OTC:BAIDF), JD.com (JD) (OTCPK:JDCMF), Vipshop Holdings (VIPS) and Weibo Corporation (WB)

I believe the long-runway growth prospects of Alibaba Cloud make a valuation premium vs its peer group (more than the current 6.4%) well-deserved. One only needs to look at Google (GOOG) (GOOGL), Microsoft (MSFT) and Amazon (AMZN) to appreciate the value of cloud vendors.

Note that Seeking Alpha’s 1-yr fwd PE for Alibaba is a bit higher at 13.32x. Also, the sector median PE is shown to be 17.02x. I suspect these differences to the values I have used are due to:

- Differences in the individual 1-yr fwd PE inputs used to form the overall consensus 1-yr fwd PE figure. Regardless, this does not change the overall point that Alibaba is deeply discounted vs its historical trading multiples.

- Differences in the companies used in the peerset that defines the sectoral median. For example, I have only compared Alibaba to other Chinese comps. This is because I think it is not appropriate to compare it with US analogues such as Amazon, since doing so would not respect the valuation discounts rightly applied to Chinese securities due to lower confidence in a stable regulatory environment.

Technicals are turning bullish for an initial leg up

If this is your first time reading a Hunting Alpha article using Technical Analysis, you may want to read this post, which explains how and why I read the charts the way I do. All my charts reflect total shareholder return as they are adjusted for dividends/distributions.

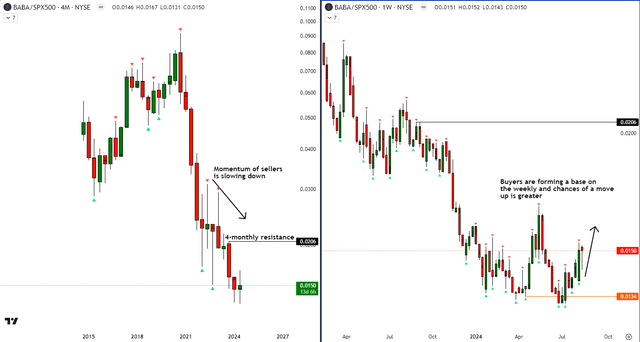

Relative Read of BABA vs SPX500

BABA vs SPX500 Technical Analysis (TradingView, Author’s Analysis)

On the relative technicals vs the S&P 500 front, I notice that the momentum of the sellers’ progress is fading since the size of new lower lows are shrinking. Moreover, the ratio chart seems to be forming a base on the weekly chart. Synthesizing these two observations together, I believe there are higher chances of a move up (corresponding to outperformance) toward the 4-monthly resistance.

China Retail Sales revival is a key monitorable

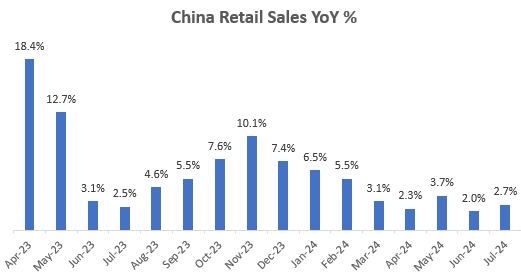

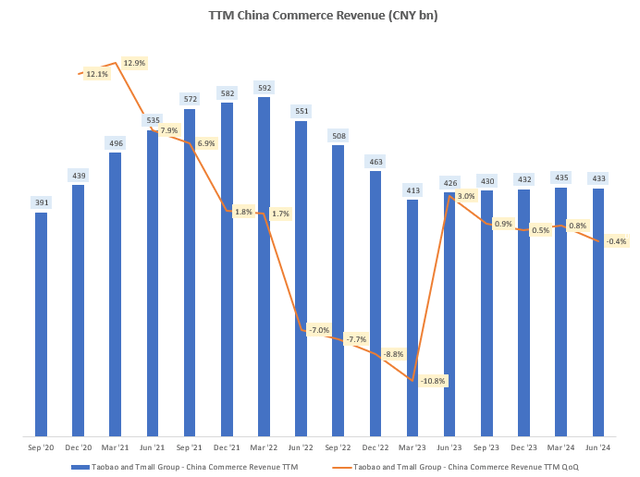

Alibaba generates 46% of its TTM revenues and 118% of its adjusted TTM EBITDA from Taobao and Tmall Group, which form the China Commerce (domestic online retail arm) of the company. Given Alibaba’s scale, I believe the monthly China’s Retail Sales data is a useful indicator of future quarterly earnings:

China Retail Sales YoY % (Trading Economics, Author’s Analysis)

So far, the growth track in China’s Retail Sales continues to be slow at 2-3%. Hence, it is not much of a surprise that Alibaba’s TTM China Commerce Revenue growth is also mostly stagnant at around $430 million for the past 4-5 quarters:

TTM China Commerce Revenue (CNY bn) (Company Filings, Author’s Analysis)

I don’t believe July 2024’s China Retail Sales print of 2.7% is enough to buck the stagnant growth trend in this largest segment for Alibaba. However, I continue to track this macro variable to try to identify growth revival points prior to the official quarterly releases.

Takeaway & Positioning

Despite lackluster revenue growth and no margin improvement, Alibaba stock remains an overwhelming favorite of Wall St and some renowned investors such as Michael Burry, who has increased his total stake in BABA to a portfolio weight of 21%. I have been hesitant to share the same enthusiasm for Alibaba until now:

I believe Alibaba Cloud, Alibaba’s International Digital Commerce and its Smart Logistics Network, which altogether make up 32.5% of TTM revenues, are all experiencing growth shoots. Management’s renewed focus on monetization with a concrete 1-2 year timeline to breakeven on currently unprofitable businesses also reinvigorates my optimism on margin expansion. With these catalysts and favorable relative technicals vs the S&P 500, I find the discounted valuations at a mere 9.6x 1-yr fwd PE attractive.

One key monitorable I’m tracking is China’s Retail Sales figures, as that would provide useful clues on a rebound in Alibaba’s most material (46% of TTM revenues and 118% of TTM adjusted EBITDA) albeit stagnant segment of China Commerce.

Rating: ‘Buy’

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P 500 on a total shareholder return basis, with higher than usual confidence. I also have a net long position in the security in my personal portfolio.

Buy: Expect the company to outperform the S&P 500 on a total shareholder return basis

Neutral/hold: Expect the company to perform in-line with the S&P 500 on a total shareholder return basis

Sell: Expect the company to underperform the S&P 500 on a total shareholder return basis

Strong Sell: Expect the company to underperform the S&P 500 on a total shareholder return basis, with higher than usual confidence

The typical time-horizon for my views is multiple quarters to around a year. It is not set in stone. However, I will share updates on my changes in stance in a pinned comment to this article and may also publish a new article discussing the reasons for the change in view.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here