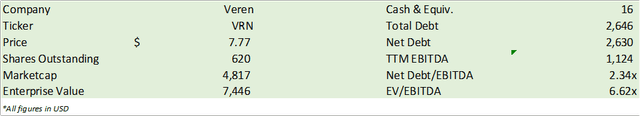

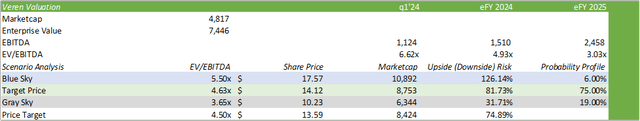

All operating values in CAD unless stated otherwise. Valuation tables are all in USD Conversion rate used is 1.35 CAD/USD.

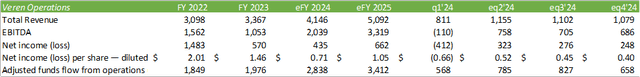

Veren Inc. (NYSE:VRN), formerly known as Crescent Point Energy, is set to report Q2 ’24 earnings on July 25, 2024, midday. Analysts are forecasting Veren to report $1.19b in revenue and $0.39/share in EPS. Looking through the duration of the fiscal year, analyst estimates moderately down in line with the CY24 strip price as reported by CME, which prices oil down to the mid-to-high $70s through December 2024.

Despite this pricing forecast, Veren will remain in a prime position as the firm’s operating breakeven price is $35-43/bbl WTI, assuming $3.35/Mcf & $2.00/Mcf, respectively. Management at Veren is positioning the company to both grow production to an average of 191-199Mboe/d and deleverage throughout the duration of eFY24. Given the firm’s outperforming new well production and their capital initiative, I reiterate my BUY rating for VRN shares with a price target of $13.59/share at 4.50x eFY25 EV/EBITDA.

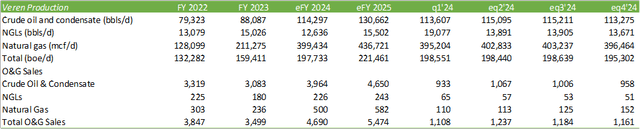

Veren Operations

Veren is forecasting significant growth in their 5-year plan to increase daily production from 195Mboe/d to 250Mboe/d in eFY28. This growth is expected to need $1.4-1.5b in annual development capital investments to reach this level of production. Where it stands, liquids production is ~65% of total O&G production, driving 90% of total revenue. At $75/bbl WTI, management forecasts eFY28 free cash flow of $5.2b, providing significant upside potential to operations. Veren’s production resides in Alberta Montney, Kaybob Duvernay, and Saskatchewan at a 50/25/25 split. The long-term strategy is to enhance production in the Montney and Kaybob basins while reducing exposure to the Saskatchewan as the firm disposes of their non-core assets.

Corporate Reports

As of q1’24, Veren had brought on 18 wells in their Alberta Montney assets. These wells have significantly improved the firm’s oil to gas mix, with wells producing 85% liquids, well above the firm’s 65% average. In Karr West, Veren brought on stream 3 multi-well pads with production in the range of 400-1,400boe/d. Management is planning to bring on stream their first fully operated pad in the region in e2h24.

Veren has been testing a plug and perf technique on two of the four wells on their multi-well pad in Gold Creek West, which management has said has produced promising results. The peak 30-day rate of these wells was 1,800boe/d with 85% liquids. Management anticipates to grow their Alberta Montney production by 40% by 2028, a ~10% CAGR.

Management has also been focusing their development efforts in the Kaybob Duvernay region, effectively drilling Canada’s longest well at 9,000 meters with a lateral length of 5,400 meters. Veren’s latest pad in the region has an average peak 30-day rate of over 1,500boe/d comprised of 75% liquids.

Corporate Reports

Forecasting out financials, I anticipate Veren to produce at the upper end of their range given the success of their well pads in the Gold Creek and Kaybob. Though this level of production per well is a one-off data point and may not result in a production trend, this level of production may average up Veren’s average production on a per-well basis. I believe Veren will generate $1.15b in net revenue and drive diluted EPS of $0.52/share. This considers Veren’s production growth and higher producing wells. This also assumes a mix of 65/35 oil/natural gas for eq2’24 as the firm focuses their efforts in more liquids-rich basins. For eFY24, I forecast revenue to come in at $4.15b, with diluted EPS of $0.71/share.

FinChat

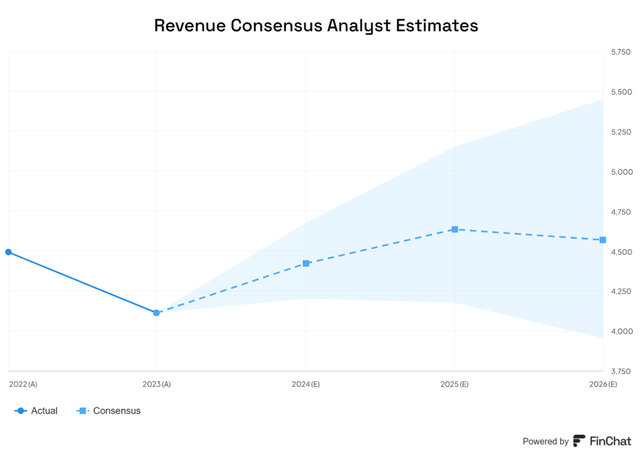

Macro Risks

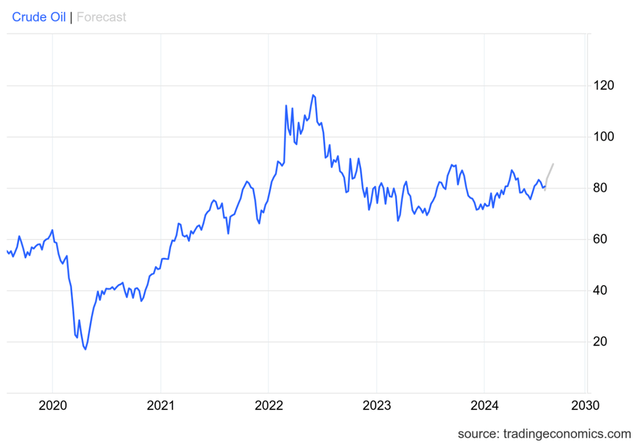

One of the biggest headwinds that Veren faces is primarily at the macro level. Looking at the CME WTI strip price, futures suggest oil may price down throughout 2025 to the low-$70/bbl. This may be driven by the bleak business outlook, as suggested by the June ISM-PMI readings. Though this is a singular data point that doesn’t necessarily affect the entirety of the O&G industry, the poor outlook may add some downward pressure to O&G demand expectations.

ISM-PMI

According to the IEA, global oil demand growth is decelerating with q2’24 growth of 710Mbbl/d, primarily driven by a consumption contraction in China. The report goes on to mention that global supply rose 150Mbbl/d to 102.9MMbbl/d in June, which was potentially eased by a drop in Saudi flows. Despite these two points, crude oil prices improved off their recent lows of $73/bbl at the beginning of June. Analysts at TradingEconomics forecast WTI prices to improve to $89/bbl throughout the next 12 months, suggesting a stronger market going forward.

TradingEconomics

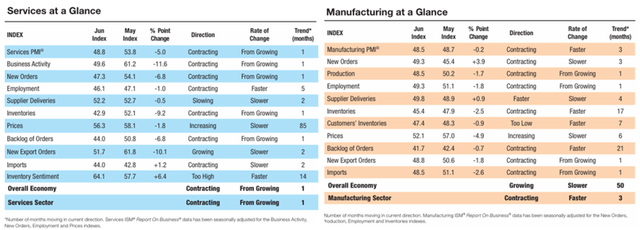

Valuation & Shareholder Value

Corporate Reports

Management will utilize all excess cash flow to reinvest in growth and reward shareholders. 60% of excess cash will go to dividends and share repurchases, and 40% will go to development capital investments and paying down debt. Management’s goal for the end of eFY24 is to reduce their net debt to $2.8b to reach 1.1x debt/cash flow. Management suggested in their June 2024 presentation that cash distributions can exceed the 60% as net debt improves over time. Considering VRN’s historic trading premium, VRN shares have a significant upside potential when taking into consideration the firm’s production growth trajectory. Translating this into EBITDA generation, adjusted at 1.35x CAD/USD, I believe VRN shares should be priced at $13.59/share at 4.50x eFY25 EV/EBITDA. I reiterate my BUY rating for VRN shares.

Corporate Reports

Read the full article here