Here at the Lab, we have extended coverage of the Italian (and European) banking industry. For our new readers, UniCredit (OTCPK:UNCFF, OTCPK:UNCRY) is an Italian-based banking group and is the second operator in its home country after Intesa Sanpaolo. The bank is involved in retail and commercial solutions, corporate and investment banking, and asset management. On a geographical footprint, the group has sizeable operations in Austria & Germany, and following the new bolt-on acquisition in ten CEE countries. Here at the Lab, we believe the company is well-positioned to capitalize on its diversified business MIX. This was already evident thanks to a solid Q2 performance, with the company over-delivering on top-line sales, a low cost of risk, and a supportive capital buffer.

Earnings Results

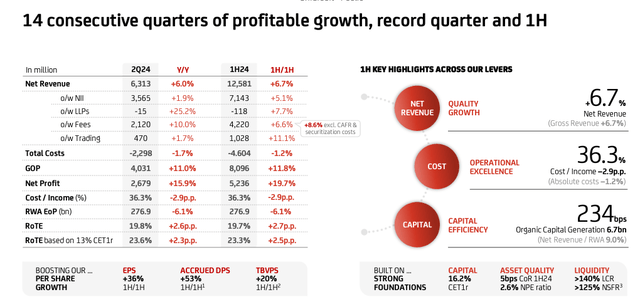

Following Another Show Of Strength in Q4 2023 and Redefining Excellence in Q1 2024, the company marked the “14th consecutive quarter of quality profitable growth.” Here at the Lab, we are not recapping the company’s financials; however, we report the following key takeaways that align well with our supportive forward-thinking view.

- UniCredit sales were up thanks to higher commissions. In detail, as reported in Fig 2, the company Q2 fee was up 10% to €2.1 billion;

- The capital generation reached €6.7 billion with a leading CET 1 ratio of 16.2%;

- The bank continues to lower its operating costs. UniCredit’s expenses reached €2.3 billion in the quarter, signing a minus 1.7% year on year. UniCredit cost/income ratio improved further to 36.3%. Higher sales and lower expenses lead to a net profit growth of 15.9% to €2.7 billion. This was above consensus expectations set at €2.35 billion.

UniCredit H1 and Q2 Financials in a Snap

Source: UniCredit Q2 results presentation – Fig 1

Why are we still positive?

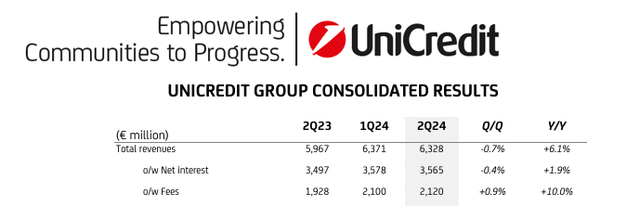

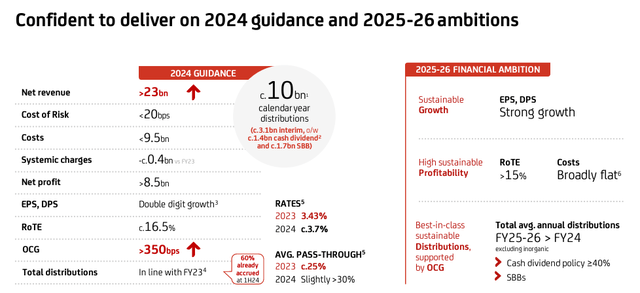

- (Higher sales guidance backed by quality commission fee growth). Looking at the H1 results, UniCredit closed the semester with a record net income and commissions above expectations. This was due to the lower interest margin (NIM) growth for the June ECB 25 basis points cut. It is no coincidence that the banking focus is now on commissions and their fee structure, which – from being marginal as they once were – have now become an important instrument of the banker’s top-line sales. In numbers, as evident in Fig 2, the net interest margin decreased by 0.4% on a quarterly basis. For this reason, the CEO reiterated its Fiscal Year 2024 adjusted net income guidance above €8.5 billion and raised net revenues to above €23 billion from €22.5 billion (Fig 3). That said, gearing to lower rates should be relatively manageable for UniCredit. Structural hedge benefits and high Austrian/German deposit costs support this. In addition, UniCredit is moving on with Azimut to re-create an internal AuM earnings engine power;

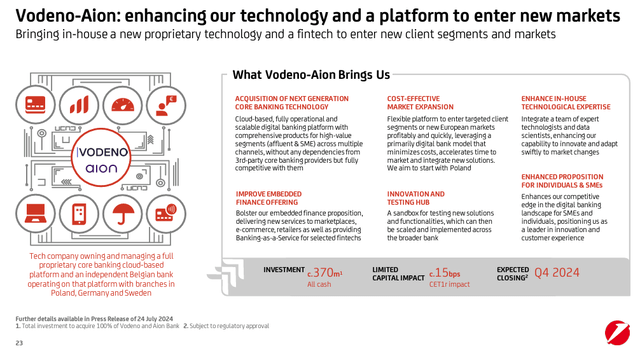

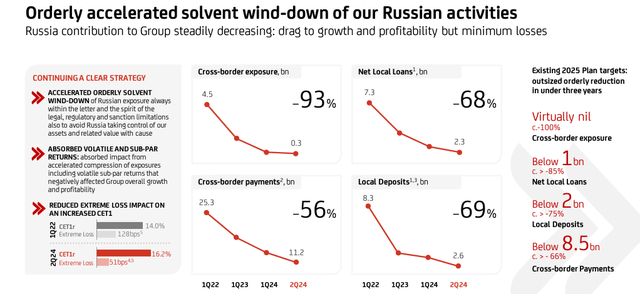

- (M&A Upside and Russia development). Here at the Lab, we were expecting new acquisitions. With the Q2 results, the company announced a double M&A. For €370 million, UniCredit acquired the entire capital of Vodeno and Aion Bank (Fig 4). This was not the expected transformational cross-border operation, but this is a good step forward for the Group’s digital path and a return to the Poland region eight years after the Pekao disinvestments. Indeed, Aion Bank is a state-of-the-art digital banking solution. This investment will allow UniCredit to enhance its proprietary technology for the benefit of the Group, combining its digital technology across the company’s geographical footprint. UniCredit expects a minimal 15 basis points CET 1 reduction in Q4; however, here at the Lab, we expect the bank might support digital international expansion into new European markets, thanks to a flexible platform and new product offerings. The bank’s presence in Russia is another aspect under the regulator’s spotlight. The CEO discussed this topic several times during the analyst call. UniCredit is accelerating its exit from Russia, as evident by Fig 5. That said, in recent weeks, the company appealed to the EU Court to clarify the regulator’s requests regarding the exit. The CEO still expects No Gift from Russia. Looking at the Q2 evolution, UniCredit further tight its Russian provision by €200 million;

- (Attractive shareholders’ remuneration). According to BofA Securities Europe SA, the intermediary appointed to execute the third tranche of the UniCredit 2023 buy-back program, the company has purchased 2.58% of the share capital. This represents a cash out of €1.5 billion. The bank planned to cancel all the shares purchased. After Q2 results, the bank offered a solid capital return with an expectation of €10 billion in shareholders’ remuneration in 2024. According to our estimates, the group will distribute through the 2024-2026 period almost €26 billion of capital;

-

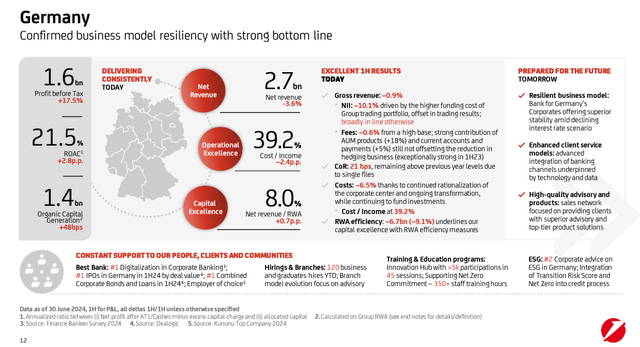

(Downside protection in Germany). UniCredit has a crucial exposure to the Bavarian HypoVereinsbank (HVB) bank in Germany, which was acquired in 2005. In recent months, the market has wondered whether the German economy’s slowdown could impact the bank’s accounts. Looking at HVB’s numbers, we do not show signs of emergency here at the Lab, and UniCredit has cautious optimism about the German economy’s resilience. In H1, the overall exposure to credit default risk decreased by €149 million (Fig 6).

NIM Evolution

Fig 2

UniCredit Higher Guidance

Fig 3

UniCredit new Acquisitions

Fig 4

UniCredit-Russian assets evolution

Fig 5

UniCredit-Germany focus

Fig 6

Valuation

UniCredit left its net income 2024 projection unchanged. Here at the Lab, we were already forecasting supportive sales and a solid net profit, which was aligned with the company’s internal outlook. For this reason, our €8.45 billion and €8.65 billion net income projections for 2024 and 2025 have not changed. Related to 2025, we see UniCredit scoring attractively in terms of EPS growth compared to the other EU peers. This is due to its international expansion and superior ROTE and CET1 ratio. The company is more protected on the balance sheet with differentiated excess capital upside. Following Intesa Sanpaolo’s expectations, the company is set for solid earnings growth despite lower rates. Rolling forward our valuation, the company’s 2025 EPS is set at €5.3, and applying an unchanged 7x P/E, we reached a valuation of €37.1 per share. Blending our valuation methodology with RoTE estimates (supported by the H1 result of 19.7%), we increased our target price to €38.55 per share.

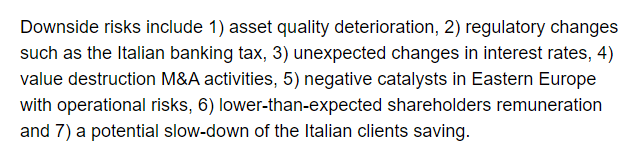

Risks

Our team has an extended coverage of UniCredit, and we suggest you check our last risks section (Fig 7). Additional downside includes 1) execution risk for new acquisitions, 2) a worsening of equity and bond market conditions, which would weaken the company’s trading and asset management solutions, 3) lower than expected shareholders’ remuneration in light of changes of regulatory requirements such as the Basel 4, 4) Russian exit development, and 5) a slowdown of the UniCredit home country saving industry that might lead to lower net commission fee generation. Regarding the Russian evolution, we should report that the company has made additional progress in running down cross-border exposure.

Mare Ev. Lab previous risk section

Fig 7

Conclusion

Accelerating fee momentum and cost stability beyond 2024 are critical positives for UniCredit. The company reiterated its positive view in Germany and made €200 million higher provision for Russian activities. This, combined with attractive capital returns, offers downside protection. Our buy rating is then confirmed.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here