Working towards a 25 basis point cut in August makes total sense.

Of course, Powell could also choose not to cut, and hold out to September. Then if employment does falter he will have to do an immediate 50BPs cut or even 75. This will of course roil stocks, which the Fed officially doesn’t care about (but really does). However, there is a real chance that this sudden move ties up the debt market, which would be a huge black mark on his legacy. Announcing a cut in the current FOMC meeting when it wasn’t telegraphed ahead of time could do the same. Everyone this week would be asking what Powell and his some 200 or so PHDs beavering away in the New York Fed see that we don’t. That could send both equity and credit markets straight to Hades.

The last thing the Fed wants to do is panic everyone

So why not start preparing the ground now, for a small 25BPs cut next month? I am sure all the Fed Presidents can get out there and explain why it makes so much sense to start the cuts at a leisurely pace. In case you are wondering, there is nothing to stop the Fed from cutting out of sequence. They could make August a live meeting and announce a cut, easy-peasy. I’ve explained why announcing a cut this week is bad. Also, how waiting for September might be too late for a sudden slide in employment. Let me add that when employment numbers start to falter, they can quickly get out of hand. So, what makes an August cut better? Rhetorically, they could just say they are taking back that last hike, which at the time many thought had taken the tightening too far.

I am also thinking that getting in a quick 25BPs cut in August gives some optionality to the Fed. If employment continues to be peachy keen, they can keep up the notion that they didn’t so much as cut too soon as adjusting the tightening. If employment shows any weakness, then another .25% cut won’t panic anyone. If employment becomes a bigger issue, then a .50% cut is a .75% cut. Also, this does fit in with their constant reminder that they are “Data Dependent” everyone recognizes that inflation has been moderating. A .25% cut reinforces that notion and adds to the Fed’s credibility. Right now, the Fed is studiously avoiding adjusting to the change. Meanwhile, if inflation does pick up, or disinflation stalls, all they did was make a tiny .25% cut. They could hold back on any further cuts and wait for more progress. Right now, the Fed is being restrictive by any measure. Even if you insist that inflation is really at 3% we are more than 2% above that in the Fed Funds Rate (FFR).

There is an argument that keeping the FFR high is contributing to inflation.

I know that sounds odd, but in one area that punches above its weight, I can make an argument for that thesis. I am talking about housing, existing home sales are not happening, Most sellers are sitting with tiny mortgages that they will never see again. It’s possible that these 3% mortgage rates will not be seen for another 50 years. That said, if mortgages do come down a little more, current homeowners with too much house or would really like to move would be more amenable to selling. Once that happens, more homes will come to market and existing home prices will begin to normalize. The point I am making here is that these restrictive interest rates could be having unanticipated consequences on the economy.

We kept hearing about the “long and variable lags” to raising interest rates

I was a big skeptic after months of no evidence of slowing. We saw just the opposite, the economy kept accelerating. I think the intended consequence of the initial hikes was that once there was a realistic price of money, more money started pouring into the economy, not less. Now there are no lags to the effects the rates are having on activity. We are seeing consumers less anxious to spend on travel. We are hearing that people are flying, but there is suddenly too much capacity. That is just doublespeak for fewer people than anticipated are traveling.

One more benefit regarding cutting in August.

It’s less political in nature, a .25% cut now is not a big statement. It is earlier than anticipated. This way the ice is broken and if another cut happens in September, it would be less newsworthy. Not that the Fed is beholden to politics, but if there’s a way to be less disruptive to the electoral process, I believe the Fed is considering this notion right now.

Now, a few words on what is happening this week.

First let me refer you to what I wrote last week, Biden’s Withdrawal May Cause Selling, Clearing The Decks For A Rally. I have made many poor predictions of late, that being right this time just isn’t bringing me as much joy as I’d like. Also, the week started with a strong rally, and not an immediate dive. I did say in the article that I didn’t trust the strong futures Sunday night. Those who took that caution perhaps saved themselves some dinero. By the end of the week, the decks had cleared, and we had a very nice rally on Friday.

I strongly believe that the rally will continue. It does depend on the Tech Titans’ performance; Tuesday starting with Microsoft (MSFT), Wednesday Meta Platforms (META), Thursday Apple (AAPL), and Amazon (AMZN) all of these names report after the market closes. A bad earning report could reverse a rally, this isn’t an excuse, it is just reality. Last week, as part of my article, I added that not only was the Biden switcheroo a cause but also some evidence of an advertising slowdown at Alphabet (GOOGL). My concern there was that GOOGL has such a big share of advertising, especially for small businesses, that it could exhibit some macro effects. I think the market completely overreacted, and punished GOOGL severely, along with the other big names. I think that part of the selling may have inoculated these names a bit. I am concerned about META in the same way I was concerned about GOOGL. The truth is that GOOGL’s results were pretty good, and the YouTube ads grew nicely, just not super-duper. Another thing, I think is a big difference between them is that GOOGL like the other hyper-scalers is spending on Capex like it’s a land grab and maybe it is. However, META, while a big spender, is using AI to generate great efficiencies and a stronger business. I think META can show that advertising is still doing well.

Even though I have been talking about the Magnificent 7, I think the tech rally will be elsewhere

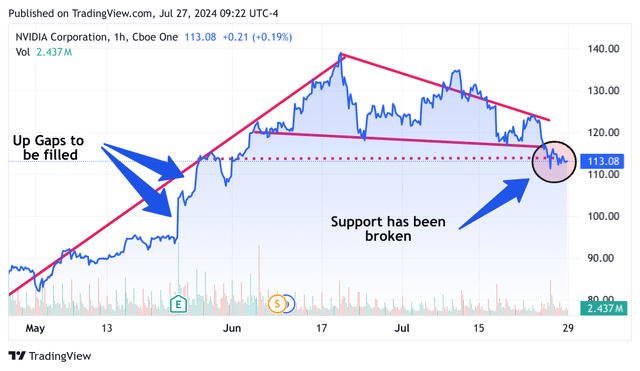

In my opinion, it is the chip sector that will enjoy most of the rebound. However, I don’t think they are running to new highs, just a very nice pop this week that could be a very nice trade. Nvidia did some technical damage to its chart. I think the rally will take them into the low to mid-120s. Check out this 3-month chart of NVDA.

TradingView

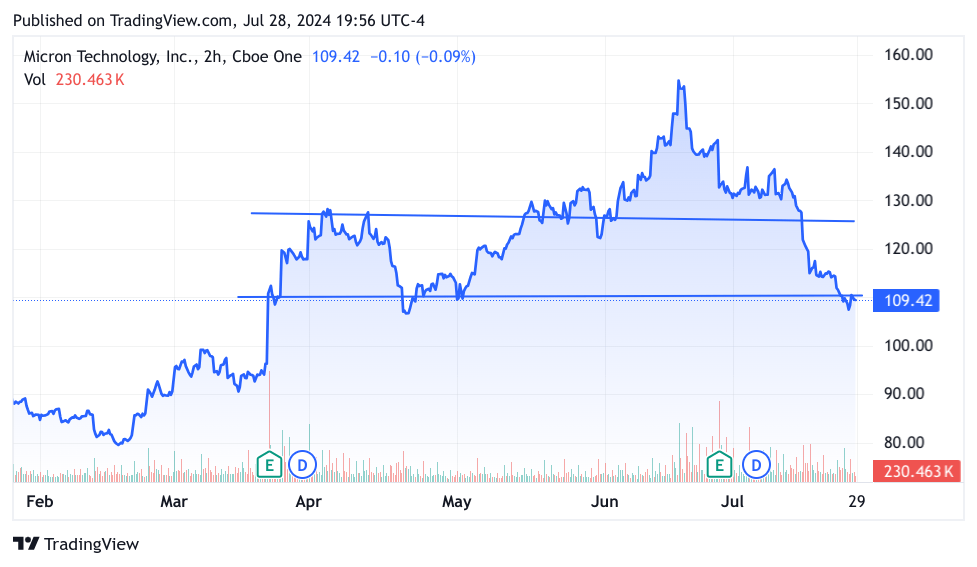

In this chart, I am illustrating that NVDA will likely trade in the double digits in the fall. However, this week, I think we get a countertrend rally somewhere in between the two solid lines on the left side mark out. Currently, support at the low teens has been broken. In charting, once support has been broken, it becomes resistance. The first solid red line above the dotted one is at about 116 and the top red line is at about 125. That gives plenty of upside to trade. Another chip name I like, and one that has been punished too severely, is Micron (MU). It has been widely reported that MU has the best High BandWidth DRAM Chip anywhere. HBW is crucial for AI to run properly, plus MU’s version uses 30% less power, a real consideration these days. In any case, I think MU should bounce this week too. I haven’t charted MU, the NVDA chart is something that I already presented to my investment group. I usually chart stocks fresh for these articles but on the rare occasion that I have created them before, I think I should tell you that. So here goes, first let’s try the 3-month chart of MU. Wow, this is a terrible chart, I had to zoom out to 6 months.

TradingView

To quote Carter Braxton Worth, a chartist that I truly admire, “Sometimes it’s so bad it’s good.”

In this case, it looks like everyone took out their AI skepticism on this one stock. The stock fell from a peak of 157ish to 109. Somewhere in the middle is where this name should be. However, for now, I think 125 is very doable this week for a trade.

My Trades

I am trading the chips rebound idea with Long Calls on the 3X Chips ETF (SOXL) so I have a chance to make money on the general movement of the chips. I might set up a trade on either NVDA and poor ole MU, it’s taken quite a beating, and it doesn’t seem rational.

My other play on this week’s rally is going Long Puts on the VIX futures at the 17 strike. Of course, the VIX shot up a lot higher than that, but I am hanging on. I think the VIX comes right back down under 14. Then I’m going to get Long Calls 15 strike with Expiration out to October and just hang on to them.

I also have Palantir (PLTR) Calls at the 27 Strike with Expiration out to September. I think I traded out of them, and then back in.

I’ve been holding DraftKings (DKNG) into the Olympics and I will be looking to close them out this week. I have my eye on GOOGL for a rebound trade as well. It’s a bit after 8 pm and I see the futures are up. Hopefully, they carry through throughout the week. I expect to hear good things from the FOMC meeting this week, even if they don’t like my idea to announce a cut in August. Please trade nimbly this week, I have no idea how the first full week of August might turn out. Make sure to leave some cash in your trading account, and do some hedging.

Good luck everyone!

Read the full article here