Small caps are trending higher with the Fed looking to make rate cuts and Nextdoor Holdings, Inc. (NYSE:KIND) is a prime stock making a big turn. The founding CEO returned last year and the business has seen reinvigorated growth. My investment thesis is ultra-Bullish, considering the limited valuation of the business and the cash to invest for a bigger future.

Source: Finviz

Next Level Up

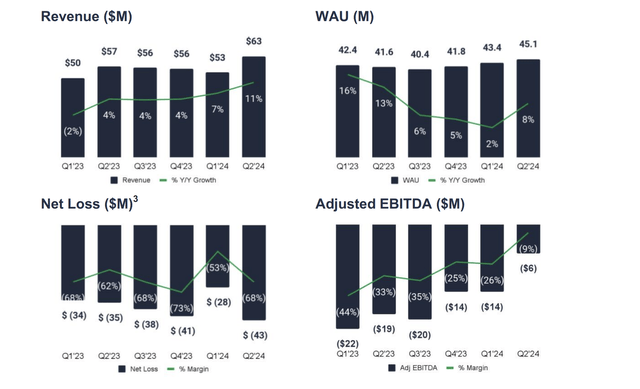

The local social media company reported a solid Q2’24 a few weeks back, but the stock is still consolidating down around $2.50 after a dip. Nextdoor reported quarterly revenue of $63.3 million grew by 11% YoY, beating consensus estimates by $4.8 million.

The market didn’t appear to like that Nextdoor reported revenues jumped over $63 million in Q2 and only guided to Q3 revenue of $62 million. Regardless, the company turned around the user slide and now is back to growing 8% YoY. The local social media company grew WAUs to 45.1 million in Q2’24 setting up double-digit growth for Q3 from the easy comps of just 40.4 million last year.

Source: Nextdoor Q2’24 shareholder letter

The Nextdoor Ads platform is playing an important role here as it enabled greater self-serve adoption, better advertiser performance and increased revenue retention in the quarter. The company is now holding on to top 50 advertisers with retention rates that improved to 96% in Q2, up from 92% in Q1.

Another big key to the story is that Nextdoor added 1.7 million WAUs sequentially from Q1 while spending limited amounts on marketing. The company still spent $30 million on sales and marketing in the quarter, down slightly from last Q2.

The adjusted EBITDA losses have been nearly eliminated with the restructuring of the business when combined with solid sales growth. Even the $6 million loss is basically offset by $6 million in interest income excluded from the adjusted EBITDA total.

The company has greatly improved productivity, with revenue per employee improving more than 50% YoY. For this reason, Nextdoor guided to a conservative Q3 adjusted EBITDA loss of $8 million, with positive EBITDA for Q4 on the holiday quarter sales jump.

Still Cheap

Nextdoor has rallied from a low below $1.50 back in January to over $2.50 now. The stock went public via a SPAC at $10 several years ago, so most shareholders have not had a positive ownership.

The consensus revenue estimates for 2024 are now up to $241 million for 10%+ growth, followed by 13% growth in 2025 to reach $272 million. The opportunity is to reach much higher sales, as user growth could approach 20% starting in Q3.

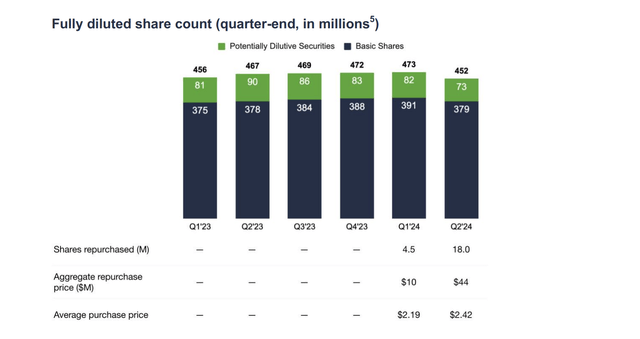

The stock has a fully diluted market cap of $1.1 billion after reducing the share count by 5% in the quarter via a buyback. In addition, Nextdoor cut some dilutive stock in the process.

Source: Nextdoor Q2’24 shareholder letter

The stock EV is only ~$600 million due to a $475 million cash balance, and Nextdoor could easily push towards 2025 revenues of $300 million. Investors are getting the stock for ~2x EV/S targets.

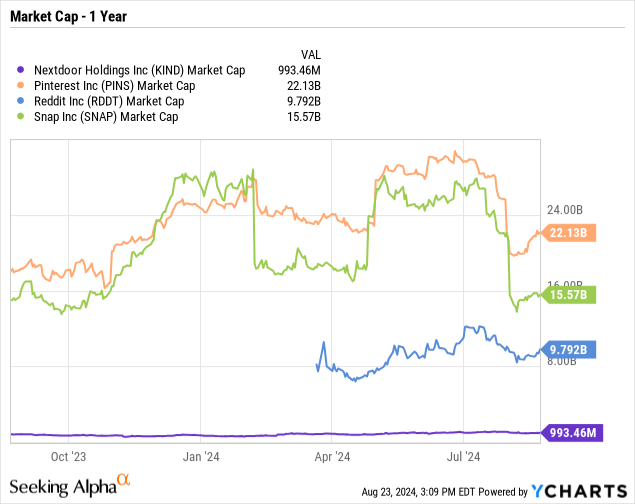

One big visualization for the massive opportunity ahead for Nextdoor is the market sizes of other social media stocks. Meta Platforms (META) is worth $1.35 trillion and no one should expect Nextdoor to have similar upside, but the company does have the potential to reach the heights of Pinterest (PINS), Reddit (RDDT) or even Snap (SNAP).

These stocks all have market caps from $10 to $20 billion. Pinterest reported 522 million MAUs and Snap has 432 million DAUs with over 800 million MAUs, so Nextdoor is a ways off at only 45 million WAUs, but the company isn’t small, and the local ad market has always been seen as the holy grail of advertising.

Nextdoor just needs to unlock local advertisers looking to target potential customers in the neighborhoods around the business. The self-serve platform was a huge key to unlocking this opportunity, with more small businesses able to now engage in local advertising.

Using a 2025 revenue target of $300 million and the cash balance of $475 million, the stock should trade in the following ranges at similar forward EV/S multiples as the other social media firms:

- 5x EV/FY25 revenues of $300M = $4.37

- 8x EV/FY25 revenue of $300M = $6.36

Of course, the risk is that the returning founder fails to reignite growth. Nirav Tolia is undertaking an ambitious plan to reimagine the user interface, and sometimes these efforts don’t produce desired results. If Nextdoor starts adding expenses, leading to another year of losses, the stock could trade right back down to the recent lows below $1.50.

Takeaway

The key investor takeaway is that Nextdoor remains a bargain with the returning founder in the process of turning around the local social media company. The stock has considerable upside in a scenario where the company reports sustainable double-digit growth while generating positive operating cash flows.

Investors should look to buy Nextdoor at the current level.

Read the full article here