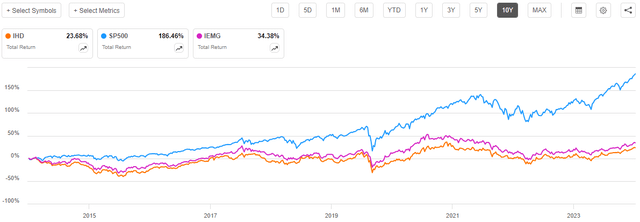

The Voya Emerging Markets High Dividend Equity Fund (NYSE:IHD) is one of the few remaining closed-end funds that provide exposure to the potentially high-growth economies of various emerging markets around the world. This used to be a very popular theme, and I can vividly remember the constant barrage of articles in the financial media discussing the very high growth being delivered by emerging markets. Of course, this was all prior to the 2007 collapse of Lehman Brothers that sparked off a deep recession and a wave of money-printing in the developed world. This caused emerging markets to take something of a back seat to the asset appreciation that occurred in the U.S. markets. Over the past ten years, the iShares Core MSCI Emerging Markets ETF (IEMG), which tracks the MSCI Emerging Markets Investible Market Index, has only gained 4.34%. This obviously compares terribly to the S&P 500 Index (SP500):

Seeking Alpha

As a result of the poor performance of emerging markets over the period, those funds that invested in the sector lost a lot of their former popularity and many of them were shut down. The Voya Emerging Markets High Dividend Equity Fund is one of the few that remain, but its 2011 inception date was after the financial crisis had already occurred. Today, though, we are starting to see a growing interest in foreign investments and particularly in emerging markets as investors are increasingly concerned about the stagnant growth in Europe and the potential effects that the persistently high U.S. deficits could have on the dollar. The central banks of many emerging markets have been aggressively buying gold, which could provide support for the currencies of emerging market nations and overall presents a pretty good case for investors seeking to improve the diversification of their portfolios.

As I have pointed out in a few previous articles, foreign equities frequently have higher yields than can be found in the United States. The MSCI Emerging Markets Investible Market Index, for example, has a 2.67% trailing twelve-month yield, which is well above the 1.30% yield of the S&P 500 Index. That carries over to the Voya Emerging Markets High Dividend Equity Fund, which boasts a very attractive 12.02% yield at the current price. Here is how that compares with some of the fund’s peers:

|

Fund Name |

Morningstar Classification |

Current Yield |

|

Voya Emerging Markets High Dividend Equity Fund |

Equity-Emerging Market Equity |

12.02% |

|

Templeton Emerging Markets Fund (EMF) |

Equity-Emerging Market Equity |

5.59% |

|

abrdn Emerging Markets Equity Income Fund (AEF) |

Equity-Emerging Market Equity |

7.35% |

|

Mexico Equity and Income Fund (MXE) |

Equity-Emerging Market Equity |

2.97% |

|

Mexico Fund (MXF) |

Equity-Emerging Market Equity |

5.15% |

|

The Central and Eastern Europe Fund (CEE) |

Equity-Emerging Market Equity |

3.31% |

As we can see, the yields of these funds are all over the place. However, most of the funds have substantially lower yields than the Voya Emerging Markets High Dividend Equity Fund. This could be a concerning sign, as any time that a fund’s yield vastly exceeds that of its peers, it is a sign that the market expects that it may have to cut the payout. However, there are a number of other things that could explain the differences in yields, such as which countries each fund invests in. After all, developing nations have their own central banks and interest rate policies just like developed nations do, and these policies can have a significant impact on yields and overall returns. As such, we should take a closer look at the fund in order to determine how sustainable its distribution is likely to be.

The poor performance history of the Voya Emerging Markets High Dividend Equity Fund is unlikely to win it any fans. Over the past ten years, shares of the fund have declined by a whopping 57.04%. This represents a severe underperformance relative to both the S&P 500 Index and the emerging markets equity index:

Seeking Alpha

There may be some investors who would be willing to take a chance on an underperforming fund, especially if that fund offered a very high yield. However, few investors would be willing to take a chance on any fund that delivered such a massive share price decline during a period of some of the strongest asset appreciation in history.

However, investors in the Voya Emerging Markets High Dividend Equity Fund did somewhat better than the above chart suggests. As I stated in a recent article:

A simple look at a closed-end fund’s price performance does not necessarily provide an accurate picture of how investors in the fund did during a given period. This is because these funds tend to pay out all of their net investment profits to the shareholders, rather than relying on the capital appreciation of their share price to provide a return. This is the reason why the yields of these funds tend to be much higher than the yield of index funds or most other market assets.

In some cases, the distributions paid out by a closed-end fund might be sufficient to offset a decline in the fund’s share price. This was certainly the case with the Voya Emerging Markets High Dividend Equity Fund. When we include the distributions that the fund paid out over the past ten years, investors benefited from a 23.68% gain:

Seeking Alpha

While this is certainly much better than the previous performance chart, it still speaks poorly for the fund. After all, we can see that the fund still substantially underperformed both domestic large-cap stocks and the emerging market index. Thus, investors would have been better off just purchasing the index over the past decade rather than chasing yield with this fund.

However, we are all aware that past performance is no guarantee of future results. As such, we should have a look at this fund’s portfolio and positioning today in order to make a reasonable guess about where it will be in the future. The remainder of this article will focus on achieving this task.

About The Fund

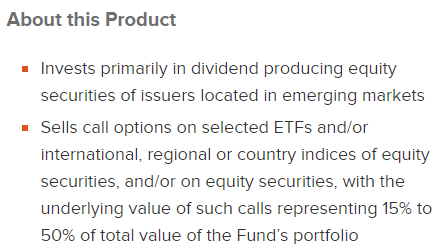

According to the fund’s website, the Voya Emerging Markets High Dividend Equity Fund has the primary objective of providing its investors with a very high level of total return. This makes a lot of sense for an equity fund, due to the simple fact that equities provide their investment returns through both capital appreciation and direct payments to investors. The name of this fund implies that it is an equity fund, but the website adds a bit more detail:

Voya

This is interesting, as the website’s description of the fund’s strategy basically states that the Voya Emerging Markets High Dividend Equity Fund does not simply purchase common equities issued by companies in emerging markets, as we would expect. Rather, the fund is attempting to use an option-income strategy against a portfolio of dividend-paying emerging market common stocks. The description sounds as though this fund operates much like some of Eaton Vance’s offerings, except that the Eaton Vance funds are using U.S. and other developed-market securities and indices for their respective strategies. This fund’s strategy may be a bit more difficult to pull off than that of other option-income funds due to the simple fact that the capital markets of many emerging nations have significantly less depth than that of the United States, so options may not have the same liquidity and ease of sale as they do domestically.

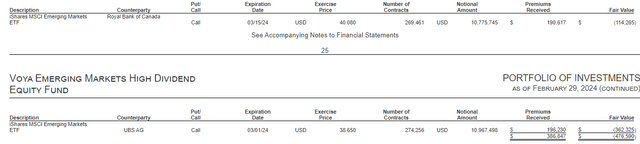

With that said, the fund does not appear to be writing options against the individual stocks in its portfolio. Indeed, the fund’s annual report states that the only written call options in the portfolio as of February 29, 2024 were against the iShares MSCI Emerging Markets ETF (EEM):

Fund Annual Report

Unlike the Eaton Vance option-income funds, these do not appear to be entirely naked call options. The fund was actually holding 37,326 shares of the index ETF as of the same date. That is far less than the number of shares that it would have to deliver were these options exercised against the fund, but it is still better than nothing.

It is uncertain whether or not the fund ever had to actually deliver the shares represented by these short call options contracts. There were two outstanding contracts as of February 29, 2024, one with a strike price of $38.65 and a March 1, 2024 expiration date and the other with a strike price of $40.08 and a March 15, 2024 expiration date. The underlying index fund closed at $40.48 on March 1, 2024. That might mean that the March 1, 2024 call option got exercised against the fund. The index fund closed at $40.77 on March 15, 2024, so that one might also have been exercised. However, the second of these two call options was probably still profitable for the fund after we consider the premiums received.

Please note that the above paragraph does not necessarily mean that the options were exercised against the fund. The fund might have closed out of its positions before they were exercised, but it only had one day to do that in the case of the March 1, 2024 call options. The fund almost certainly took a loss on the March 1, 2024 call option, no matter what it did, as it had the short position open on the night before the option expired and the underlying security was trading above the strike price on the following day. This risk of loss is something that we have to accept with any fund that uses call option sales as a part of its investment strategy during a bull market, though, so it is not really a complaint about this particular fund.

The fund’s portfolio consists almost entirely of common equities and written call options. The annual report states that the fund’s portfolio as of February 29, 2024 was:

|

Asset Type |

% of Net Assets |

|

Common Stock |

93.8% |

|

Exchange-Traded Funds |

1.4% |

|

Preferred Stock |

4.7% |

|

Money Market Funds |

0.4% |

There was only a single exchange-traded fund held by the fund as of February 29, 2024. This was, of course, the aforementioned iShares MSCI Emerging Markets ETF. The only money market fund that is used by the Voya Emerging Markets High Dividend Equity Fund is the Goldman Sachs Financial Square Government Fund, Institutional Class (FGTXX). This fund has a 5.22% yield, which is not bad at all for a money market fund. As might be expected, the fund simply uses this as a place to store its cash until it purchases new securities or makes a distribution to its investors. The remainder of the fund is invested in common and preferred stock, except for the short option position. Overall, this is pretty much what we expected.

The Voya Emerging Markets High Dividend Equity Fund appears to be reasonably well-diversified across countries. The annual report provides the following country weightings for the fund:

|

Country |

% of Net Assets |

|

Brazil |

3.3% |

|

Chile |

0.7% |

|

China |

22.7% |

|

Columbia |

0.2% |

|

Egypt |

0.3% |

|

Greece |

1.5% |

|

Hong Kong |

1.3% |

|

Hungary |

1.0% |

|

India |

17.1% |

|

Indonesia |

0.9% |

|

Ireland |

1.0% |

|

Kuwait |

0.1% |

|

Malaysia |

1.7% |

|

Mexico |

2.5% |

|

Netherlands |

0.5% |

|

Philippines |

0.4% |

|

Poland |

0.5% |

|

Qatar |

1.4% |

|

Russia |

N/A |

|

Saudi Arabia |

3.0% |

|

Singapore |

0.3% |

|

South Africa |

2.0% |

|

South Korea |

9.8% |

|

Taiwan |

16.9% |

|

Thailand |

2.3% |

|

Turkey |

0.1% |

|

United Arab Emirates |

2.3% |

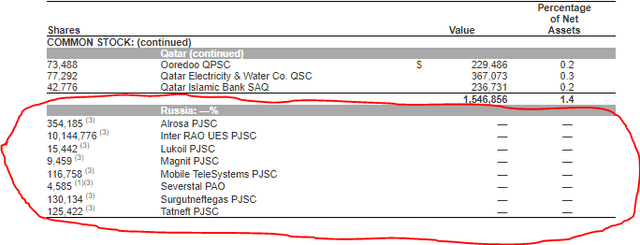

The fund does have fairly substantial holdings in Russia, but they have a listed value of $0 right now:

Fund Annual Report

This is almost certainly because of the current American sanctions on Russia. These sanctions have rendered it quite difficult for the fund to sell any of these holdings, so for now, it is forced to simply hold on to them in the hopes that the sanctions may someday be lifted. It is impossible to speculate on when that will occur, if ever, so for now, the fund appears to be sitting on an unrealized loss due to geopolitical issues. These are only unrealized losses at this time, though, so they might someday go away.

There are certainly some things that we can like about the portfolio. In particular, we see fairly high weightings to India, South Korea, and Taiwan. India is the fastest-growing economy in the world, and it has been for a while. The International Monetary Fund projects that the country will grow its gross domestic product by 7% in 2024 and by 6.5% in 2025. This is substantially higher than any developed market nation, and it largely exemplifies the emerging market investment case that existed in sane periods of monetary policy (i.e. before 2008). Taiwan and South Korea, meanwhile, have largely developed their economies into some of the strongest in the world built on the manufacturing of various high-tech items. It is almost difficult to call them “emerging markets” anymore, since both countries have gross domestic product per capita figures that compare reasonably well to developed nations:

|

Country |

GDP Per Capita |

|

Taiwan |

$34,432 |

|

South Korea |

$34,165 |

(figures from the International Monetary Fund)

To put this in perspective, both of these countries beat Spain ($34,045) and Japan ($33,138). There is nobody who would call Spain or Japan “emerging nations,” as both countries have long been recognized as developed countries. Taiwan and South Korea both have reasonable growth rates as well:

|

Country |

2024 Growth Rate Estimates |

|

Taiwan |

3.43% |

|

South Korea |

2.50% |

(figures are the International Monetary Fund’s current 2024 estimates)

The International Monetary Fund expects that the United States will grow its economy by 2.60% in 2024, so Taiwan exceeds the domestic economic growth rate and South Korea comes very close. In theory, higher gross domestic product growth should result in higher profitability growth for companies domiciled in those nations and therefore better stock performance. This has not necessarily been the case ever since central banks in developed countries committed themselves to incredibly loose monetary conditions, but the overall investment thesis still suggests that we should have exposure to these economies in our portfolios.

The large weighting to China could be a risk of investing in this fund, though. First, we cannot ignore the deteriorating relationship between China and the United States. This could cause the governments of one or both countries to take some action that has an adverse effect on American investors who hold Chinese common stocks. The Voya Emerging Markets High Dividend Equity Fund is an American entity, so any such action would have an adverse impact on the fund’s portfolio. Second, China’s demographics are somewhat similar to Japan’s in that the nation has an aging population that could pose problems for the nation’s workforce in the future. As Baird Investment Management explains:

In 2022, China’s population declined for the first time in six decades. China’s total fertility rate dropped to a record low of 1.09 in 2022 from 1.30 in 2020 and is now even lower than Japan’s, a country long known for its aging society. China’s ongoing demographic transition constitutes a significant constraint on economic growth. A working-age population that peaked in 2011 at more than 900 million is projected to decline by over 20% to 700 million by 2050. These workers will have to provide for nearly 500 million Chinese aged 60 and over, compared with 200 million today. Higher age dependency ratios will place additional pressure on productivity growth, which has been slowing for two decades. From the 1980s to the early 2000s, labor productivity gains contributed one-third of China’s GDP growth. Over the past decade, that contribution has fallen to one-sixth.

China is hardly alone in demographic problems. After all, Japan, the European Union, and the United States have the same problem. As Baird correctly points out, this could cause the country’s economic growth to slow down and thus be a drag on Chinese stock prices. Other emerging economies, such as India, do not have this problem and thus could provide better opportunities. The Voya Emerging Markets High Dividend Equity Fund does have exposure to some of these nations, but they are lower weighted than China, so there could be potential risks here.

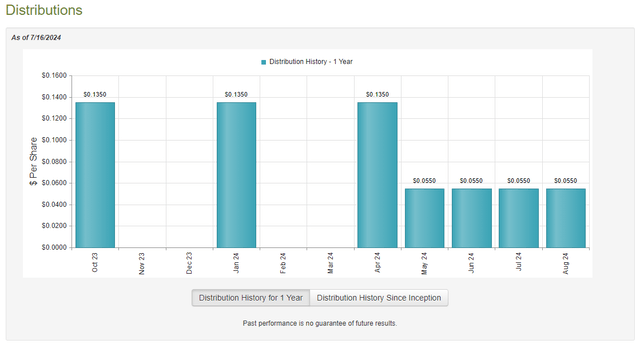

Distribution Analysis

The primary objective of the Voya Emerging Markets High Dividend Equity Fund is to provide its investors with a very high level of total return. As is the case with most closed-end funds, this one aims to deliver its total return via direct payments to its investors. To this end, the fund pays a monthly distribution of $0.0550 per share ($0.66 per share annually) to its shareholders. This gives the fund a very attractive 12.02% yield at the current share price.

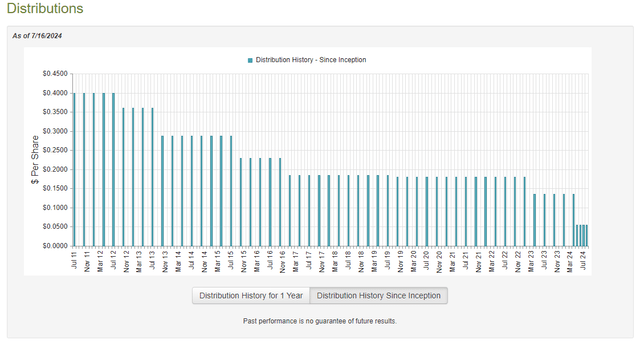

The Voya Emerging Markets High Dividend Equity Fund has not been particularly consistent with respect to its distributions over the years:

CEFConnect

This fund appears to share the same problem as many of the other Voya closed-end funds that we have discussed in this column over the years. In particular, the fund has a history of steadily decreasing its distribution over time. However, the most recent move was actually a distribution increase, not a decrease. We can see that here:

CEFConnect

First, we notice that back in May, the fund switched from a quarterly distribution to a monthly distribution. However, the change actually increased the distribution. This is because a $0.0550 per share distribution paid monthly actually works out to $0.1650 per share paid quarterly. Thus, the distribution increased by $0.03 per share quarterly a few months ago. Any investor who has been ravaged by inflation over the past few years will appreciate the higher level of income.

As is always the case, though, we should have a look at the fund’s finances to determine how well it can afford the distributions that it pays out. As of the time of writing, the fund’s most recent financial report is the annual report for the full-year period that ended on February 29, 2024. A link to this report was provided earlier in this article.

For the full-year period that ended on February 29, 2024, the Voya Emerging Markets High Dividend Equity Fund received $3,746,391 in dividends and $12,185 in interest from the assets in its portfolio. When we combine this with a small amount of income that was received from other sources, we see that the fund had a total investment income of $3,759,245 for the period. The fund paid its expenses out of this amount, which left it with $2,245,095 available for the shareholders. That was not sufficient to cover the $9,839,882 that the fund paid out over the same period.

Fortunately, the fund was able to make up the difference through capital gains. For the full-year period that ended on February 29, 2024, the Voya Emerging Markets High Dividend Equity Fund reported net realized losses of $3,302,596, but these were more than offset by $11,450,355 in net unrealized gains. Overall, the fund’s assets declined by $881,849 after accounting for all inflows and outflows over the period.

The only reason that the Voya Emerging Markets High Dividend Equity Fund failed to cover its distributions during the period is that it bought back $1,434,821 of its own stock during the period. The fund’s net investment income, net realized losses, and net unrealized gains work out to $10,392,854 for the period:

Fund Annual Report

That was enough to cover the distributions, but the fund did have to rely on unrealized capital gains to accomplish it. While this could be problematic, the global equity market has been very strong since late February, so overall things are probably okay.

We should keep an eye on the fund’s net asset value to ensure that it covers its distributions, but for now, there does not appear to be any reason to worry.

Valuation

Shares of the Voya Emerging Markets High Dividend Equity Fund currently trade at a 13.33% discount on net asset value. This is slightly better than the 12.94% discount that the shares have had on average over the past month. Thus, the current price seems very reasonable for anyone who wishes to pick up some shares of the fund.

Conclusion

In conclusion, the Voya Emerging Markets High Dividend Equity Fund is one of the few remaining closed-end funds that focuses on investing in emerging market equities. The fund’s portfolio appears to be reasonably well diversified across nations, but its exposure to China could be a risk that we should not ignore. The fund’s performance history is also probably going to be a turn-off for some investors, as it has failed to keep pace with the indices. Its yield is substantially higher than any common stock index, and it appears to be fully covered, though, so that is a plus. Finally, the fund has a very reasonable valuation right now.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here