Shoemakers this year have been under pressure from weaker results from Nike (NKE), but some of the pure-play shoe companies in the market are still offering decent growth prospects for attractive valuations.

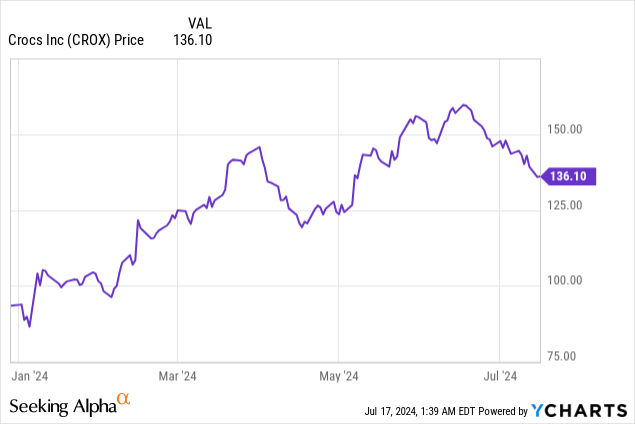

Crocs (NASDAQ:CROX), in particular, is one company worth watching. The maker behind the eponymous open-air clogs, Crocs shares have quietly risen more than 40% year to date, after a challenging 2023 in which the company dealt with a slowdown in one of its major subsidiaries, the HEYDUDE brand. Despite ongoing challenges and the year-to-date rally, there’s still plenty of upside momentum left for Crocs.

I view Crocs in a very similar light as Birkenstock (BIRK), the German shoemaker that has been able to demonstrate consistent ~20% y/y growth despite its centuries-old history (note: I’m also long on Birkenstock). Crocs is a slower-growing, but more value-oriented alternative to Birkenstock that is, to me, even more attractive amid a very elevated stock market that runs the risk of a near-term correction. But despite isolated headwinds, Crocs shares many of the same attractive traits as Birkenstock, including attractive growth prospects in China and other overseas markets.

Overall, I’m initiating Crocs at a buy rating. To me, this under-the-radar company offers attractive financials for its price, and given a recent sharp dip from a YTD peak at ~$160 notched last month, I’d say now is quite an opportune time to catch this stock before an upswing.

The HEYDUDE hangover

Before we discuss all of Crocs’ merits, let’s first highlight its biggest risk and the eyesore for the brand: HEYDUDE, a company it acquired in 2021 for a staggering $2.5 billion. Crocs initially paid for the acquisition with a mix of $2.05 billion in cash (mostly debt financed, which the company is still paying off now) and $450 million in stock. Press on the acquisition at the time was mixed: while some thought the acquisition to be a smart fusion of two quite different shoe brands, others thought that Crocs was splurging unnecessarily on an untested brand. According to a Forbes article at the time of acquisition, Crocs had thought that it could double sales of HEYDUDE and turn it into a $1 billion annual brand.

These high hopes have turned out to be pipe dreams. HEYDUDE is the major drag on Crocs at the moment, with sales declining in the double digits.

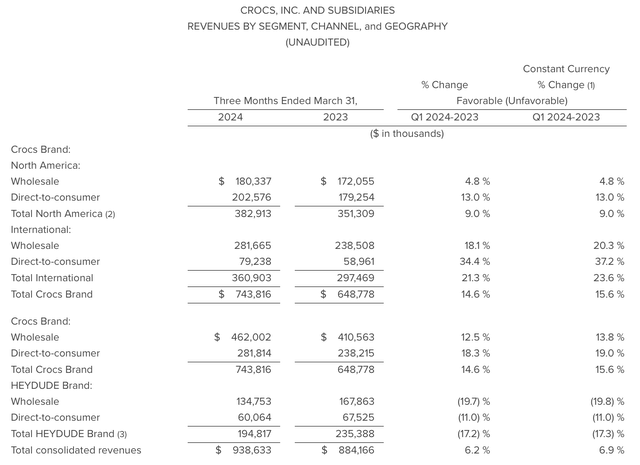

As shown in the chart below: HEYDUDE revenue in Crocs’ most recent quarter declined -17% y/y to $194.8 million, or just over 20% of the company’s total revenue. Shoe units sold, meanwhile, fell even further at -21% y/y; offset by a 5% increase in HEYDUDE ASP.

Crocs sales by brand (Crocs Q1 earnings release)

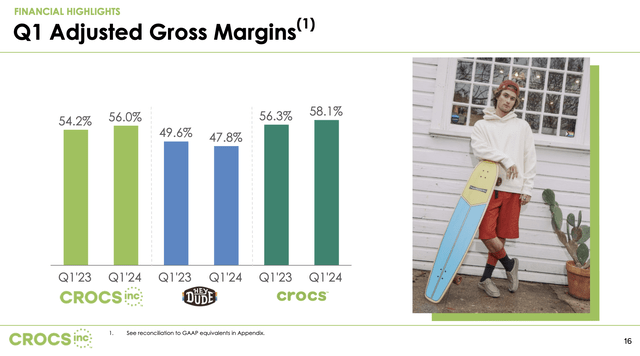

But not only is HEYDUDE’s sales profile much weaker than Crocs as a whole, but its margin profile is weaker as well. The chart below shows that while Crocs-branded products posted a 58.1% gross margin in Q1 (+180bps y/y), HEYDUDE’s margins were much worse at 47.8%, which is down -180bps y/y.

Crocs gross margins by brand (Crocs Q1 earnings deck)

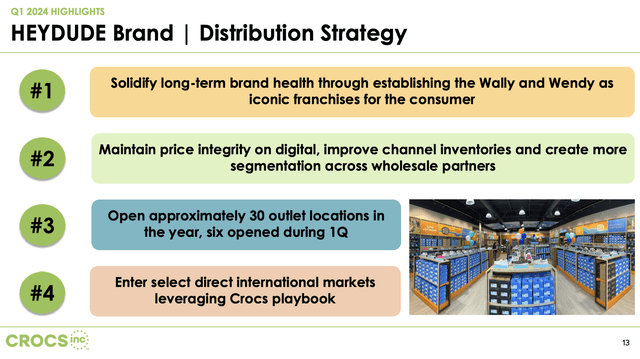

Of course, the company isn’t standing pat while its big subsidiary declines. The company has a four-point plan to turn around HEYDUDE this year, including putting more marketing behind the brand’s core shoe lineup (Wally and Wendy, a line of casual sneakers for men and women respectively that range between $60-$80 in retail price) and opening new stores.

HEYDUDE business plan (Crocs Q1 earnings deck)

Outside of HEYDUDE, attractive financials abound

But if, for a minute, we put aside the ~20% of the business that is struggling, we find a vibrant growth trajectory for the Crocs brand itself.

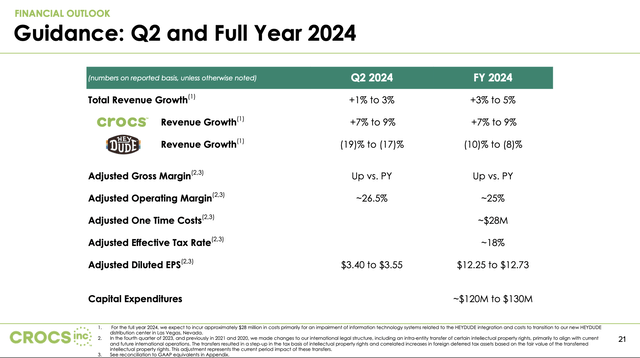

For the current fiscal year, Crocs is guiding to 3-5% y/y revenue growth, but the Crocs brand without the drag from HEYDUDE is expected to grow at a 7-9% y/y pace.

Crocs guidance (Crocs Q1 earnings deck)

I’d say even this outlook may be light, when we consider the fact that on a constant-currency basis, Crocs brand revenue grew at a 15.6% y/y pace (versus 9.0% y/y growth on an as-reported basis, with quite a heavy FX headwind). Given broad expectations for the Fed to decrease interest rates this year, it’s very likely that the dollar will depreciate versus foreign currencies and cause less of an FX drag on Crocs’ results.

We note as well that the Crocs brand has quite an attractive margin profile. Gross margins for the Crocs brand of ~58% were two points higher than 56% for Birkenstock in the same quarter, the other key pure-play niche shoemaker. The company’s guidance also calls for gross margins to be up in FY24 versus FY23, though sales mix tilting away from HEYDUDE and more toward Crocs is one of the core drivers here.

Crocs has succeeded at expanding its product lineup beyond its signature clogs. In particular, the company is noting strength with sandals as well as its Kids line. The company’s wide variety of styles has helped to increase the brand’s global penetration and mass appeal across customer demographics.

Crocs product portfolio (Crocs website)

Per CEO Andrew Rees’ remarks on the Q1 earnings call on categories showing particular strength:

As we think about product, we continue to prioritize our three pillars, clogs, sandals, and personalization. Growth in our first quarter was led by our classic clogs, and we are seeing both new and existing consumers come to the brand through our icons. Our kids’ business was another highlight, with double-digit growth in the quarter. We continue to create multi-product franchises that broaden users’ occasions for the consumer. Building on the success of our Echo franchise, we launched the Echo Storm, a fully molded sneaker. This launched in our DTC channels, as well as Foot Locker and JD Sports during the quarter and performed well […]

For the year, we continue to expect sandals to grow in excess of our overall growth and increase in penetration. Our personalization vehicle, Jibbitz, grew double digits in the quarter, led by growth in Asia. We continue to see ample white space for personalization, and our strategy is focused around three pillars. Number one, driving higher penetration within digital and wholesale.”

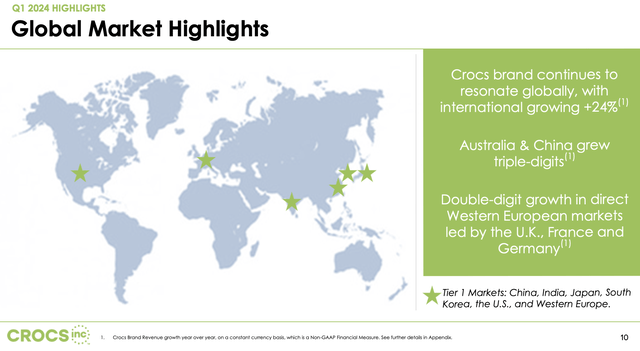

We also like the fact that Crocs is demonstrating considerable expansion overseas. As shown in the chart below, underpinning 24% y/y growth in international revenue in Q1, Australia and China saw triple digit y/y growth, indicating a vast market opportunity for Crocs in the world’s largest consumer economy.

Crocs international opportunity (Crocs Q1 earnings deck)

Valuation and key takeaways

The number-one reason to invest in Crocs, however, is its modest valuation.

This year, as shown in the prior section, Crocs is guiding to 3-5% y/y revenue growth and $12.25-$12.73 in pro forma EPS ($12.51, or 4% y/y earnings growth at the midpoint). Meanwhile, looking ahead to next year FY25, Wall Street analysts have a consensus revenue growth target of $4.37 billion (+6% y/y) and $13.77 in pro forma EPS (+10% y/y).

At current share prices just above $130, this puts Crocs’ valuation multiples at:

- 10.9x FY24 P/E

- 9.9x FY25 P/E

It’s fairly clear here that the struggling minority ~20% of Crocs’ business, HEYDUDE, is distracting from the strong growth profile and attractive margins of its main brand. We note that Crocs has $875 million of share buyback authorization, or ~11% of its current market cap, to take advantage of cheaper share prices now.

While investors certainly have to contend with the risk that HEYDUDE will continue to detract and that the company will continue to throw more resources behind it, I’d say that attractive international growth drivers and a broad, successful Crocs brand more than justify buying this stock at a ~10x P/E, well below the major indices.

Read the full article here

Huge Games Selection

Huge Games Selection