Introduction

With August coming to a close soon, I couldn’t help but think about what the months of September and October would bring for the stock market. I’ve actually been building up my cash position to take advantage of any buying opportunities we might get this fall. In this article, I list two blue-chip stocks I’m buying if we see a market correction this year.

Building A Cash Position

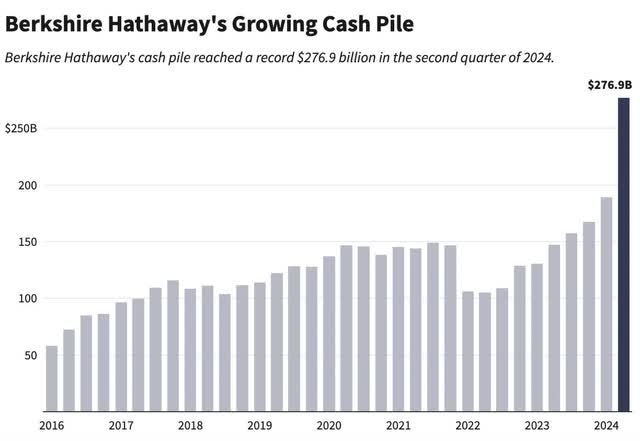

Over recent months, news has hit the market about Warren Buffett having a record amount of cash. Some have indicated this could be a signal that the market may crash. I’ve long been a fan of Buffett and while I pay attention to what he does, I hardly follow any trades or try to emulate what he does in the market.

Investopedia

However, I have been building some cash after taking profits on some of my stocks lately. I usually don’t prefer to sell shares, even after a stock’s share price has run up.

But this year, I decided to go ahead and take some profits. The main reason is because a lot of my holdings are now trading at prices well-above my buy range. So, I decided I would sit on the sidelines and be hopeful we’d get a market correction soon.

Worst Months For Market Returns

Historically, September is the worst month for stocks. And if history repeats itself, then there’s a chance the market could drop in the coming weeks. One reason for this could be that investors are returning from vacation and deciding to lock in capital gains from the summer months.

Trade That Swing

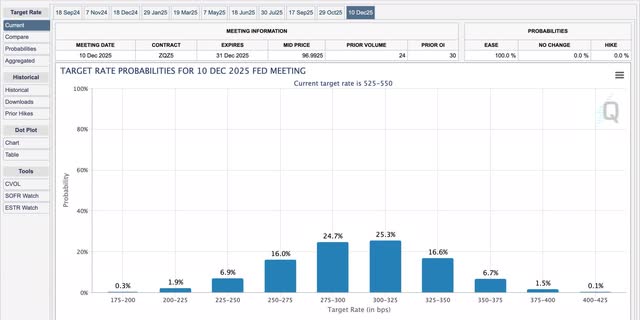

There’s also reason to believe the market sells off due to tax-loss purposes. Things could be different this year of course as anything can happen. With the FED deciding they are likely to lower interest rates in September, maybe we won’t see a correction this year? Maybe the market will continue to rally into the holidays and make new highs going into 2025? In my opinion, I think this is a real possibility.

I don’t try to predict what a stock will do or even the market. But a saying I used to tell my sailors when I was active duty was, “Stay ready so you don’t have to get ready.” And this is exactly what I’ve been doing. Getting ready to put capital to work should the opportunity arise. Without further ado, here are the two stocks I’m buying should the stock market see a correction this September.

Stock #1: PepsiCo (PEP)

The first stock I’m buying is Dividend King, Pepsi. At the moment, PEP is one of the smaller positions in my portfolio. And as a buy-and-hold investor, I plan to continue to add to it for as long as the fundamentals remain intact. But that doesn’t mean that the company hasn’t faced its fair share of headwinds this year.

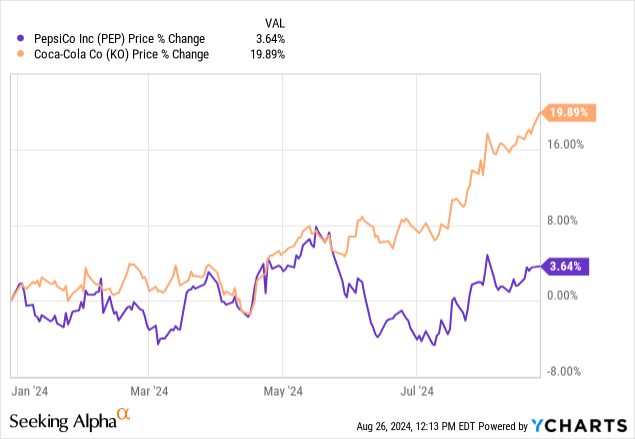

One reason is a weaker consumer, especially in the U.S. With interest rates at record highs, consumers have cut back on discretionary items such as snacks and drinks. With that being said, PEP has been handily outperformed by its peers Coca-Cola (KO) since the beginning of 2024.

Below you can see KO is up nearly 20% to just 3.64% for the latter. KO has seemingly been firing on all cylinders, while PEP’s share price has continued to lag. And for this reason, this may be a great buying opportunity for the long term.

During the stock’s most recent quarter, total revenue was up at less than 1%. Volume was down 2% and the company saw a huge drop by 17% in its Quaker Foods North America segment. This has been an issue during the year; a result of the downward pressure high interest rates have placed on consumers’ finances.

In Europe, PEP seems to be doing fine, with organic sales up a solid 5%. And management still expects to deliver 4% revenue growth for the full-year. In the chart below, you can see how the Quaker Foods segment in North America has been challenged the last few quarters.

Year-over-year, the segment was down from $1.46 billion to $1.15 billion. But management expects the business to grow materially by Q4 of this year and supply chain issues to be solved by then as well. Frito-Lay also saw a slight decrease from Q2 2023 from $3.246 billion to $3.146 billion.

Seeking Alpha

But despite challenges, EPS managed to see some solid growth quarter-over-quarter, rising nearly 42% from $1.61 to $2.28. And for the full-year, EPS is expected to grow 7% to at least $8.15.

Pepsi’s cash flows have also faced some downward pressures. Cash from operations declined roughly 35% from $2 billion to $1.3 billion, while CAPEX spending increased over the same period from $1.5 billion to $1.7 billion. I touched on the company’s cash flow headwinds in an article this past June and how I expected them to fare in terms of dividend safety.

PEP is no stranger to tough economic times, and I expect them to successfully navigate choppy waters with continued headwinds along the way. But the good news is interest rates are anticipated to be much lower by the end of next year. If so, I expect PEP to see some tailwinds, and growth to pick back up in the coming months/years.

CME FedWatch

Their balance sheet was also solid, with $6.353 billion in cash & cash equivalents. They also have no debt due until 2026. This had a weighted-average interest rate of 2.625% and an A+ credit rating from S&P. Additionally, they paid down some debt this year and had $36.6 billion in long-term debt. But this was small in comparison to their market cap of $241.57 billion.

Stock #2: Visa (V)

Another small position in my portfolio I plan to add on a dip is credit card behemoth, Visa. Like Pepsi, Visa has also faced some headwinds this year. With talks of a recession picking up, this will likely have an impact on the company going forward as credit card transactions are likely to witness a slowdown.

Additionally, credit card debt has continued to surge to record amounts, with it reaching above $1 trillion! This was a 5.8% increase from last year. And this has increased significantly from 2022, the year interest rates were hiked. Although consumer spending has remained resilient here in the U.S., it’s no secret Americans have relied heavily on credit cards.

And if we see a recession or unemployment continues to pick up, this will likely continue going forward. The current President has also tried to help this by putting a cap on late fees for credit cards, a move to save Americans from shelling out extra money. This should benefit financially constrained consumers going forward, but this is still a telltale sign of how higher for longer interest rates have impacted the U.S. economy.

Through all of this, however, Visa has remained resilient. Moreover, they are one of the best dividend growth stocks with strong, growing cash flows and minimal capital expenditures. During their latest quarter, V managed to see double-digit growth in revenue and earnings per share.

Revenue was up 10% to $8.9 billion, while EPS was up 12% to $2.42 year-over-year. But from the beginning of the year, you can see how high interest rates and credit card debt have weighed down on the stock. Revenue was up 3% from Q1’s $8.63 billion, while EPS was up a penny.

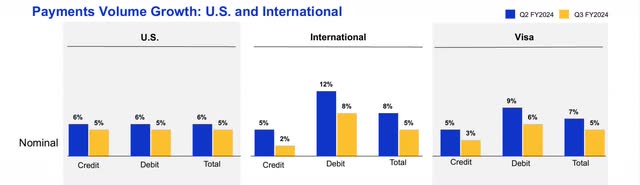

Payments volumes were 7% vs 5% in the prior year. Like Pepsi, V also saw stronger growth internationally. Total volume overseas grew 3% from the prior year to 8% compared to just 1% in the states.

Visa investor presentation

Unlike Pepsi, Visa’s cash flows have remained strong. YTD the company has only paid roughly $3.2 billion in dividends while free cash flows were strong at $12.3 billion. In my prior article on Pepsi, I mentioned how I expected dividend growth to slow going forward. For Visa, however, I anticipate their solid dividend growth to continue for the foreseeable future.

Moreover, management anticipates low, double-digit growth on its top and bottom lines for 2024. And as interest rates continue to decrease, this should provide tailwinds for the credit card giant.

However, this won’t be instant and will be a gradual process as lower interest rates take some time to work through the economy. Furthermore, management expects operating expenses to pick up at the end of the year as a result of the negative FX impact. This is also expected to weigh negatively on earnings, suppressing them into the low teens.

Moreover, V also had a strong balance sheet and A credit rating. They also have some debt due in 2026. Their weighted-average interest rate was even lower than Pepsi’s at just 1.5%. They also had significant cash on their balance sheet with nearly $13 billion and roughly $21 billion in long-term debt, minimal compared to a market cap over $500 billion.

Valuations

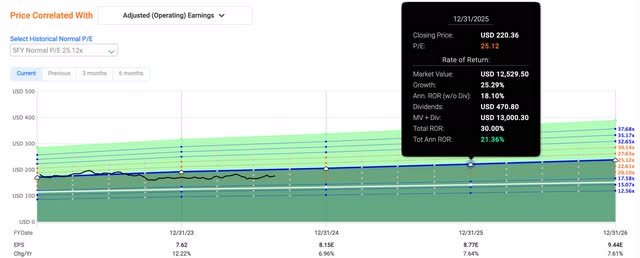

Currently, Pepsi offers 24% upside over the next 16 months with a price target of $220. They currently have a forward P/E of 21.6x, below their 5-year average of 25x.

And despite them trading above the sector median, using the dividend yield theory the stock is undervalued. PEP currently has a forward dividend yield of 3%, higher than their 5-year average of 2.75%. And with interest rates likely to be much lower a year from now, I expect PEP’s share price to climb higher.

FAST Graphs

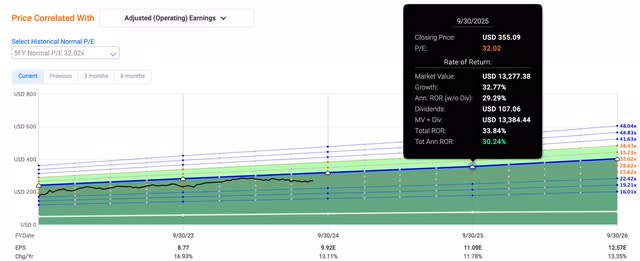

According to Visa’s forward P/E, the stock is overvalued compared to the sector median’s 11.87x. But this is lower than their 5-year average over 30x earnings. And seeing by their resilient business, strong cash flows, and anticipated double-digit earnings growth, I think the stock has plenty of upside over the long term.

Currently, they offer 32.5% upside to their price target of $355 over roughly 12 months. Using the dividend yield theory, similarly to Pepsi, the stock is also slightly undervalued with a dividend yield above its 5-year average of 0.66%.

FAST Graphs

Investor Takeaway

With interest rates higher for longer, Pepsi and Visa are blue-chip stocks that have seen a slowdown in their businesses as a result of a weaker consumer. But with rates likely to be much lower over the next 12 months, I expect both will see some nice upside as inflation and headwinds moderate over the near to medium-term. However, I expect both businesses will navigate successfully.

As a long-term investor, if we see a drop in the market this September, both will likely present even better buying opportunities in the coming weeks. And if so, I have cash on the sidelines ready to pounce at the opportunity. If you’re looking for companies with solid fundamentals that offer strong upside and dividend growth, then you should consider these two stocks on a pullback.

Read the full article here