In August, I covered Air Lease Corporation (AL) common stock and attached a buy rating to the name with 25% upside. Since then, the stock has appreciated by nearly 17%. However, Air Lease Corporation also has redeemable preferred stock (NYSE:AL.PR.A) and in this report, I will discuss whether there is any appeal to the fixed-floating rate preferred stock.

What Is Fixed-Floating Rate Preferred Stock?

Before we go into the details of the 6.15% Fixed-to-Floating Non-Cumulative Perpetual Preferred Stock Series A, we first have to look at what the “Fixed-to-Floating Non-Cumulative Perpetual Preferred Stock” means. We do so by breaking it down into the relevant parts:

- Preferred Stock: This shows that the stock ranks senior common equity, but lower than debt, meaning that in the case of a default, preferred shareholders will get paid back before common shareholders but after bondholders.

- Perpetual: The perpetual nature of the stock indicates that there is no mandatory redemption data, although the stock could be called after a certain period.

- Non-Cumulative: The non-cumulative nature indicates that if there is need for it, a company may elect to not pay a dividend and that dividend does also not carry over to any period when a dividend is being paid.

- Fixed-to-Floating: This part identifies that the stock has a fixed dividend yield for a fixed-rate period and floating-rate yield that is a certain percentage plus a benchmark reference for the floating-rate period.

Why Does A Company Elect For Issuing Fixed-Floating Rate Preferred Stock

There are various reasons for a company to issue fixed-floating rate preferred stock. One of them could be to attract capital that it would normally not be able to attract from issuing common stock. For instance, from investors that are looking for a bit more safety on their yield and stability in their underlying invested capital. Another reason is that it is non-dilutive. So, it allows the company to raise capital without diluting common shareholders and since it is also not ranked as debt, it does not increase the debt balance.

Furthermore, compared to debt the company has the ability to skip dividend payments while that interest is still due on debt and contrary to most forms of debt, the perpetual nature of the preferred stock means that there is no obligation to repay contrary to maturity dates on debt.

So, it is way to raise capital without a maturity date and allows a company to improve its debt to equity ratio without diluting shareholders.

The Details Of The Air Lease Corporation 6.15% Fixed-To-Floating Non-Cumulative Perpetual Preferred Stock Series A

The Series A preferred stock were issued in March 2019 at a par value of $25 with 10 million shares issued for a total capital raise of $250 million and a 6.15% yield for the fixed-rate period that ended in March 2024 after which the dividend yield would be a function of LIBOR and later 3-month SOFR plus +0.1% plus 3.65% with a quarterly review date for the SOFR rate.

At the time preferred stock was issued the interest rates were low and the 6.15% yield was appealing as it was and still is higher than the common stock dividend yield and it was significantly higher than the composite rate on debt which was 3.3%. So, for the first five years the company paid a premium to attract capital without raising debt or dilute shareholders, and it could very well have been the case that the base assumption was that interest rates would remain low which after a five-year elevated fixed-rate period would result in the yield to be closer to 3.65% which would result in a small spread to the composite cost on debt and would be a premium that Air Lease Corporation was willing to pay in order to not increase its debt balance.

Is Air Lease Corporation Preferred Series A Stock Attractive?

Currently, the preferred stock trades at a price of $25.61 which is $0.61 above the par value of $25. That does not seem to be extremely attractive as it basically means that if Air Lease Corporation were to redeem the shares it would be at a discount to the trading price leaving preferred stock investors as a loss who would then have to hope that they already would have offset that loss with cumulated dividends. However, the current preferred stock price included the $0.5744 quarterly dividend payment until the ex-dividend date by the end of August. So, the premium to par value primarily reflects the dividend that some sellers would like to collect if they were to sell their shares now.

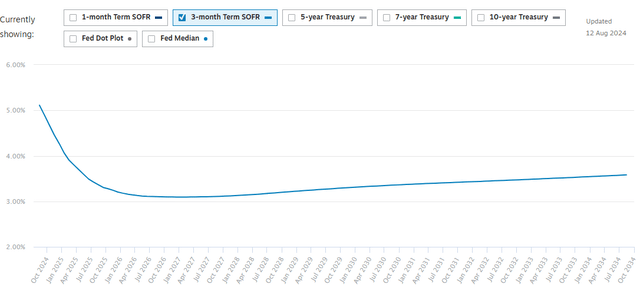

What further complicates the matter is that in March 2024, the dividend yield flipped from fixed rate of 6.15% to floating rate and in there we find an answer for the premium compared to the par value of the preferred stock. The dividend yield is now based on the 3-month SOFR rate plus 0.1% spread adjustment plus 3.65% with the next dividend rate reset date, which is the data on which the SOFR rate is being reviewed, on 15 September 2024. The forward curve for the 3-month SOFR suggests that the dividend yield will be based on a 4.88% SOFR rate, which would bring the dividend yield to 8.63% against the par value with an effective yield of 8.4%.

Chatham Financial

While the Effective Federal Funds Rate and SOFR are different in nature, SOFR pretty much tracks with the EFFR. This means that as interest rates are expected to come down, so will the SOFR rate which is expected to bottom out somewhere around 3.1% which would bring the dividend yield to 6.85%. One could wonder whether there is any reason for Air Lease Corporation to not redeem the preferred stock since for the foreseeable future, the floating rate yield is expected to be higher than the yield during the fixed-rate period.

One reason why Air Lease Corporation could elect to redeem the preferred stock, apart from the high yield that is significantly higher than the cost of debt, is to improve the return on common equity. At a rate of 8.63%, the Series A dividend would be around $5.4 million per quarter and $21.575 million per year. Eliminating that portion of the preferred dividend would increase the return on equity over the trailing twelve months from 10.8% to 11.1%. With $454.1 million in cash and cash equivalents, I do wonder whether there is an imminent desire for Air Lease Corporation to redeem the preferred stock. Indeed, the company could borrow $250 million at a rate that is lower than what it pays in dividend to keep the $250 million, so that could be a reason to redeem the preferred stock. However, since the twelve month-trailing return on common equity is still higher than the dividend yield, I could also see why there would be no urgency in redeeming the preferred stock.

Conclusion: Air Lease Corporation Preferred Series A Stock Is Interesting With A Few Risks

Due to the higher interest rate environment, the set-up of the preferred stock Series A offers a juicy dividend yield. However, at the same time, we see that the yield is in excess of the 5.2 to 5.3 percent notes recently issued and in some way exchanging the preferred stock for debt would increase interest expense but reduce dividend payments in a net favorable manner. So, redeeming the preferred stock makes a lot of sense. However, from the perspective of common equity returns, there is no imminent need to redeem the preferred stock. If the stock would trade at par value of $25, it would almost be a no-brainer to but there is a $0.61 spread between the preferred and par value and I would say that while there is no indication that Air Lease Corporation will redeem the preferred stock, the safer moment to buy in this high-yielding dividend name would be after the ex-dividend date which limits and potential losses on the invested amount in case a redemption does happen. Therefore, I am rating the preferred stock a buy with an attractive yield but recommend buying after the stock trades ex-dividend.

Read the full article here